- United States

- /

- Pharma

- /

- NYSE:ELAN

Elanco Animal Health (ELAN) Is Up 8.2% After FDA Strengthens Zenrelia Safety Labeling – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Elanco Animal Health recently announced that the FDA approved updates to the Zenrelia label, removing prior language about fatal vaccine-induced disease risks and reinforcing Zenrelia’s safety and efficacy profile for the treatment of canine skin allergies.

- This development follows widespread real-world success for Zenrelia and growing support from veterinarians and pet owners across key international markets.

- We'll explore how the FDA’s strengthened safety endorsement of Zenrelia could impact Elanco's future growth prospects and earnings outlook.

The latest GPUs need a type of rare earth metal called Terbium and there are only 32 companies in the world exploring or producing it. Find the list for free.

Elanco Animal Health Investment Narrative Recap

For shareholders, the core thesis for Elanco Animal Health is centered on sustained growth via new pet health innovations and expanding global reach, both relying heavily on rapid adoption of key drugs like Zenrelia. The FDA’s updated safety label for Zenrelia may help reduce execution risk tied to new product adoption, which is arguably the most important near-term catalyst. However, it does not meaningfully address the company’s sizable operating expenses, which remain a significant potential headwind in the short term.

Another recent announcement with strong relevance is Credelio Quattro’s surge past US$100 million in net sales within its first eight months. This success highlights Elanco’s momentum in bringing new, high-value pet products to market, reinforcing the company’s reliance on rapid execution and uptake in veterinary channels as it seeks to drive future revenue growth.

But on the other hand, investors should also consider the execution risks around rapid new product adoption, especially as Elanco pushes further into...

Read the full narrative on Elanco Animal Health (it's free!)

Elanco Animal Health's outlook projects $5.1 billion in revenue and $186.7 million in earnings by 2028. This is based on a forecasted 4.5% annual revenue growth rate and a decrease in earnings of $247.3 million from the current $434.0 million level.

Uncover how Elanco Animal Health's forecasts yield a $19.00 fair value, a 7% downside to its current price.

Exploring Other Perspectives

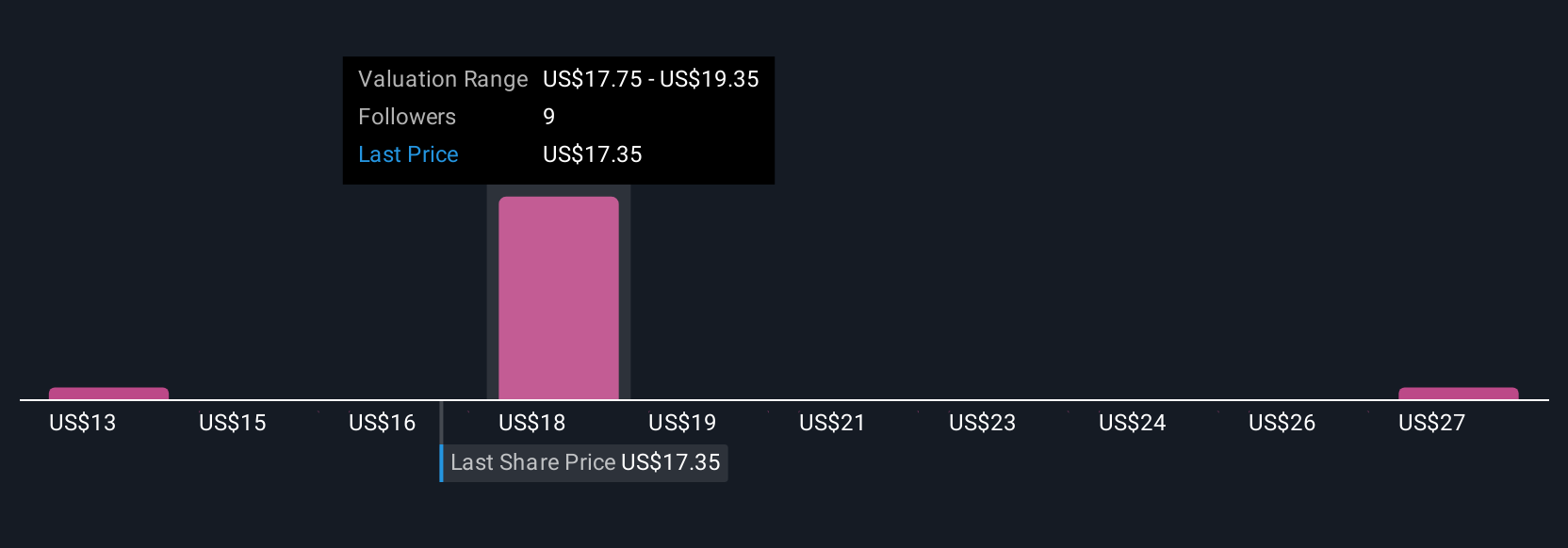

Three separate fair value estimates from the Simply Wall St Community range from US$12.93 to US$29.12, reflecting a broad mix of outlooks. While many anticipate innovation-driven revenue acceleration, you should review these contrasting views for greater perspective on Elanco’s future potential.

Explore 3 other fair value estimates on Elanco Animal Health - why the stock might be worth as much as 42% more than the current price!

Build Your Own Elanco Animal Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Elanco Animal Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Elanco Animal Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Elanco Animal Health's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elanco Animal Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELAN

Elanco Animal Health

An animal health company, innovates, develops, manufactures, and markets products for pets and farm animals worldwide.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives