- United States

- /

- Life Sciences

- /

- NYSE:QGEN

Will Qiagen’s (QGEN) Earnings Beat and Steady Guidance Reshape Its Diagnostics Growth Narrative?

Reviewed by Sasha Jovanovic

- In the past quarter, Qiagen reported third-quarter 2025 adjusted earnings of US$0.61 per share, up 7% year over year, with revenue rising 6% and both metrics surpassing analyst estimates, while reiterating guidance for 2025 net sales growth of 4–5% and adjusted EPS of about US$2.38 at constant exchange rates.

- Beyond the headline beat, the combination of higher earnings, solid revenue growth and maintained full-year guidance suggests resilient demand across Qiagen’s key diagnostics and life sciences franchises despite a mixed funding backdrop.

- We’ll now examine how Qiagen’s earnings beat and confirmed full-year guidance might influence its investment narrative and future prospects.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Qiagen Investment Narrative Recap

To own Qiagen, you need to believe in steady demand for molecular diagnostics and life science tools that can compound through automation, recurring consumables and targeted M&A. The Q3 2025 beat and reaffirmed guidance support this thesis in the near term and help underpin confidence in key growth drivers, while the biggest immediate risk still looks like funding and budget pressure in research and academic markets, which this quarter’s numbers have not fully removed as a concern.

In this context, Qiagen’s recent launch of QIAsymphony Connect, with a broader automation portfolio slated through 2026, ties directly into one of the clearest catalysts: rising adoption of automated, digitally connected sample prep and workflows. If execution on these new platforms goes to plan, it could reinforce the earnings durability that Q3’s results pointed to, even as macro and competitive headwinds in areas like digital PCR remain an undercurrent for the story.

But against this solid quarter, investors should still be aware of how intensifying competition in digital PCR could...

Read the full narrative on Qiagen (it's free!)

Qiagen's narrative projects $2.5 billion revenue and $554.3 million earnings by 2028.

Uncover how Qiagen's forecasts yield a $50.79 fair value, a 8% upside to its current price.

Exploring Other Perspectives

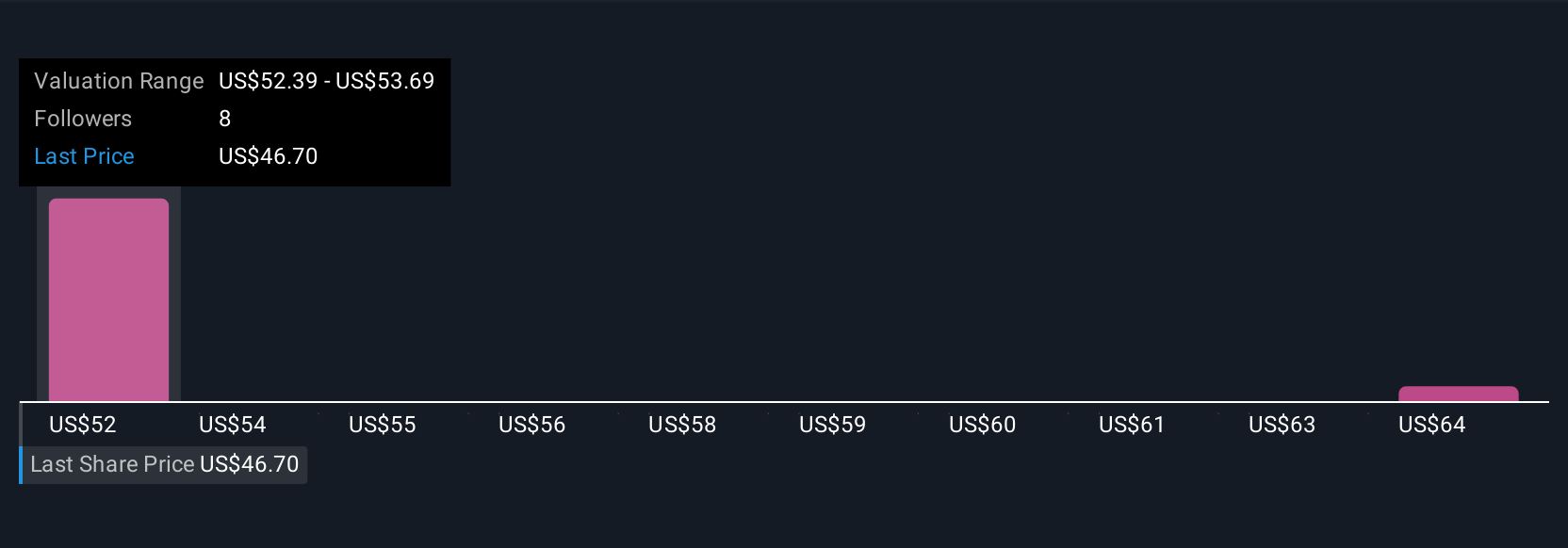

Two fair value estimates from the Simply Wall St Community span roughly US$50.79 to US$60.00, highlighting how differently individual investors assess Qiagen’s potential. When you weigh that range against ongoing risks around life sciences funding and academic budget cuts, it underlines why many investors look at several viewpoints before forming a view on the company’s prospects.

Explore 2 other fair value estimates on Qiagen - why the stock might be worth just $50.79!

Build Your Own Qiagen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Qiagen research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Qiagen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Qiagen's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qiagen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QGEN

Qiagen

Provides sample to insight solutions that transform biological samples into molecular insights in the Netherlands and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026