- United States

- /

- Life Sciences

- /

- NYSE:TMO

Should Thermo Fisher's (TMO) New $5 Billion Buyback Change Views on Its Capital Allocation Priorities?

Reviewed by Sasha Jovanovic

- Thermo Fisher Scientific Inc. recently announced that its Board of Directors authorized a quarterly cash dividend of US$0.43 per common share, payable on January 15, 2026, to shareholders of record as of December 15, 2025, along with a new US$5 billion share repurchase program with no expiration date.

- This combination of capital return initiatives highlights the company’s financial strength and sustained focus on rewarding shareholders while supporting long-term growth capacity.

- We’ll explore how the announced US$5 billion share buyback program could influence Thermo Fisher’s investment narrative and future capital allocation.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Thermo Fisher Scientific Investment Narrative Recap

To be a shareholder in Thermo Fisher Scientific, you need confidence in its ability to deliver stable returns from its strong market positions across life sciences, diagnostics, and laboratory solutions, while balancing pressures on margins and international revenues. While the new US$5 billion share buyback underscores management’s focus on capital returns and operational strength, it does not materially shift the most important short-term catalyst, long-term demand from pharma and biotech, or mitigate the ongoing risks stemming from volatility in international revenues, especially in China.

Among recent announcements, Thermo Fisher’s definitive agreement to acquire Clario Holdings for US$8.875 billion stands out, reflecting its goal of deepening its clinical research capabilities. This planned acquisition relates closely to the key growth catalyst of increasing integration into high-growth end markets, but does little to offset near-term macro or regional uncertainties that continue to pressure parts of the business.

In contrast, the persistent risk from China’s sluggish economic environment and trade policy concerns is information investors should be aware of, especially as...

Read the full narrative on Thermo Fisher Scientific (it's free!)

Thermo Fisher Scientific's narrative projects $50.0 billion in revenue and $9.0 billion in earnings by 2028. This requires 5.0% yearly revenue growth and a $2.4 billion increase in earnings from the current $6.6 billion.

Uncover how Thermo Fisher Scientific's forecasts yield a $613.58 fair value, a 5% upside to its current price.

Exploring Other Perspectives

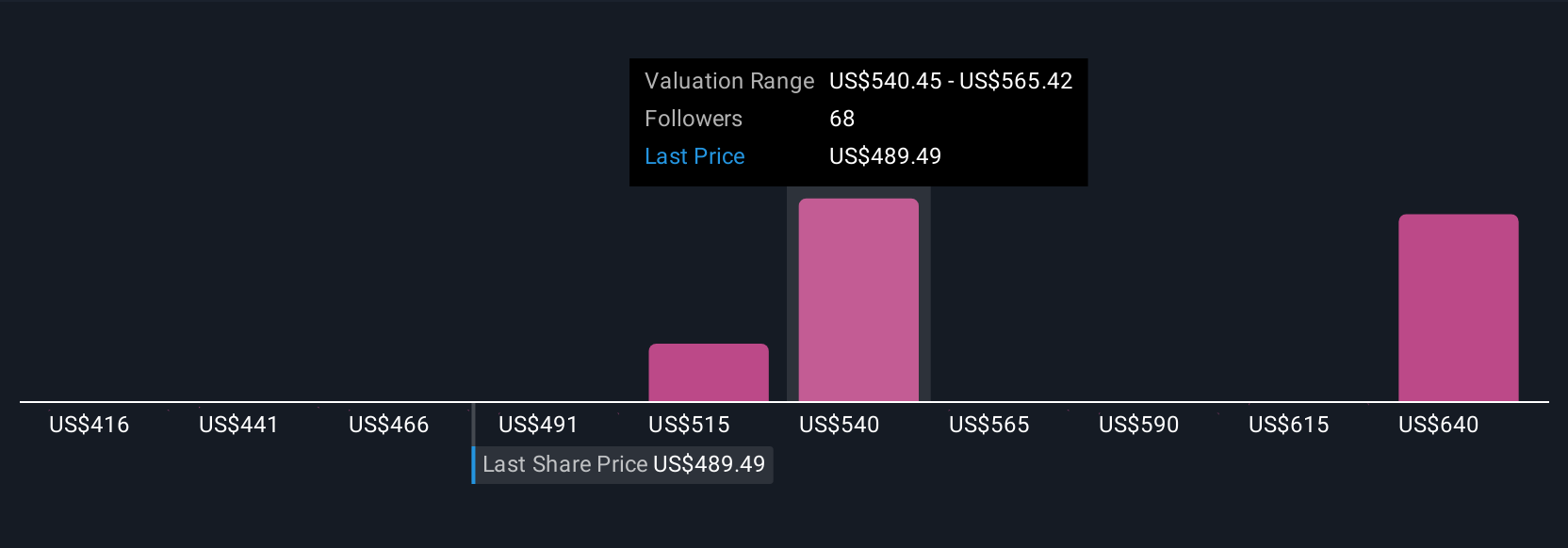

The Simply Wall St Community provided 13 fair value estimates for Thermo Fisher Scientific, ranging from US$450 to US$662,165, showing how much investor views can vary. While some see outperformance tied to new end-market initiatives, the ongoing international revenue headwinds could impact your expectations, be sure to compare these community perspectives for a fuller picture.

Explore 13 other fair value estimates on Thermo Fisher Scientific - why the stock might be worth as much as 13% more than the current price!

Build Your Own Thermo Fisher Scientific Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Thermo Fisher Scientific research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Thermo Fisher Scientific research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Thermo Fisher Scientific's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thermo Fisher Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TMO

Thermo Fisher Scientific

Provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives