- United States

- /

- Life Sciences

- /

- NYSE:BIO

Bio-Rad Laboratories (BIO): Losses Widen 51% Annually, Undervalued Status Reinforces Turnaround Narrative

Reviewed by Simply Wall St

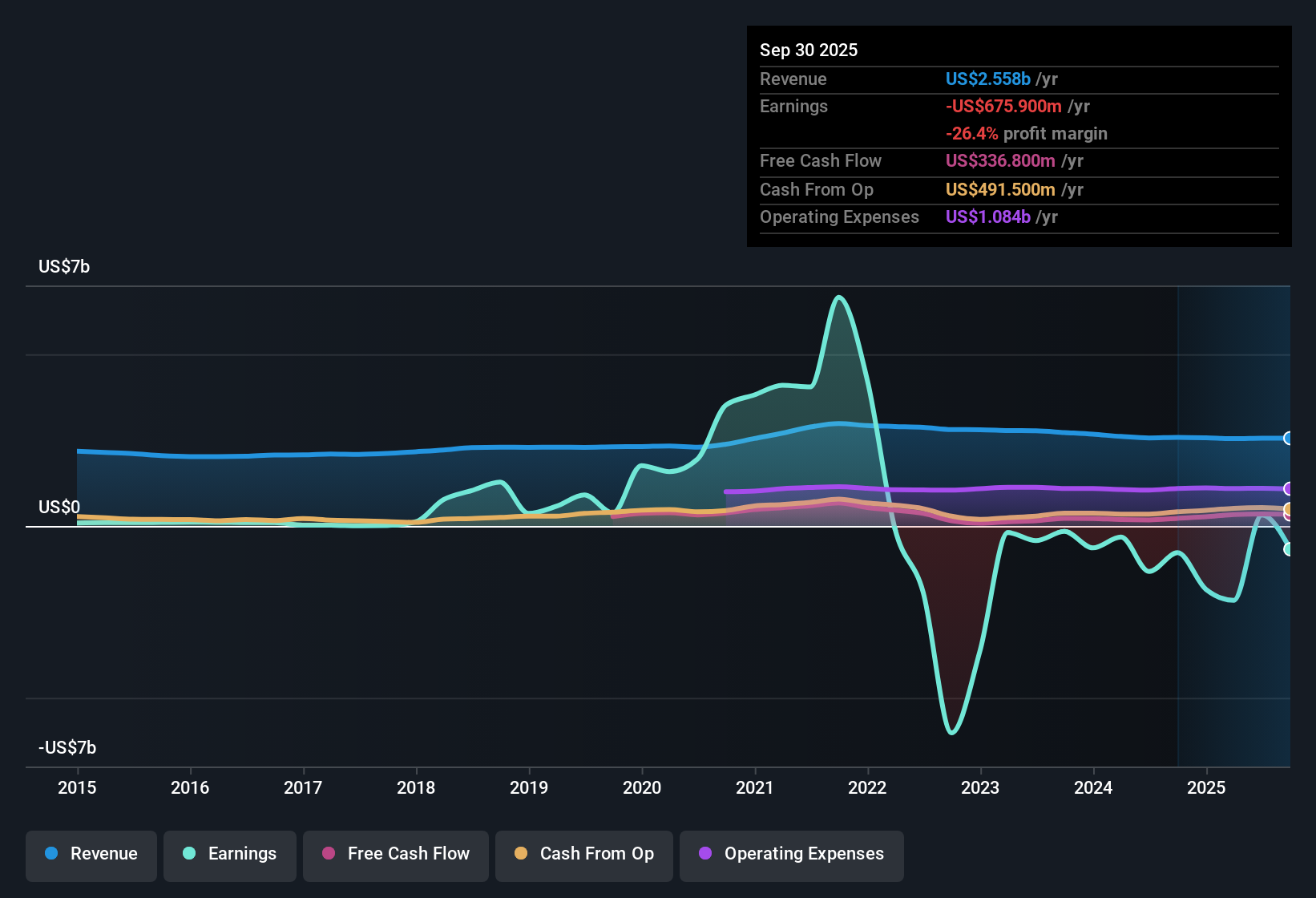

Bio-Rad Laboratories (BIO) posted another period of unprofitability, with net losses accelerating at a rate of 51% per year over the past five years. The company is expected to turn profitable within three years as earnings are forecast to grow at a robust 42.12% annually. The price-to-sales ratio stands at 3.2x, which is lower than both the industry and peer averages. An estimated fair value above the current share price of $304.61 may attract investors looking for turnaround potential in life sciences, as BIO’s valuation and future earnings trajectory could be compelling.

See our full analysis for Bio-Rad Laboratories.The next step is to put these results side by side with the most popular market narratives, revealing which stories hold up and which get challenged by the latest numbers.

See what the community is saying about Bio-Rad Laboratories

Profit Margins Seen Contracting to 8.5%

- Consensus estimates indicate profit margins are expected to narrow from 12.5% down to 8.5% by 2028, signaling compression even if revenue grows modestly at 2.3% annually.

- Analysts' consensus view points out that:

- Margin pressure is likely, as ongoing cost inflation and weak demand for instruments could further weigh on manufacturing absorption and potentially shrink profits.

- With gross margin already falling from 55.6% to 53% year over year, the company's future profitability will depend on robust growth in consumables and improved operating leverage from new platforms.

- Despite the earnings growth outlook, consensus is that investors should track both gross and operating margins closely as policy and reimbursement changes, especially in China, can quickly erode the benefits from new products.

- Surprisingly, resilience in high-margin consumables sales is helping offset some of this margin compression, but whether this can continue long term is still unclear.

Consensus view expects future margin improvement will hinge on successful mix shift and product launches, but warns about volatility in public funding and external cost shocks.

📊 Read the full Bio-Rad Laboratories Consensus Narrative.

Recurring Revenue from Consumables Stabilizes Cash Flows

- High single-digit growth in consumables and reagents has insulated Bio-Rad's cash flows from swings in instrument demand and delayed academic funding cycles.

- Analysts' consensus view highlights:

- As recurring consumables make up a larger share of revenue, stability improves and supports the company’s ability to invest in future growth even if new instrument installations slow.

- This stable cash flow helps buffer top-line results from regional policy shocks and swings in global research budgets, particularly compared to more cyclical industry peers.

Valuation Signals Upside Against DCF Fair Value

- Bio-Rad's current share price of $304.61 trades at a 28% discount to its DCF fair value estimate of $424.13, making it notably cheaper than analyst consensus or peer multiples suggest.

- Analysts' consensus view notes:

- At a price-to-sales ratio of 3.2x, BIO is not only below the US Life Sciences industry average (3.4x), but also undercuts its peer group. This is widely seen as a constructive setup for value-driven investors.

- Still, the consensus price target of $324.00 implies only modest upside, and investors need conviction that Bio-Rad can hit its margin and earnings forecasts through 2028 to justify further rerating in the stock.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bio-Rad Laboratories on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have an alternate take on the figures? Bring your viewpoint to life and create your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Bio-Rad Laboratories.

See What Else Is Out There

Bio-Rad faces margin pressures and inconsistent profit growth because of cost inflation and slowdowns in key product demand. This raises questions about its long-term earnings stability.

If you want steadier opportunities, consider stable growth stocks screener (2113 results) where you’ll find companies consistently growing earnings and revenues even when market conditions are less predictable.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bio-Rad Laboratories might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BIO

Bio-Rad Laboratories

Manufactures and distributes life science research and clinical diagnostic products in the United States, Europe, Asia, Canada, and Latin America.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives