- United States

- /

- Life Sciences

- /

- NYSE:MTD

Assessing Mettler-Toledo International (MTD) Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

Mettler-Toledo International (MTD) has attracted attention recently thanks to its consistent financial growth, as investors gauge potential opportunities in the laboratory instrument and precision equipment space. Shares have moved higher in the past month.

See our latest analysis for Mettler-Toledo International.

Mettler-Toledo International’s share price has picked up momentum lately, with a 30-day share price return of 8% and a strong 16% gain so far this year. Looking at the broader picture, its one-year total shareholder return of just 2.5% suggests that recent optimism is still gaining traction among investors, rather than establishing a long-term trend at this stage.

If you’re interested in finding more companies showing growth potential in related industries, it might be the perfect moment to discover fast growing stocks with high insider ownership

But with Mettler-Toledo International’s recent rally, investors are left to wonder if there is still value to be found, or if the current price already reflects future growth prospects.

Most Popular Narrative: 5.7% Overvalued

The most widely followed valuation narrative sees Mettler-Toledo International trading above its fair value, with a current share price that exceeds consensus fair value estimates. This difference raises key questions about whether future earnings growth and margin expansion will justify today's price. This sets the stage for a closer look at the drivers behind this calculation.

Accelerating trends in automation and digitalization of manufacturing and laboratory environments are creating strong, recurring demand for Mettler-Toledo's data-driven solutions and process analytics. This enables greater share of wallet, increased adoption of its automation products, and supports revenue growth as well as higher-margin recurring software and services.

Curious about the financial assumptions supercharging this valuation? The real story hinges on bold profit projections and ambitious margin expansion. Numbers like these are rarely seen outside the tech sector. Which estimates are driving such a premium? Dive into the full narrative and uncover the ingredients shaping this fair value.

Result: Fair Value of $1,343.36 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent global tariff uncertainties or prolonged weakness in key regions could dampen Mettler-Toledo’s growth outlook and potentially challenge the prevailing optimism.

Find out about the key risks to this Mettler-Toledo International narrative.

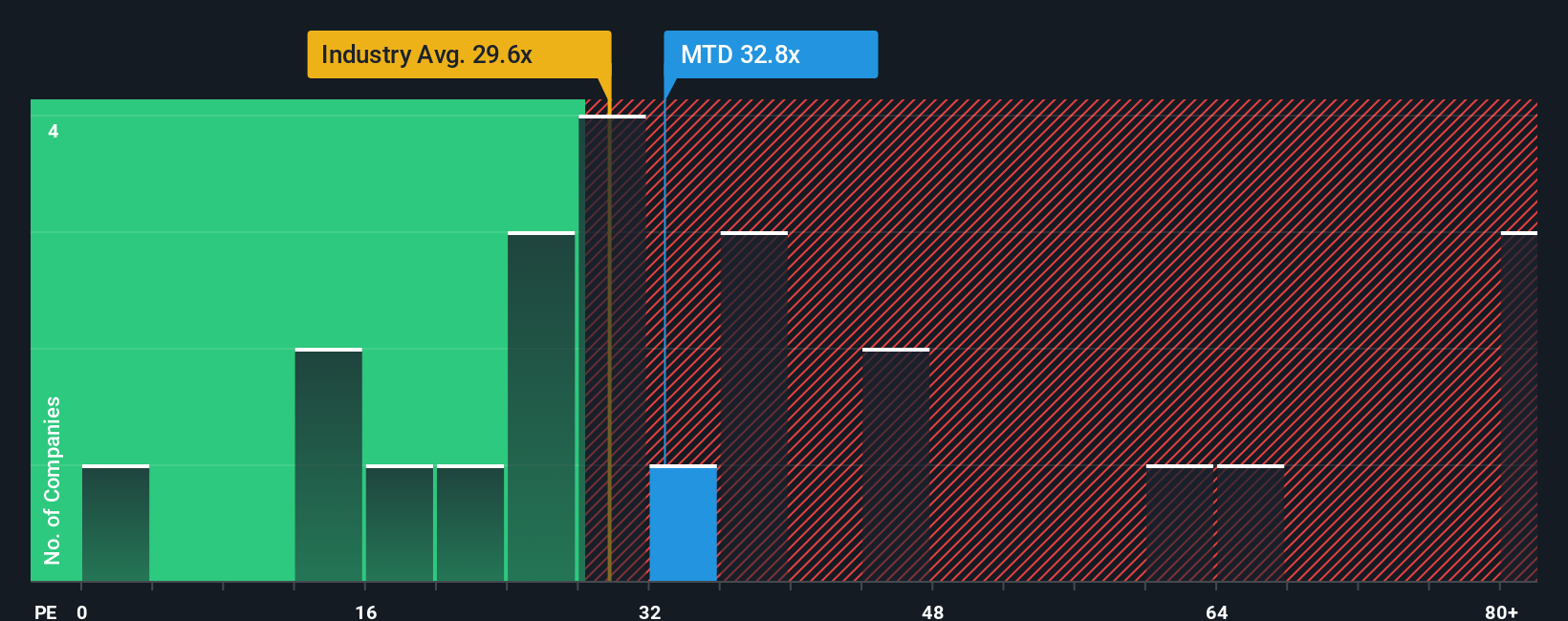

Another View: How Market Ratios Stack Up

Looking at valuation through the lens of the price-to-earnings ratio, Mettler-Toledo International is trading at 35.3x, just below the broader industry average of 36.1x. However, compared to the peer group at 34.4x and a fair ratio of 22.6x, this suggests the market is still pricing in quite a bit of optimism and leaving less room for error. Will investors continue to support this premium, or could reality start to catch up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mettler-Toledo International Narrative

If you have a different perspective, or want to investigate the numbers for yourself, you can easily build your own view in just a few minutes. Do it your way

A great starting point for your Mettler-Toledo International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investment Opportunities?

Why settle for ordinary when you could target tomorrow’s winners? The Simply Wall Street Screener helps you spot potential in places others overlook. Don’t miss out on what’s next.

- Uncover companies making waves in digital assets by checking out these 81 cryptocurrency and blockchain stocks. These companies are reshaping how we think about money, security, and financial systems.

- Catch up on emerging breakthroughs by scouting these 33 healthcare AI stocks for innovative health tech driven by artificial intelligence and real-world impact.

- Stay ahead of the market by targeting these 840 undervalued stocks based on cash flows before the crowd recognizes their potential value based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTD

Mettler-Toledo International

Manufactures and supplies precision instruments and services in the Americas, Europe, Asia, and internationally.

Proven track record with limited growth.

Similar Companies

Market Insights

Community Narratives