- United States

- /

- Pharma

- /

- NYSE:LLY

A Look at Eli Lilly’s (LLY) Valuation After Strong Q3 Earnings, Upbeat Guidance, and Zepbound Expansion Plans

Reviewed by Simply Wall St

Eli Lilly (LLY) delivered a surge of news this week, posting strong third-quarter earnings, raising its full-year outlook, and rolling out big plans for manufacturing expansion and retail access to its weight-loss drug Zepbound. Investors are watching closely as the company stakes an even bigger claim in the obesity and diabetes treatment markets.

See our latest analysis for Eli Lilly.

Eli Lilly’s shares have powered higher lately, with momentum picking up after the strong Q3 earnings beat and upbeat guidance. The 13% share price return over the past three months reflects investors’ renewed confidence as management invests ahead of surging demand and lines up major partnerships. A stellar five-year total return of 539% underscores the long-term growth story.

If you’re looking to spot other healthcare leaders with compelling growth drivers, now’s the perfect moment to explore See the full list for free.

With so much good news already propelling the stock, the key question now is whether Eli Lilly shares still offer fresh upside or if future growth is already fully reflected in the current price.

Most Popular Narrative: 27% Undervalued

According to eat_dis_watermelon’s narrative, Eli Lilly’s fair value sits far above its recent close, suggesting the market may be missing major upside. The gap signals outsized optimism built around the next wave of products and rapid operational expansion.

Market penetration for all GLP-1 drugs is only at 4% of the target audience of 100 to 120 million people in the USA alone. Still has a lot of room to penetrate for more than one GLP-1 drug.

What financial assumptions are fueling this bullish outlook? The narrative hints at blockbuster revenue growth and an ambitious margin profile that could push shares well beyond current levels. Want the specifics and the bold projections behind this target? Discover the full growth thesis inside the complete narrative.

Result: Fair Value of $1,189 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks remain, such as supply chain delays or emerging competition. Either of these could challenge the current bullish outlook on Eli Lilly.

Find out about the key risks to this Eli Lilly narrative.

Another View: What Do Price Multiples Say?

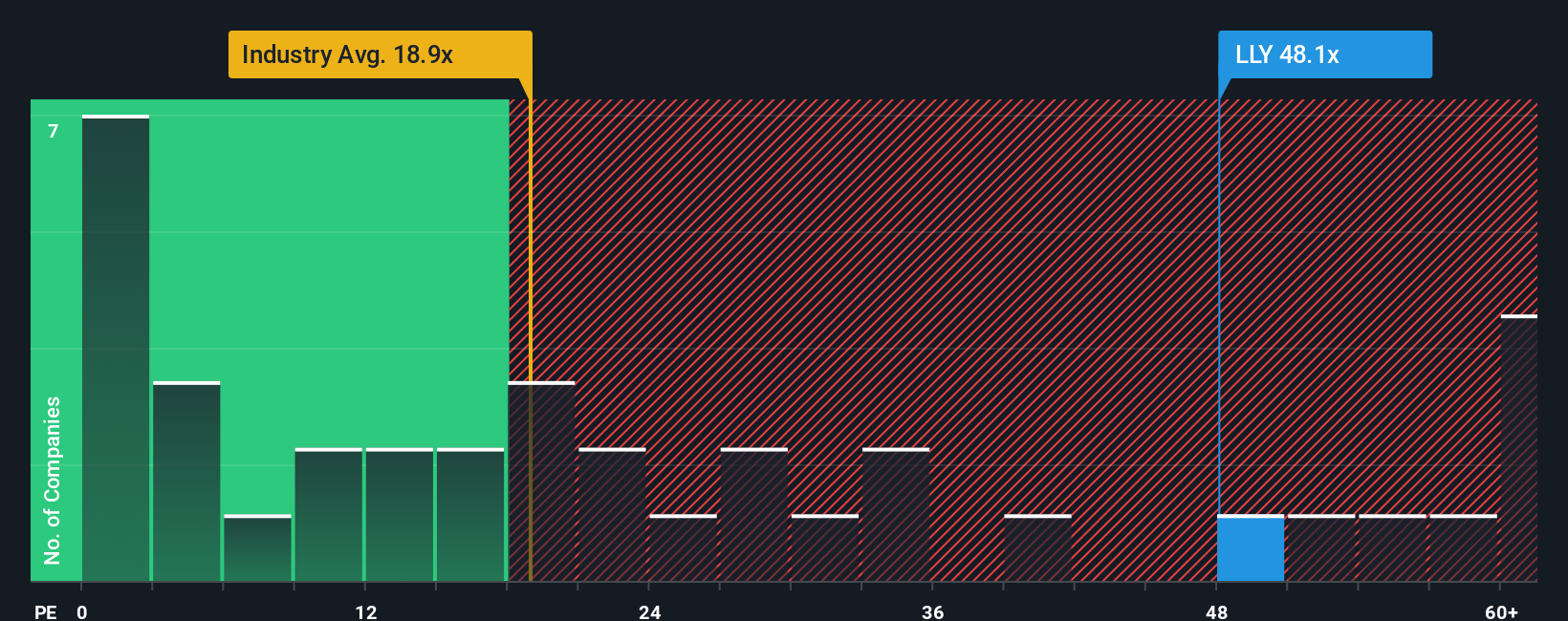

While fair value estimates suggest Eli Lilly is undervalued, looking at its price-to-earnings ratio tells a different story. Shares trade at 42 times earnings, which is well above the industry average of 18.1 and the peer group at 14.5. Even compared with the fair ratio of 39, this premium signals investors are willing to pay up for Lilly’s expected growth. But does this steep valuation mean higher risk ahead, or does demand justify the price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eli Lilly Narrative

If you see the story differently, or want to uncover your own insights, you can dig into the numbers and craft your personal narrative in just a few minutes. Do it your way

A great starting point for your Eli Lilly research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Can’t-Miss Opportunities?

Unlock your edge as an investor by checking out new corners of the market you might be overlooking. These unique strategies could give your portfolio the spark it needs. Don’t let them pass you by!

- Start building a stream of income and see how your capital could grow faster by tapping into these 22 dividend stocks with yields > 3% with yields that beat the average savings account.

- Stay ahead of tomorrow’s trends by targeting breakthrough innovation. Power up your watchlist with these 26 AI penny stocks that are transforming industries with artificial intelligence advances.

- Capitalize on deep value plays with strong fundamentals when you seize the chance to find these 831 undervalued stocks based on cash flows before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives