- United States

- /

- Pharma

- /

- NYSE:ELAN

Elanco Animal Health (ELAN): Assessing Valuation After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

Elanco Animal Health (ELAN) has seen its shares climb steadily, gaining 12% over the past month and jumping by 40% in the past 3 months. Investors appear interested in the company’s momentum as it navigates current market conditions.

See our latest analysis for Elanco Animal Health.

Elanco’s 1-year total shareholder return stands at a strong 42%, and the recent 90-day share price return of 40% suggests optimism is picking up among investors. While the bigger picture shows a stock regaining its footing, market participants seem to be betting on growth potential as risk perception improves.

If Elanco’s renewed momentum has you curious about other opportunities, it could be the perfect time to branch out and discover See the full list for free.

With shares surging and investor optimism on the rise, the big question remains: is Elanco Animal Health still trading below its true value, or is the current share price already accounting for all that future growth?

Most Popular Narrative: 9% Overvalued

With Elanco shares closing at $20.64, the most widely followed narrative suggests a fair value of $19. This figure is slightly below the current price and indicates that optimism may be stretching beyond the fundamentals. This market dynamic is shaped by strategic launches and a renewed revenue outlook.

Operational focus on strategic product launches and divesting non-core businesses such as the Aqua division has enabled debt reduction and increased investment capacity. These actions are expected to improve net margins and financial stability.

Want to see what’s fueling this ambitious valuation? This narrative is based on record-setting pipeline launches and a high-multiple forecast that is usually reserved for more explosive growth stocks. Find out what bold projections and future earnings expectations are powering this price target. The details might surprise you.

Result: Fair Value of $19 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing FX headwinds and rising operating expenses could limit Elanco’s profitability. These factors could challenge optimistic growth forecasts if these pressures persist.

Find out about the key risks to this Elanco Animal Health narrative.

Another View: Discounted Cash Flow Model Suggests Upside

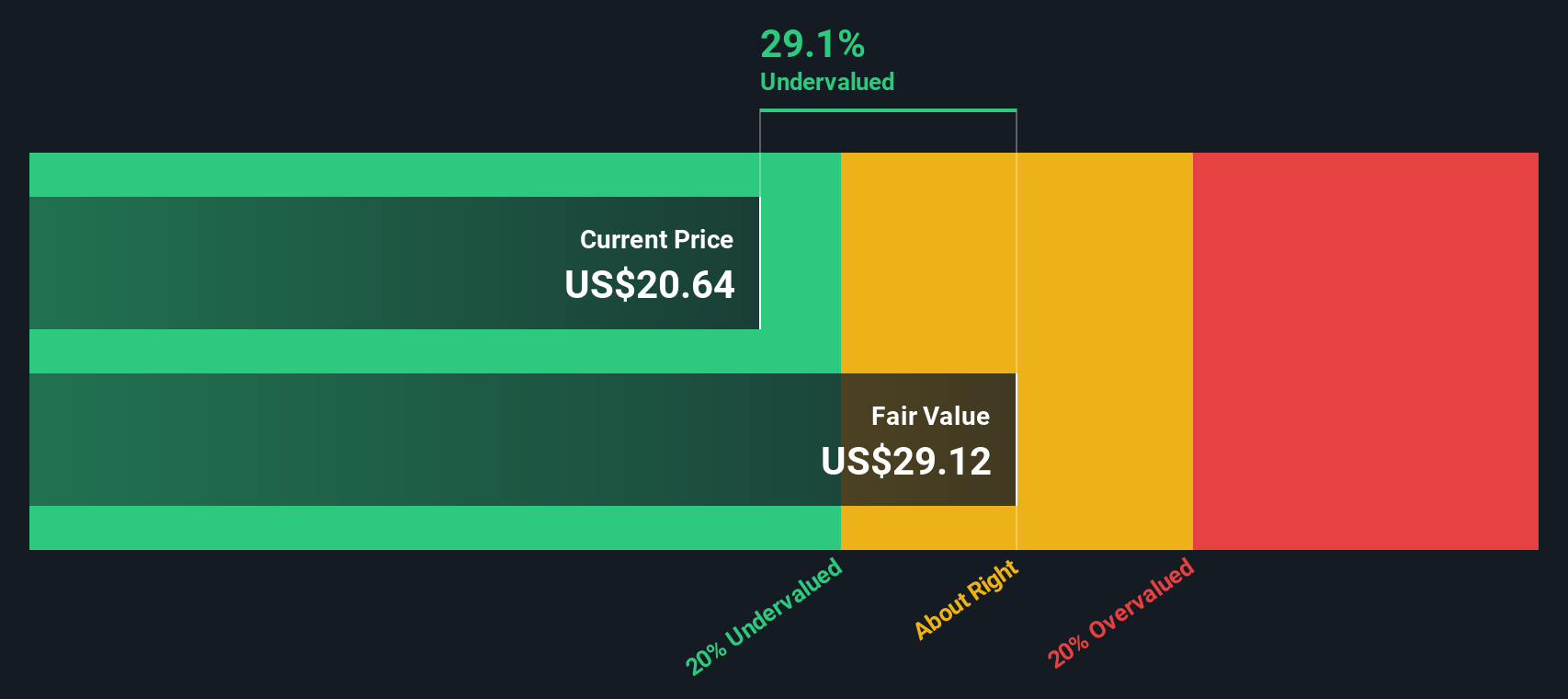

While traditional profit multiples paint Elanco as somewhat expensive compared to peers, our SWS DCF model comes to a different conclusion. It values Elanco at $29.12 per share, which is well above the current market price. Could the market be underestimating Elanco’s future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Elanco Animal Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Elanco Animal Health Narrative

If you see things differently or want to dive into the numbers on your own terms, you can easily craft your own perspective in just a few minutes, and Do it your way

A great starting point for your Elanco Animal Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t wait and risk missing out on what could be your next winning stock. Use these handpicked shortlists to catch new opportunities now:

- Unlock the potential of generous income by tapping into these 19 dividend stocks with yields > 3%, which can put consistent cash in investors’ pockets.

- Seize the advantages at the frontier of artificial intelligence with these 25 AI penny stocks, which are transforming everyday industries.

- Maximize your chances of finding value by exploring these 887 undervalued stocks based on cash flows, offering strong cash flow upside before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elanco Animal Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELAN

Elanco Animal Health

An animal health company, innovates, develops, manufactures, and markets products for pets and farm animals worldwide.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives