- United States

- /

- Pharma

- /

- NYSE:NUVB

Why Nuvation Bio (NUVB) Is Up 6.5% After Strong Safusidenib Phase 2 Glioma Data And What's Next

Reviewed by Sasha Jovanovic

- Nuvation Bio recently reported encouraging Phase 2 trial results for safusidenib in IDH1-mutant grade 2 gliomas, achieving its primary endpoint with a 44.4 percent objective response rate and a manageable safety profile.

- These data, which suggest safusidenib may help delay chemoradiation and preserve quality of life, have drawn increased attention from both management and analysts to Nuvation Bio’s emerging oncology pipeline.

- We’ll now examine how the promising safusidenib Phase 2 results could reshape Nuvation Bio’s investment narrative and future growth opportunities.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Nuvation Bio's Investment Narrative?

For Nuvation Bio to make sense as a holding, you have to believe in its ability to turn an early commercial foothold with taletrectinib and a high-upside pipeline into a sustainable oncology franchise, despite ongoing losses and a rich valuation. The new Phase 2 safusidenib data strengthen that story by adding a potentially meaningful second pillar, and help explain the very large share price move over the past few months. In the near term, catalysts now skew more toward regulatory and partnership progress for safusidenib and the commercial ramp of IBTROZI, while trial execution, safety scrutiny after past reporting issues, and financing obligations tied to taletrectinib remain key risks. The recent insider sale by the CMO also keeps questions about management’s confidence and timing front of mind for investors.

However, one issue in particular could matter more than the recent trial headlines for shareholders. Nuvation Bio's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

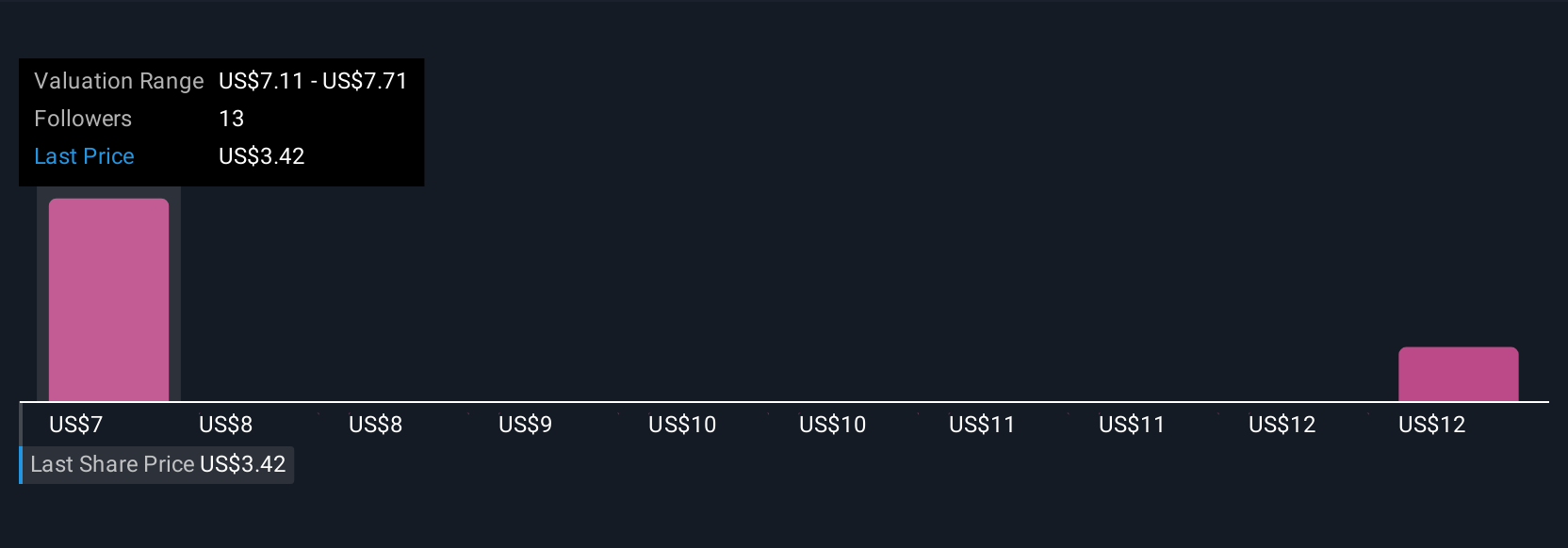

Six fair value estimates from the Simply Wall St Community span roughly US$0.76 to almost US$32 per share, reflecting wide disagreement. Set against the recent safusidenib data and sharp price gains, this spread highlights how differently people are weighing trial risk, commercial execution and Nuvation Bio’s path to profitability.

Explore 6 other fair value estimates on Nuvation Bio - why the stock might be worth less than half the current price!

Build Your Own Nuvation Bio Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nuvation Bio research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nuvation Bio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nuvation Bio's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuvation Bio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NUVB

Nuvation Bio

A clinical-stage biopharmaceutical company, focuses on developing therapeutic candidates for oncology.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026