- United States

- /

- Pharma

- /

- NYSE:PFE

Is There an Opportunity in Pfizer After Recent Drug Approvals and Pipeline Progress?

Reviewed by Bailey Pemberton

- Ever wondered if Pfizer stock is a hidden bargain or just treading water? Let's break down whether the current price is an opportunity or a warning sign.

- Pfizer's share price recently climbed 5.1% in just seven days and is up 4.6% over the past month, even after a challenging 2.8% dip year to date.

- One of the driving factors behind these moves has been renewed investor optimism around the pharmaceutical sector, sparked by major industry headlines on drug approvals and pipeline progress. Notably, increased attention to Pfizer's development partnerships has put the spotlight back on its long-term innovation prospects.

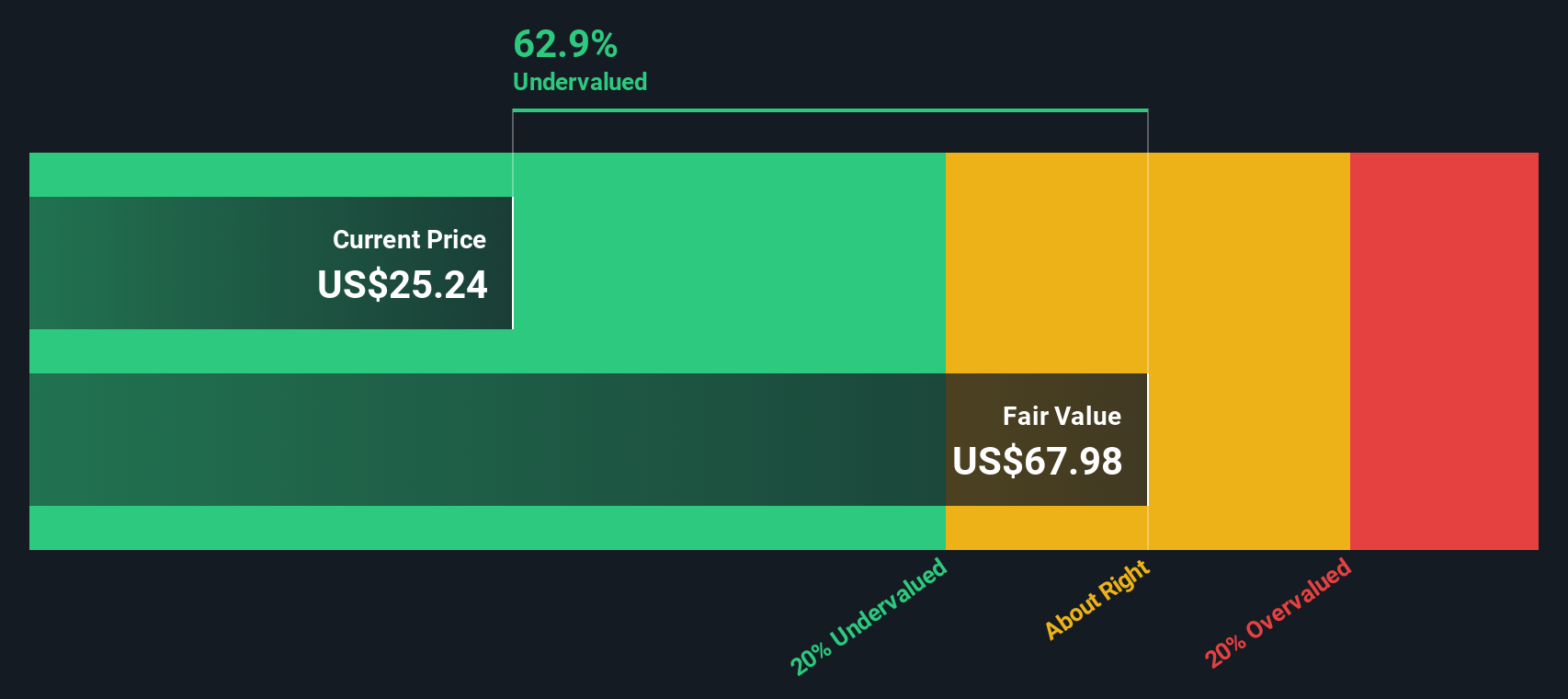

- Right now, Pfizer earns a valuation score of 5 out of 6 for being undervalued in most of our key checks, which is impressive. However, numbers only tell part of the story. Let’s explore what these valuation approaches actually mean and consider a smarter, more nuanced way to look at Pfizer’s true value.

Find out why Pfizer's 3.8% return over the last year is lagging behind its peers.

Approach 1: Pfizer Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a valuation approach that estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This method focuses on the cash Pfizer is expected to generate over time, rather than short-term market sentiment.

Currently, Pfizer's Free Cash Flow is around $9.95 billion. According to analyst forecasts and extended projections, this figure is expected to grow, reaching an estimated $16.32 billion by 2029. Professional analysts typically supply estimates for the next five years, and additional years are extrapolated based on recent trends and industry expectations. This provides a longer-term view for investors.

Based on this DCF analysis, Pfizer's fair intrinsic value per share is calculated at $62.28. With the stock trading at a significant discount, the model suggests Pfizer may be approximately 58.5% undervalued compared to its calculated worth. In practical terms, this indicates the current market price may not fully reflect Pfizer's cash-generating potential over the coming decade.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Pfizer is undervalued by 58.5%. Track this in your watchlist or portfolio, or discover 863 more undervalued stocks based on cash flows.

Approach 2: Pfizer Price vs Earnings (P/E) Ratio

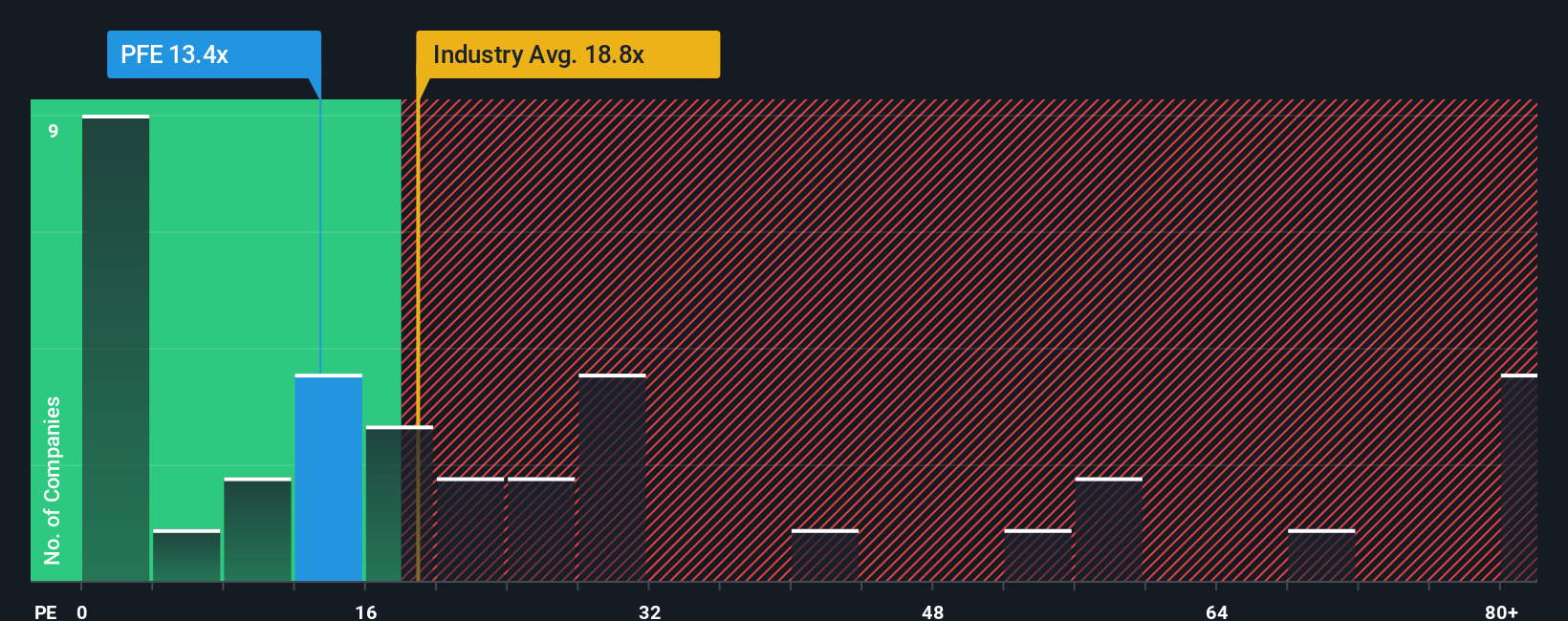

The Price-to-Earnings (P/E) ratio is a favored way to value profitable companies like Pfizer because it directly links share price to the company's bottom-line performance. Investors often look at the P/E ratio to judge how much they are paying for each dollar of earnings, a key benchmark for any established business with steady profits.

It is important to remember that what counts as a "normal" or reasonable P/E ratio depends on a company’s growth prospects and risk. Higher growth often justifies a higher P/E, while elevated risks or lower projected growth tend to bring it down. For Pfizer, the latest P/E stands at 15x, which is below the pharmaceutical industry average of 18.1x and the average of similar peers at 16.8x. This suggests the market may be cautious or pricing in lower expectations.

Simply Wall St’s proprietary Fair Ratio model takes this basic comparison further. The Fair Ratio for Pfizer is calculated at 24.5x, factoring in not just industry averages and peer benchmarks, but also the company’s unique characteristics, growth outlook, risks, profit margins, and market cap. This offers a more tailored benchmark than relying on blunt industry or peer averages, which can miss company-specific strengths or vulnerabilities.

Since Pfizer’s actual P/E of 15x is well below its Fair Ratio of 24.5x, the stock appears to be undervalued based on this approach.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1368 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Pfizer Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your unique perspective or “story” about a company, combining what you believe about its future (like estimated growth rates or margins) with the logic behind your valuation, connecting the facts, forecasts, and fair value into a coherent, actionable view.

Narratives help investors go beyond static numbers by linking a company’s business story and assumptions to a dynamic financial forecast, all in a way that is easy to visualize and update as the world changes.

On Simply Wall St’s platform, Narratives are accessible within the Community page, used by millions of investors, where you can create or view others’ Pfizer forecasts and see how their personal stories translate into fair values and buy or sell signals as news and earnings data roll in.

This approach empowers you to decide when to buy or sell by comparing your Narrative’s Fair Value to the market price, and ensures you’re always acting on the most current information, rather than just outdated models.

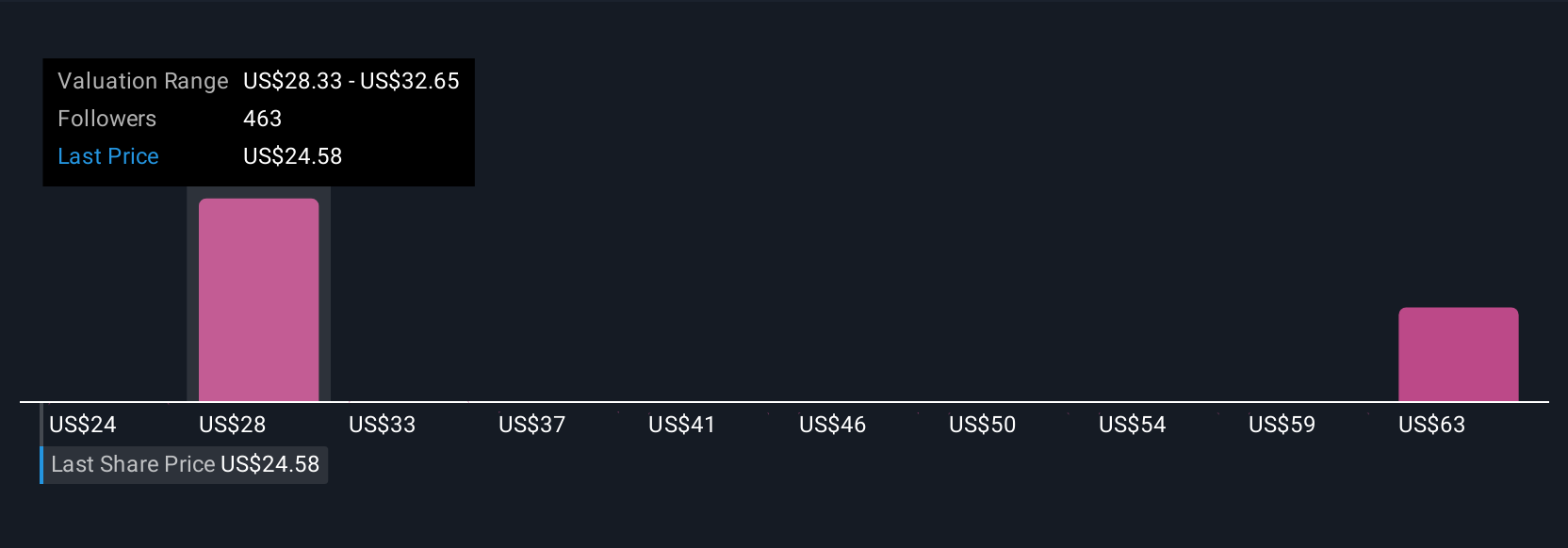

For example, some investors see Pfizer’s fair value as high as $36 if new oncology launches and margin expansion beat expectations, while others estimate it closer to $24 based on price pressures and patent risks. Narratives visualize, organize, and update these different viewpoints so you can choose what makes sense for you.

For Pfizer, we’ll make it really easy for you by providing previews of two leading Pfizer Narratives:

Fair Value: $28.86

14.6% undervalued vs. current price

Forecast Revenue Growth: -2.25% per year

- Strategic expansion in innovative therapies and biologics, vigorous pipeline development in oncology and rare diseases, and a focus on emerging markets are expected to support long-term growth and resilience against industry headwinds.

- Operational efficiency is improving through rapid digitalization and AI adoption, which is aiding profit margin expansion even as revenues are projected to dip modestly in the near term.

- Main risks include global regulatory and pricing pressures, intensifying competition, looming patent expirations, and the challenge of replacing legacy blockbuster revenues with new product launches and acquisitions.

Fair Value: $24.00

7.8% overvalued vs. current price

Forecast Revenue Growth: -4.21% per year

- Persistent regulatory reforms, pricing negotiations, and patent expirations are expected to constrain Pfizer's revenue and squeeze profit margins, especially in key global markets.

- Heavy dependence on R&D pipeline success to offset declining exclusivity of top-selling drugs introduces significant execution risk, with new product launches potentially falling short of expectations.

- Bullish offsets include cost-cutting, capital discipline, pipeline progress, and expanding access in international markets. However, bearish analysts see a greater risk of revenue and earnings stagnation or decline through the decade.

Do you think there's more to the story for Pfizer? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFE

Pfizer

Pfizer Inc. discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives