- United States

- /

- Pharma

- /

- NYSE:JNJ

Stability and Pricing Power - Why Johnson & Johnson's (NYSE:JNJ) 2.4% Dividend is Worth Your Time

In turbulent times, some investors turn from speculative stocks that have their cash flows far in the future, to reliable and strong companies like Johnson & Johnson (NYSE:JNJ). The company has been around for years, has a recognized brand and strong product portfolio. For investors, it provides both a cash and equity return. Today, we will evaluate the cash - dividend returns of JNJ and see if the stock is a viable option.

Looking at equity returns, we can see that with the latest rally, the stock is now in the green and has returned 9.2% to shareholders in the last 12 months.

Additionally, if we include dividends in this calculation, we get a total stock return of 12%. This is slightly better than the 5-year total stock return of 10%, showing that JNJ is a low return but reliable stock.

Now we will look at the company from the perspective of dividends.

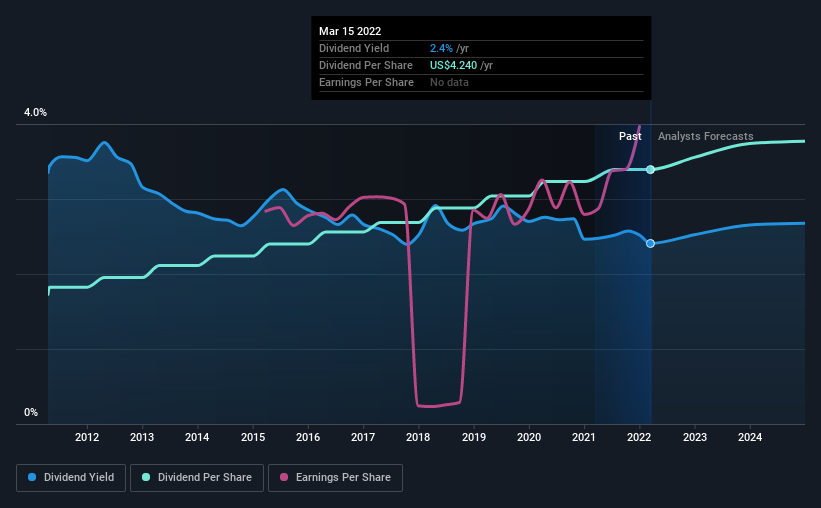

Johnson & Johnson' has a 2.4% dividend yield, which has been on a slight decline from 3.8% in 2012. The company also bought back stock during the year, equivalent to approximately 0.5% of the company's market capitalization at the time. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Click the interactive chart for our full dividend analysis

While not having the highest yield, JNJ's dividend yield is close to the industry's average of 2.5%. All Things considered, a 2.5% cash return is quite a good thing today.

Now, we need to estimate if the company can keep affording the dividends in the future.

Payout ratios

We can gauge the sustainability of dividends relative to net profits after tax. Looking at the data, we can see that 53% of Johnson & Johnson's profits were paid out as dividends in the last 12 months. A payout ratio above 50% generally implies that the business is mature and doesn't aspire to take on too many growth projects. This is not bad for shareholders, as they are left with reliable cash returns.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. The company paid out 56% of its free cash flow.

It's positive to see that Johnson & Johnson's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Remember, you can always get a snapshot of Johnson & Johnson's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. For the purpose of this article, we only scrutinise the last decade of Johnson & Johnson's dividend payments.

The dividend has been quite stable over the past 10 years, which is great.

During the past 10-year period, the first annual payment was US$2.2 in 2012, compared to US$4.2 last year. Dividends per share have grown at approximately 7.0% per year over this time.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend.

Johnson & Johnson has grown its earnings per share at 5.6% per annum over the past five years, which means that dividends are nicely tied to the growth in profits.

Conclusion

Johnson & Johnson's dividends seem to be affordable, reliable and provide a 2.4% yearly cash return. The company itself has been around for years and its products are diversified and have enough pricing power to justify possible price hikes.

As investors move from speculative to reliable stocks, we see JNJ as a company to keep in your watch list for potential opportunities.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:JNJ

Johnson & Johnson

Engages in the research and development, manufacture, and sale of various products in the healthcare field worldwide.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026