- United States

- /

- Life Sciences

- /

- NYSE:A

Agilent Technologies (A): Assessing Valuation Following Strong Q4 Results and Upbeat 2026 Guidance

Reviewed by Simply Wall St

Agilent Technologies (A) caught investors' attention after reporting fourth-quarter results that topped forecasts, supported by strong core revenue growth and higher margins. Management also shared upbeat revenue guidance for 2026, indicating confidence in ongoing business momentum.

See our latest analysis for Agilent Technologies.

Agilent's upbeat 2026 outlook and a solid string of product launches have fueled fresh momentum in its shares, which now hover at $153.50 after surging over 22% in the past three months. For investors with a longer horizon, the 1-year total shareholder return stands at just over 12%, and the five-year total return remains a healthy 38%. This signals a company that is quietly compounding value as confidence returns to the sector.

If you’re curious what other science and diagnostics leaders are gaining traction, this is a great chance to discover See the full list for free.

With shares sitting near all-time highs after recent gains, the question for investors now is whether Agilent is still undervalued based on its future growth potential or if the market has already priced in the optimism.

Most Popular Narrative: 8.4% Undervalued

With Agilent Technologies' fair value from the most followed narrative sitting above the recent $153.50 share price, there is growing anticipation that its fundamentals are not yet fully reflected by the market. This contrast has become a focal point for investors looking for smart healthcare exposure.

Strong, broad-based growth in the pharmaceutical and chemicals/advanced materials end markets, driven by increased global healthcare demand, lab instrument replacement cycles, and expanding R&D budgets, demonstrates that Agilent is well positioned to benefit from rising healthcare and analytical testing needs, supporting sustained core revenue growth.

Curious what the most followed valuation is considering? Explore the inside story: revenue expansion, margin gains, and a potential future earnings multiple that could define the next phase for Agilent. The full narrative breaks down how much future growth is included in this fair value estimate. Discover the drivers that set this price apart.

Result: Fair Value of $167.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, supply chain complexities and tightening research budgets remain potential risks that could curb Agilent’s projected margin improvements and long-term growth outlook.

Find out about the key risks to this Agilent Technologies narrative.

Another View: What Does the SWS DCF Model Show?

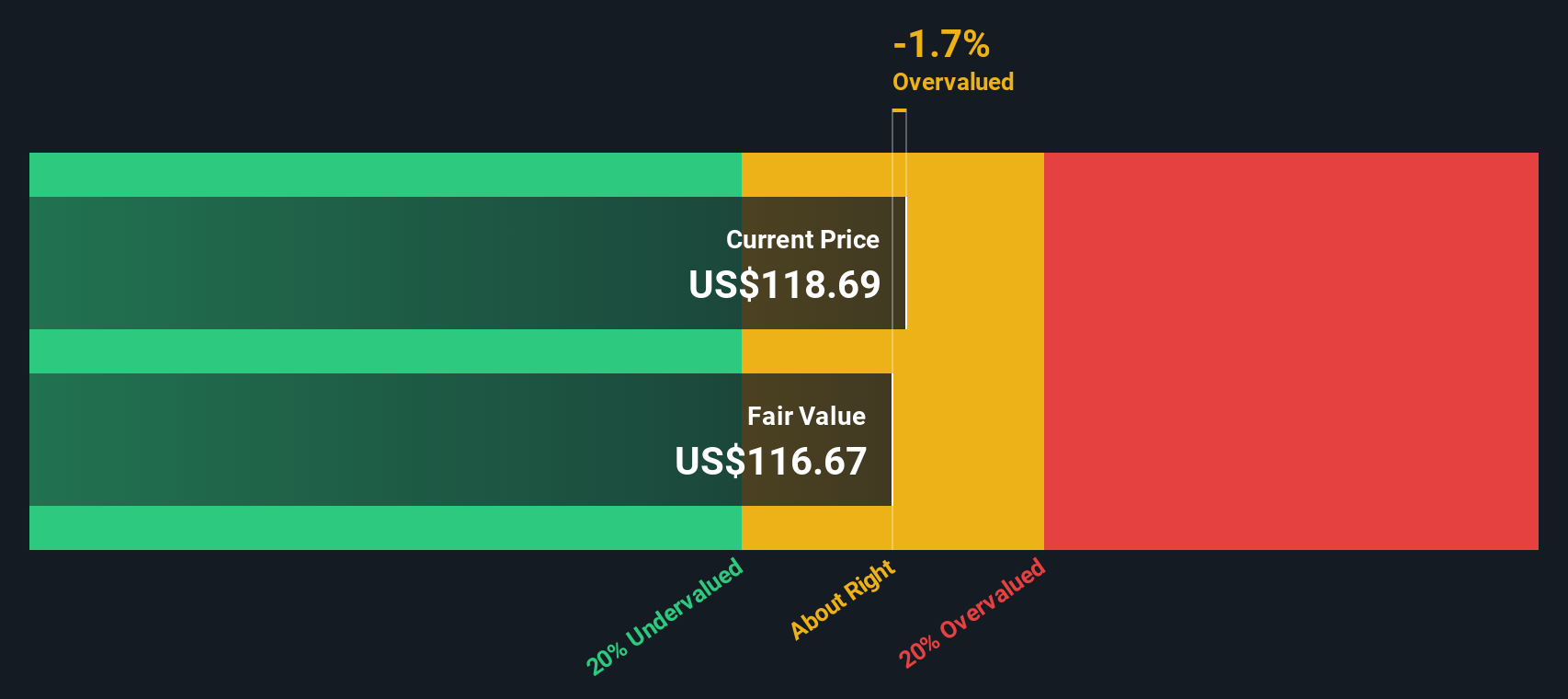

Taking a different approach, our DCF model values Agilent at $146.54, just below its current market price. This suggests the stock may be trading slightly above its estimated fair value based on cash flow projections. This could indicate a need for caution, or it may reflect that market participants expect more growth than the model currently accounts for.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Agilent Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Agilent Technologies Narrative

If you see things differently or want to dive into the details yourself, take a few minutes to shape your own outlook with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Agilent Technologies.

Looking for More Investment Ideas?

Time your next move with confidence by checking out high-potential opportunities most investors haven't seen yet. Don’t wait, as trends can shift quickly. These ideas could reshape your portfolio’s growth outlook.

- Tap into tomorrow’s breakthroughs by reviewing these 25 AI penny stocks and spot the innovators reshaping industries with artificial intelligence.

- Lock in reliable income by seeing these 15 dividend stocks with yields > 3% that reward shareholders with robust, above-average yields.

- Catch market mispricings early with these 914 undervalued stocks based on cash flows that offer hidden gems trading below their intrinsic value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:A

Agilent Technologies

Provides application focused solutions to the life sciences, diagnostics, and applied chemical markets worldwide.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026