- United States

- /

- Life Sciences

- /

- NYSE:BIO

Is Bio-Rad’s Third Quarter Net Loss and Share Buyback Shaping the Investment Case for BIO?

Reviewed by Sasha Jovanovic

- Bio-Rad Laboratories recently reported third quarter 2025 earnings, with sales of US$653 million and a shift from net income to a net loss of US$341.9 million, alongside an update on its ongoing share repurchase program.

- Despite year-to-date sales staying nearly flat, the company's net loss and continued buyback activity stand out as important factors shaping recent investor sentiment.

- We'll examine how Bio-Rad's swing to a quarterly net loss and completion of a major share repurchase tranche may influence its investment outlook.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Bio-Rad Laboratories Investment Narrative Recap

For investors in Bio-Rad Laboratories, the core investment thesis hinges on the company's ability to regain earnings momentum through cutting-edge diagnostics and stable consumables growth, even as cyclical challenges weigh on revenue. The recent third quarter net loss and completion of a significant share repurchase tranche do not appear to meaningfully alter the biggest short-term catalysts, advances in molecular diagnostics, or the key risk of continued weak instrument demand and lingering margin pressure. The direct impact of this news on those factors seems limited.

Among recent announcements, the expanded partnership with Biodesix to advance diagnostic assays using Bio-Rad’s ddPCR technology is particularly relevant, reinforcing one of the company’s main growth levers. Progress in this area could counterbalance near-term financial volatility, underscoring how new platform launches and partnerships remain central to the company’s future potential. Yet, investors should stay alert to headwinds in instrument sales or academic funding that may challenge these positive drivers.

In contrast, while innovations and partnerships offer promise, persistent softness in instrument demand is an ongoing risk that investors should keep in mind as...

Read the full narrative on Bio-Rad Laboratories (it's free!)

Bio-Rad Laboratories is projected to reach $2.7 billion in revenue and $232.0 million in earnings by 2028. This outlook requires 2.3% annual revenue growth and a $87.2 million decrease in earnings from the current $319.2 million level.

Uncover how Bio-Rad Laboratories' forecasts yield a $324.00 fair value, a 3% upside to its current price.

Exploring Other Perspectives

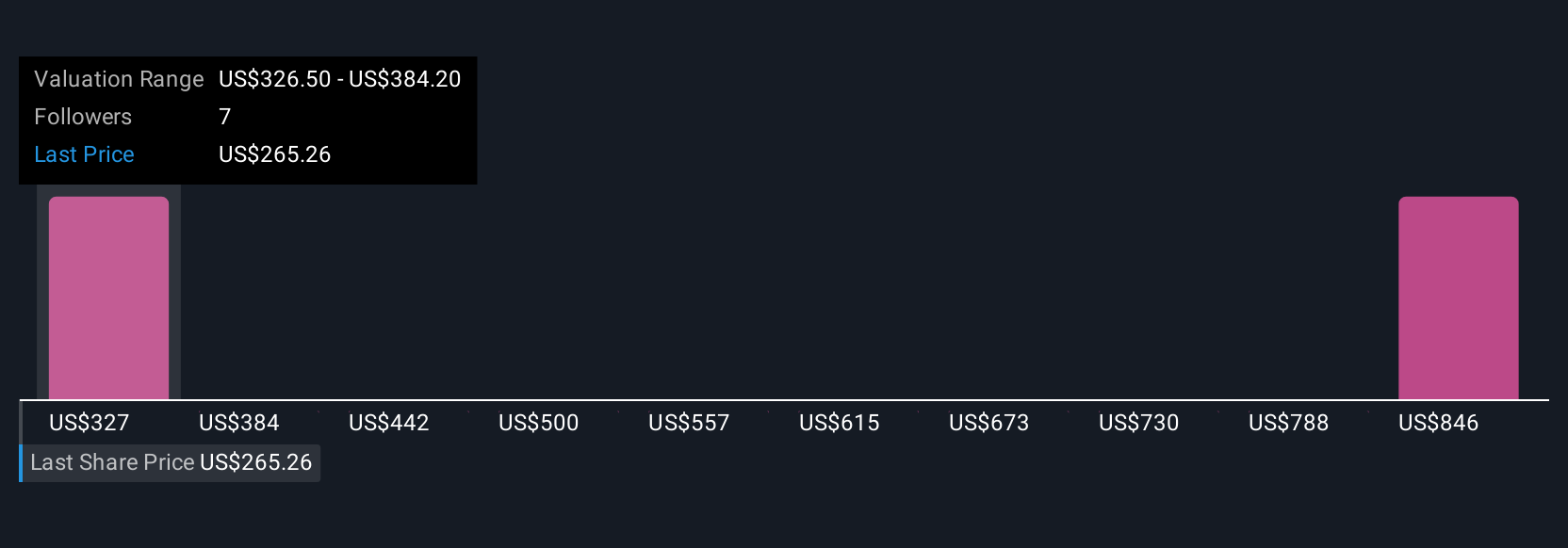

Simply Wall St Community members provided two fair value estimates for Bio-Rad Laboratories, ranging from US$324 to US$394.91 per share. While some foresee growth opportunities in diagnostics, many remain aware of risks tied to sustained weakness in core product demand, encouraging you to review multiple viewpoints before forming your own outlook.

Explore 2 other fair value estimates on Bio-Rad Laboratories - why the stock might be worth as much as 26% more than the current price!

Build Your Own Bio-Rad Laboratories Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bio-Rad Laboratories research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Bio-Rad Laboratories research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bio-Rad Laboratories' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bio-Rad Laboratories might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BIO

Bio-Rad Laboratories

Manufactures and distributes life science research and clinical diagnostic products in the United States, Europe, Asia, Canada, and Latin America.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives