- United States

- /

- Biotech

- /

- NYSE:ABBV

Is AbbVie Stock Set for More Gains After 25% Rally and Product Launches?

Reviewed by Bailey Pemberton

- Wondering if AbbVie stock is truly worth its recent buzz? You’re not alone, and we’re about to dig into whether it stacks up as a solid buy or just hype.

- Despite dipping 1.9% this week, AbbVie’s share price is still up 25.5% year-to-date and has climbed 158.5% over the last five years. This hints at major momentum shifts beneath the surface.

- This run has coincided with headline-grabbing announcements such as regulatory wins and new product launches. These events have fueled conversations among investors about the company’s evolving prospects, and help put the latest price movements into better context as we start to assess value.

- As for the numbers, AbbVie lands a 4 out of 6 on our valuation checks, showing the company looks undervalued in a few key areas. We’ll break down what goes into that score and why some valuation approaches are better than others, especially the method we’ll reveal toward the end.

Approach 1: AbbVie Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. For AbbVie, this involves using forecasts of the company’s Free Cash Flow (FCF) and adjusting for the time value of money to determine a fair price for the shares.

Currently, AbbVie generates approximately $19.9 billion in Free Cash Flow. Analyst forecasts and extended projections suggest this figure could reach around $42.0 billion by 2035. The growth is based on a combination of direct analyst estimates through 2029, with further values extrapolated for the following years by Simply Wall St’s model.

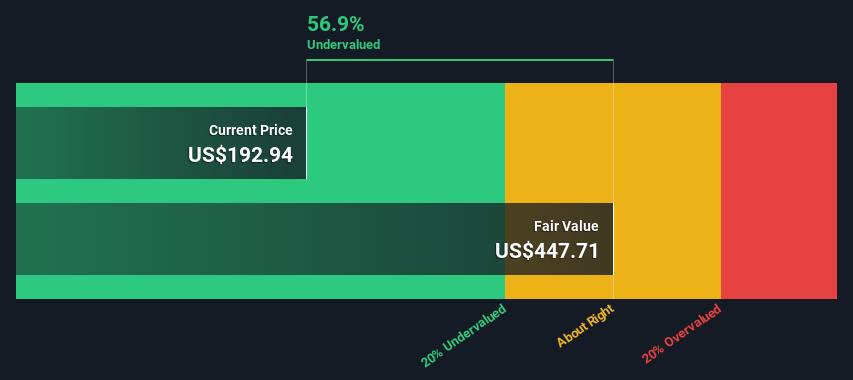

Using all available projections and discounting future cash flows, the DCF model calculates AbbVie’s fair value at $427.65 per share. With the present share price sitting about 47.4% below this estimated fair value, the model suggests that AbbVie is significantly undervalued in today’s market.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AbbVie is undervalued by 47.4%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: AbbVie Price vs Sales

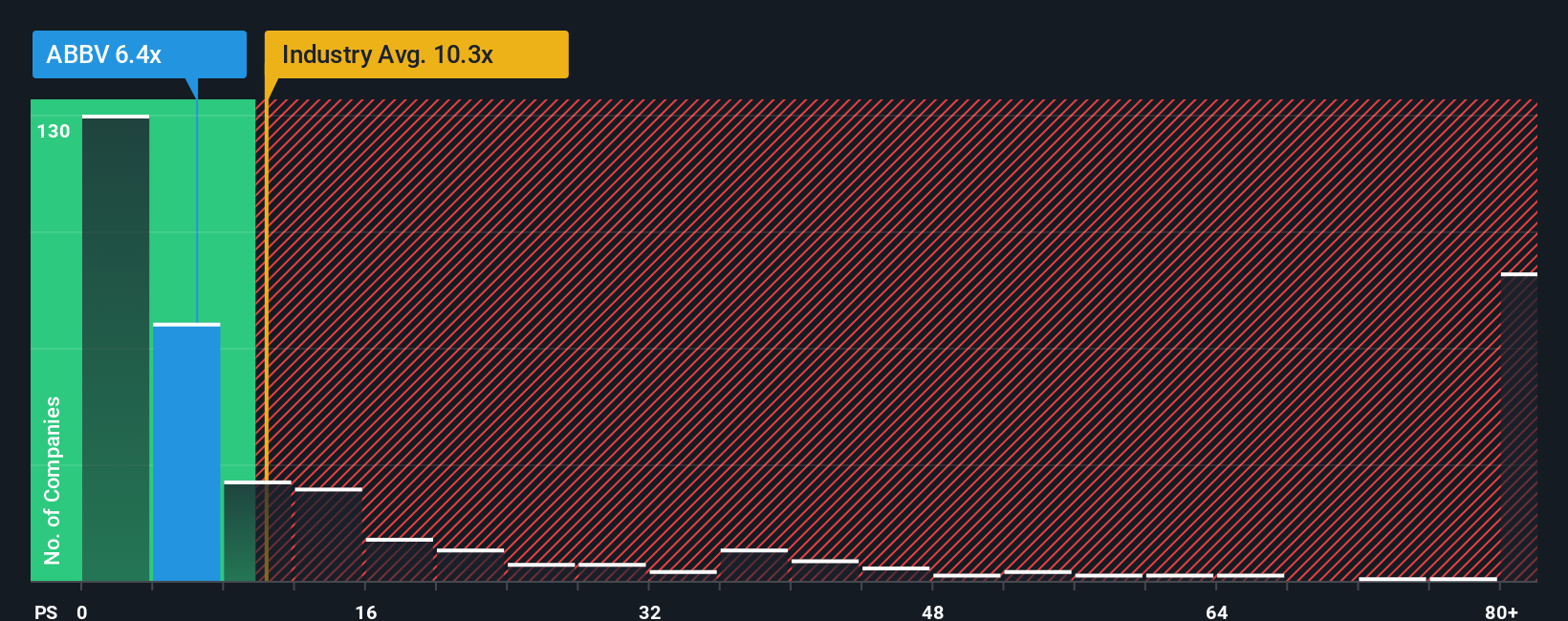

The Price-to-Sales (PS) ratio is a valuable valuation tool for profitable companies like AbbVie. This is especially true in the biotech sector, where revenues can be more stable than earnings due to factors such as R&D expenses or accounting changes. Investors often use the PS ratio to gauge how the market values each dollar of a company’s revenue, which helps in comparing companies at different growth stages.

Growth expectations and risk both play a significant role in determining what is considered a “normal” or “fair” PS ratio. Companies with faster expected growth, higher profit margins, or lower risks are typically associated with higher PS multiples. On the other hand, companies facing more uncertainty or operating in smaller markets may have lower ratios.

AbbVie’s current PS ratio is 6.67x. This is slightly above the average of its peers, which is 6.24x, but noticeably lower than the biotech industry average of 12.07x. For a more tailored benchmark, Simply Wall St provides a “Fair Ratio” for AbbVie, which is based on factors like the company’s growth potential, profit margins, risks, industry, and size. AbbVie’s Fair PS Ratio is calculated at 11.22x. This indicates what investors might consider a balanced multiple for its unique profile.

The Fair Ratio methodology is more precise than basic industry or peer comparisons because it takes into account specific metrics such as growth forecasts, risk factors, market capitalization, and margin profile. This allows for a truer apples-to-apples benchmark when evaluating a stock’s valuation.

With AbbVie currently trading at 6.67x compared to its Fair Ratio of 11.22x, the analysis suggests the stock remains undervalued using this metric.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AbbVie Narrative

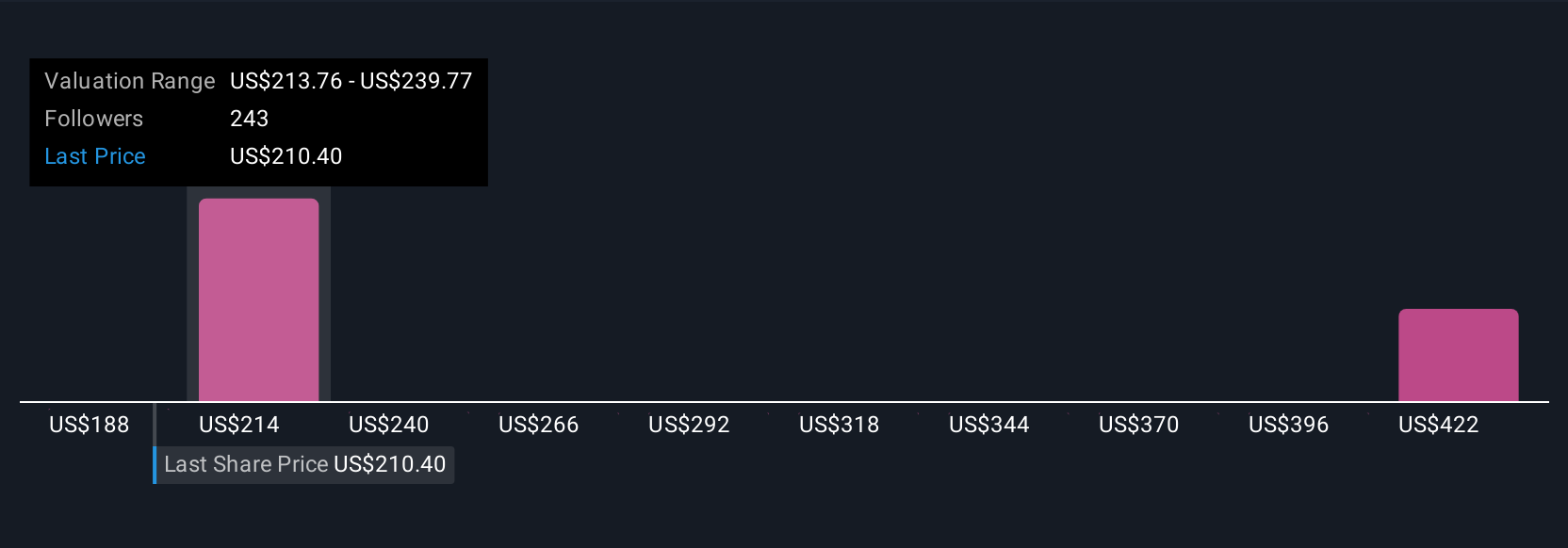

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are a simple yet powerful tool for investors. They let you connect your perspective on a company’s future—how you see its story unfolding—with the hard numbers you believe in, like projected earnings and growth rates, to create a personalized financial forecast and estimate of fair value.

By linking a company’s specific story to real financial forecasts, Narratives bridge the gap between gut feeling and solid analysis. On Simply Wall St’s platform, Narratives are accessible directly within the Community page, where millions of investors share, compare, and refine their outlooks with just a few clicks.

These tools make it easy to decide when to buy or sell by letting you weigh your assumed Fair Value against the current share price. Unlike static analysis, Narratives update dynamically any time new information comes in, such as earnings reports, product launches, or regulatory news. This ensures your view always stays relevant.

For example, looking at AbbVie, some investors might focus on its expanding neuroscience pipeline and set a high fair value of $255, while others may be more cautious about patent risks and opt for a lower valuation around $170. Narratives let you see these different views at a glance, empowering you to invest with more context and confidence.

Do you think there's more to the story for AbbVie? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ABBV

AbbVie

A research-based biopharmaceutical company, engages in the research and development, manufacture, commercialization, and sale of medicines and therapies worldwide.

Moderate risk, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026