- United States

- /

- Life Sciences

- /

- NYSE:DHR

Danaher (DHR): A Fresh Look at Valuation After Recent Share Price Momentum

Reviewed by Simply Wall St

Danaher (DHR) stock is on investors’ radar following recent performance data that highlights both short-term gains and long-term challenges. With the share price edging up in the past month, some are taking a closer look at the company’s earnings growth and valuation.

See our latest analysis for Danaher.

After a choppy start to the year, Danaher’s share price has rallied over the last month with a 6.6% gain, suggesting some investors are warming up to its story even as the total shareholder return over the past year remains negative. This recent momentum hints that sentiment may be shifting; however, longer-term investors are still waiting for stronger evidence of a sustained turnaround.

If you’re thinking bigger picture, this could be the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

With Danaher’s stock trading near $216 but still below analysts’ $254 price target, the key question is whether the recent uptick signals an undervalued opportunity or if the market has already priced in expected growth.

Most Popular Narrative: 15.2% Undervalued

According to the most widely followed valuation narrative, Danaher’s estimated fair value of $254.40 stands notably above the latest close of $215.79. This sizable gap sets the tone for a deeper dive into the drivers and critical assumptions underpinning the premium analysts place on the stock.

“The sustained advancement of precision medicine and personalized therapies, including new AI-assisted diagnostic solutions and groundbreaking launches in genomics (like support for in vivo CRISPR therapies), positions Danaher’s technology portfolio to capture higher-margin growth and drive long-term EBITDA expansion.”

Want to see the formula behind Danaher’s premium price? Unlock which future innovations, operating improvements, and ambitious margin targets support this striking valuation. The answer might surprise you. Tap through to unravel the numbers and tech bets that analysts are counting on.

Result: Fair Value of $254.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent trade tensions and weaker biotech funding could undermine Danaher’s growth outlook and pose real challenges to the current bullish valuation narrative.

Find out about the key risks to this Danaher narrative.

Another View: Looking at Valuation Through Earnings Multiples

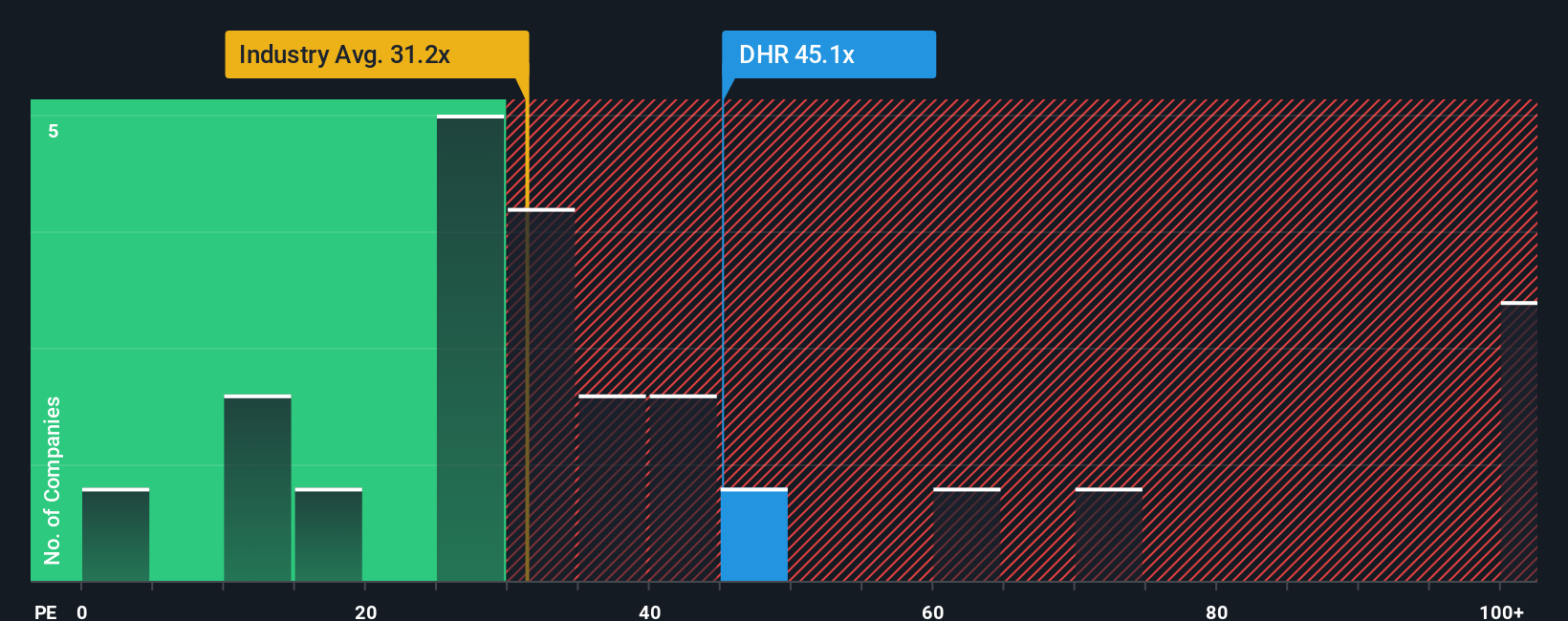

While fair value models suggest Danaher is slightly undervalued, a scan of its current price-to-earnings ratio tells a different story. The stock trades at 43.5 times earnings, a notable premium to both its peer group (33.1x) and the broader North American Life Sciences industry (37.3x). This compares to the fair ratio of 30.5x suggested by market regression analysis. This wide gap signals pricing risk: are investors paying up in hopes of a turnaround, or ignoring concerns about slower growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Danaher Narrative

If you see Danaher's story differently, take a hands-on approach and build your own narrative. You can start your own analysis and conclusions in just minutes. Do it your way

A great starting point for your Danaher research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Level up your strategy and don’t let fresh opportunities pass by just because you stopped at one stock. The market is full of high-potential picks you might be missing.

- Seize high-yield potential by targeting companies offering reliable income through these 15 dividend stocks with yields > 3% with yields above 3%.

- Capitalize on the AI boom by catching the latest innovations and surge in demand with these 25 AI penny stocks before the crowd does.

- Boost your portfolio’s upside by acting on these 857 undervalued stocks based on cash flows currently trading below their intrinsic value, waiting for savvy investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHR

Danaher

Designs, manufactures, and markets professional, medical, research, and industrial products and services in the United States, China, and internationally.

Excellent balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives