- United States

- /

- Pharma

- /

- NYSE:LLY

How Investors Are Reacting To Eli Lilly (LLY) FDA Approval of New Kisunla Dosing Schedule

Reviewed by Simply Wall St

- Earlier this month, Eli Lilly received U.S. FDA approval for an updated dosing schedule of Kisunla (donanemab-azbt), its amyloid-targeting therapy for adults with early symptomatic Alzheimer's disease, which was shown to significantly reduce the risk of imaging abnormalities associated with treatment.

- This label change, based on recent clinical trial data, highlights efforts to enhance the safety profile of Kisunla while maintaining its efficacy, potentially supporting broader patient adoption in a competitive Alzheimer's treatment market.

- We'll explore how the improved safety profile resulting from the new Kisunla dosing schedule could influence Eli Lilly's investment narrative.

Eli Lilly Investment Narrative Recap

To own Eli Lilly, an investor needs to believe in the company’s ability to drive innovation and capture growth in critical therapy areas, particularly Alzheimer’s and obesity. The recent Kisunla dosing label update is a positive for the Alzheimer’s franchise and may limit near-term risk of adoption hurdles, but the largest catalyst remains data and approvals for pipeline assets, while the key risk centers on pricing and competition for core products like Mounjaro and Zepbound, areas largely unaffected by this news.

Among recent announcements, the competitive pricing of high-dose Zepbound at US$499 per month directly relates to the ongoing risk of pricing pressure and PBM negotiations in obesity treatments. While focus on Alzheimer’s advances is important, revenue stability for Eli Lilly continues to rely on uptake and price management in key franchises, reinforcing the importance of strategic launch execution and payer discussions for future growth.

However, investors should also keep in mind that intensified competition and shifting PBM dynamics could...

Read the full narrative on Eli Lilly (it's free!)

Eli Lilly's narrative projects $85.5 billion in revenue and $31.8 billion in earnings by 2028. This requires 20.4% annual revenue growth and a $20.7 billion increase in earnings from $11.1 billion currently.

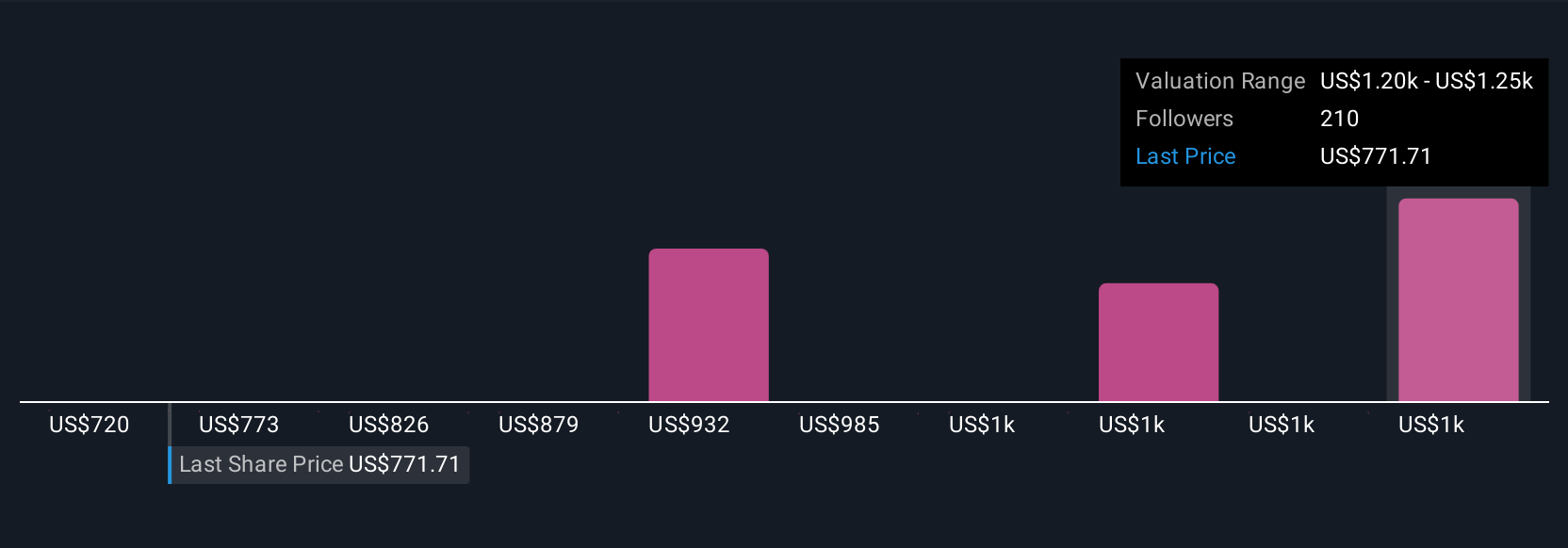

Uncover how Eli Lilly's forecasts yield a $952.27 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Eighteen private investors from the Simply Wall St Community estimated Eli Lilly’s fair value between US$745.63 and US$1,250.37. Amid wide opinions, pricing pressure in diabetes and obesity therapies remains a central issue influencing long-term performance, so consider multiple viewpoints before making a decision.

Explore 18 other fair value estimates on Eli Lilly - why the stock might be worth just $745.63!

Build Your Own Eli Lilly Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eli Lilly research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Eli Lilly research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eli Lilly's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives