- United States

- /

- Pharma

- /

- NYSE:NUVB

Nuvation Bio (NUVB): Assessing Valuation After NUV-1511 Program Discontinuation Reshapes Pipeline

Reviewed by Simply Wall St

Nuvation Bio (NUVB) announced it is discontinuing the development of its NUV-1511 program due to efficacy concerns. This marks a meaningful shift in the company’s research and development strategy and future drug pipeline.

See our latest analysis for Nuvation Bio.

The sizable shift in Nuvation Bio’s clinical strategy arrives after an extraordinary streak in its share price, which has soared 204% year-to-date and delivered a total shareholder return of nearly 296% over the past three years. Even with the recent discontinuation news, the last quarter’s 150% share price return shows that momentum had been building fast. This likely reflects changing risk perceptions and renewed optimism across the biotech sector.

If the rapid pivots and surging share prices in biotech have you watching the broader landscape, it might be the perfect time to discover See the full list for free.

With recent analyst price targets still above the current share price and rapid gains behind it, is Nuvation Bio undervalued after the NUV-1511 setback, or has the market fully priced in future prospects?

Price-to-Book of 8.3x: Is it justified?

Based on the latest data, Nuvation Bio trades at a price-to-book ratio of 8.3x, which makes it appear more expensive than the US Pharmaceuticals industry average, where peers trade at around 2.5x.

The price-to-book ratio compares a company's market value to its book value and is a common measure in asset-heavy biotech firms to gauge how investors are valuing the company’s net assets, including intellectual property, clinical pipeline, and cash reserves.

While investors are valuing Nuvation Bio at a premium to the industry, this could reflect expectations for future breakthroughs or significant progress in its pipeline. However, relative to its peers, this premium raises questions about whether the valuation is supported by fundamentals.

For further context, compared to the peer group average price-to-book ratio of 10.6x, Nuvation Bio appears more moderate but still well above the industry norm. This highlights the tension between optimistic future projections and the company's current unprofitable status.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 8.3x (OVERVALUED)

However, setbacks such as clinical discontinuations and ongoing net losses could quickly challenge current optimism and put pressure on Nuvation Bio's elevated valuation.

Find out about the key risks to this Nuvation Bio narrative.

Another View: What Does the DCF Model Say?

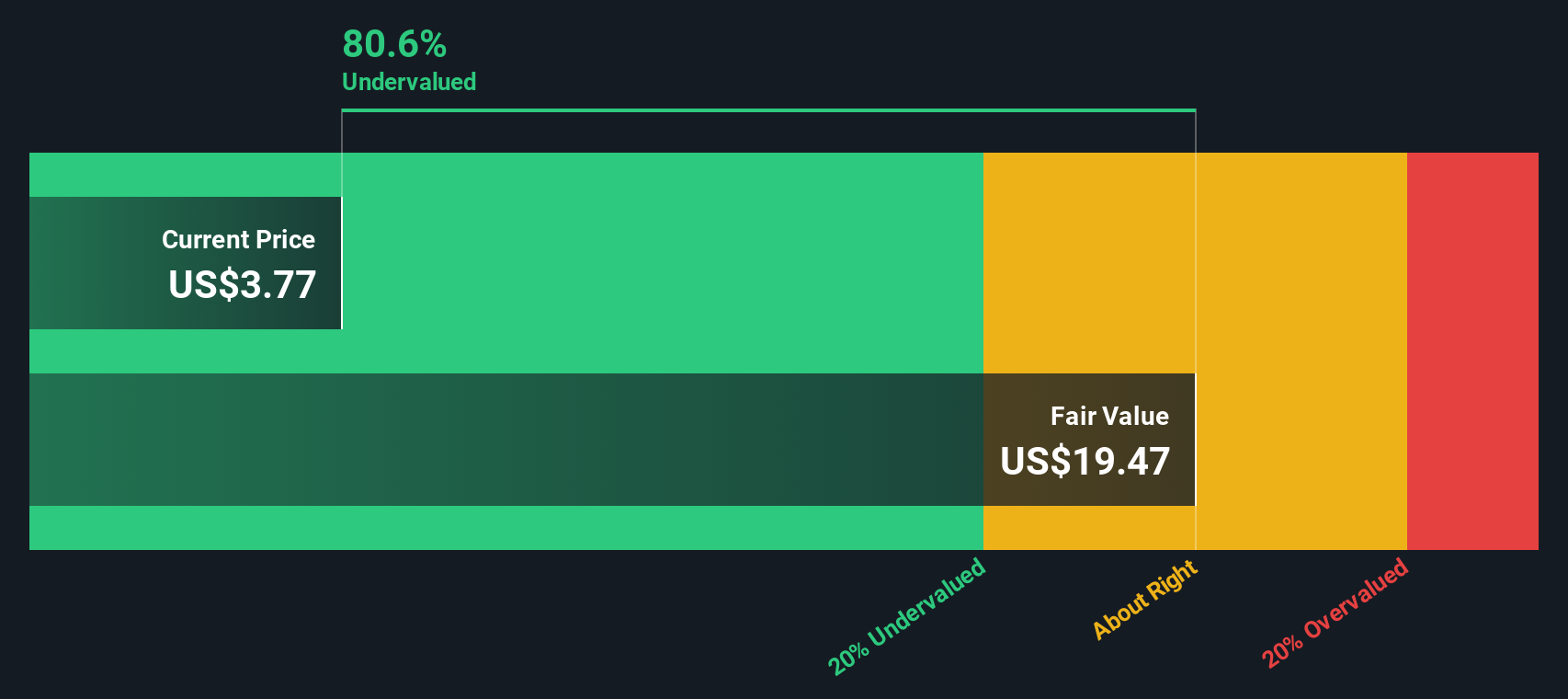

While the price-to-book ratio signals Nuvation Bio is trading at a premium, our DCF model offers a different perspective. According to this approach, Nuvation Bio’s shares are trading at a steep discount to fair value, which suggests the market may be overlooking long-term potential. Is the gap an opportunity or a reflection of real risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nuvation Bio for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nuvation Bio Narrative

If you see the story differently or want to dig into the numbers on your own terms, you can craft your own take in just a few minutes. Do it your way

A great starting point for your Nuvation Bio research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Broaden your investment plans and gain an edge by using the Simply Wall Street Screener. You could be missing exciting opportunities while others get ahead.

- Uncover untapped potential by reviewing these 3567 penny stocks with strong financials with robust financials and promising upside that most investors overlook.

- Capture future growth by reviewing these 25 AI penny stocks that are revolutionizing industries with artificial intelligence breakthroughs.

- Secure your portfolio’s long-term strength when you compare these 14 dividend stocks with yields > 3% featuring attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuvation Bio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NUVB

Nuvation Bio

A clinical-stage biopharmaceutical company, focuses on developing therapeutic candidates for oncology.

High growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026