- United States

- /

- Pharma

- /

- NYSE:BHC

Does Bausch Health’s Shift to Profitability Mark a New Era for BHC’s Investment Case?

Reviewed by Sasha Jovanovic

- Bausch Health Companies Inc. reported results for the third quarter ended September 30, 2025, showing revenue of US$2.68 billion and net income of US$179 million, both improved compared to the previous year.

- This shift from a net loss to net profitability indicates that operational improvements have translated into stronger bottom-line performance for the company.

- We'll explore how this turnaround in profitability could influence the company's investment narrative and outlook for future growth.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Bausch Health Companies Investment Narrative Recap

Investors interested in Bausch Health Companies generally need to believe in the company's ability to drive sustainable earnings growth despite looming regulatory and product-specific risks. The strong swing to quarterly profitability is a clear positive, but heightened concerns remain around Xifaxan’s potential price reductions due to likely inclusion in Medicare Drug Price Negotiation over the next two years, a risk that overshadows recent operational improvements as the most important short-term catalyst and headwind, respectively.

Among recent announcements, the approval of the triple-combination acne gel CABTREO by the FDA is particularly relevant, reflecting Bausch’s ongoing push to diversify its product lineup. This aligns with the need for new revenue streams as a counterbalance to potential price compressions in its core franchises, offering incremental support but not fundamentally altering the long-term risk profile linked to government pricing actions.

Yet, as optimism builds around profitability, investors should remain alert to significant evolving policy risks that could rapidly reshape Bausch's earnings picture...

Read the full narrative on Bausch Health Companies (it's free!)

Bausch Health Companies is projected to reach $10.1 billion in revenue and $264.4 million in earnings by 2028. This outlook assumes revenue will decline by 0.9% per year and that earnings will increase by $166.4 million from the current level of $98.0 million.

Uncover how Bausch Health Companies' forecasts yield a $7.08 fair value, a 4% upside to its current price.

Exploring Other Perspectives

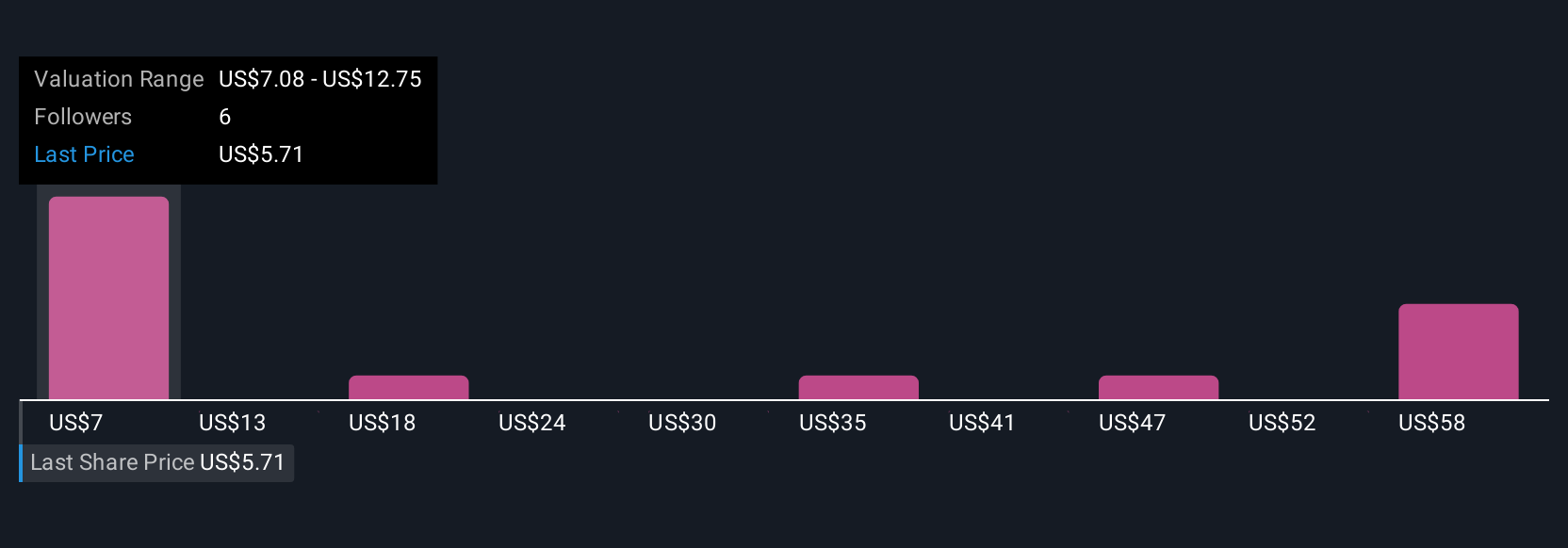

Simply Wall St Community members have published five fair value estimates for Bausch Health, ranging from US$7.08 up to US$68.71 per share. While many believe new product launches can help diversify revenue, substantial policy risks ahead still weigh heavily on earnings visibility.

Explore 5 other fair value estimates on Bausch Health Companies - why the stock might be worth over 10x more than the current price!

Build Your Own Bausch Health Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bausch Health Companies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bausch Health Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bausch Health Companies' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bausch Health Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BHC

Bausch Health Companies

Operates as a diversified specialty pharmaceutical and medical device company, develops, manufactures, and markets a range of products primarily in gastroenterology, hepatology, neurology, dermatology, generic pharmaceuticals, over-the-counter (OTC) products, aesthetic medical devices, and eye health in the United States and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives