- United States

- /

- Pharma

- /

- NasdaqGS:ZVRA

Why Zevra Therapeutics (ZVRA) Is Up After Achieving Profitability in Q3 Results and What’s Next

Reviewed by Sasha Jovanovic

- Zevra Therapeutics, Inc. reported third quarter 2025 results, with sales of US$26.06 million, a significant increase from US$3.7 million a year ago, and reduced net loss to US$0.54 million versus US$33.23 million previously.

- For the first nine months of 2025, Zevra moved from a US$69.77 million net loss last year to a net income of US$71.06 million, marking a substantial turnaround in the company’s financial performance.

- We’ll examine how Zevra’s shift to profitability this quarter may influence the company’s investment narrative and future outlook.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Zevra Therapeutics Investment Narrative Recap

To be a Zevra Therapeutics shareholder today, you need to believe in the company's ability to drive top-line momentum through rare disease therapies and convert that into lasting profitability despite product concentration risks. The strong third-quarter results show Zevra’s revenue growth and swing to net income, but do not materially resolve concerns about reliance on MIPLYFFA or the slow Urea Cycle Disorder market, these remain key short-term catalysts and risks, respectively, and should be watched closely.

One announcement that stands out is Zevra’s July 2025 submission of a Marketing Authorization Application for arimoclomol in Europe. This development aligns with the thesis that geographic expansion could accelerate revenue diversification, but does not immediately remove the hurdles of complex, country-specific reimbursement that continue to be a risk for sustained growth.

However, investors should be aware that despite this financial turnaround, questions remain about patient uptake and the ultra-orphan revenue base...

Read the full narrative on Zevra Therapeutics (it's free!)

Zevra Therapeutics is projected to generate $296.5 million in revenue and $151.4 million in earnings by 2028. Achieving these targets would require annual revenue growth of 68.5%, and an increase in earnings of $155.3 million from the current level of -$3.9 million.

Uncover how Zevra Therapeutics' forecasts yield a $23.22 fair value, a 147% upside to its current price.

Exploring Other Perspectives

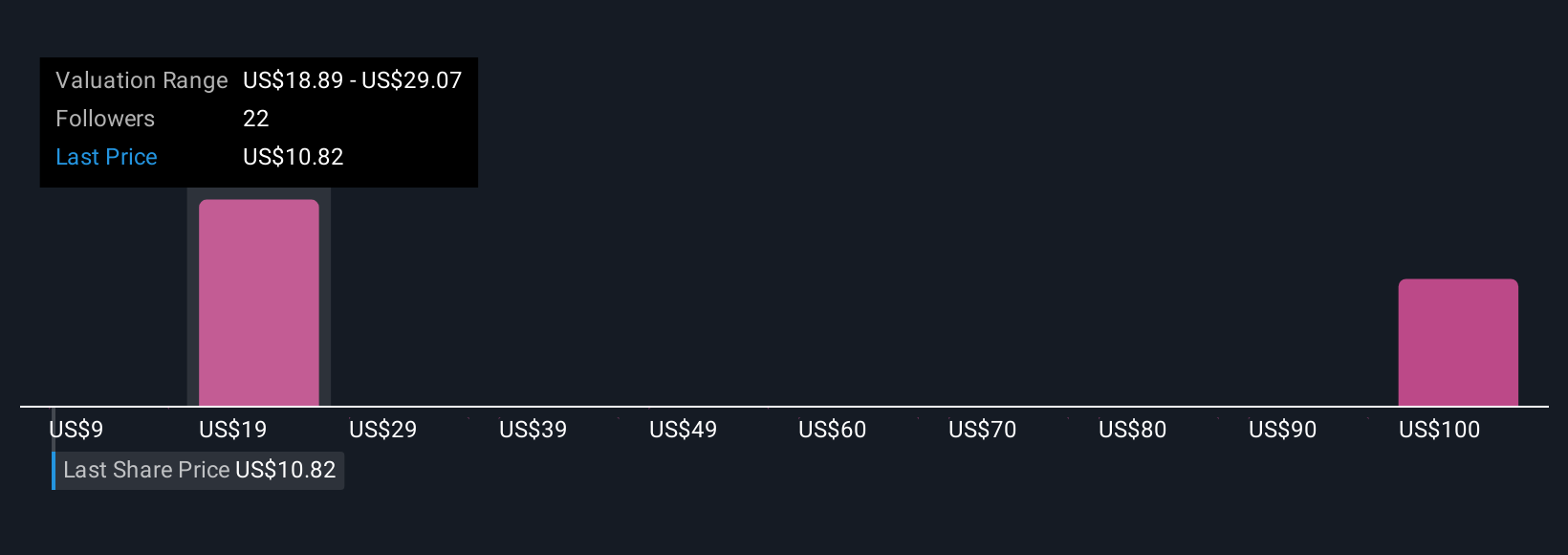

Eight members of the Simply Wall St Community estimate Zevra’s fair value across a wide range from US$18 to US$112.03. While profit growth is a major catalyst, such variance in views underlines how opinions can differ, consider reading several perspectives before deciding.

Explore 8 other fair value estimates on Zevra Therapeutics - why the stock might be worth just $18.00!

Build Your Own Zevra Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zevra Therapeutics research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Zevra Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zevra Therapeutics' overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zevra Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZVRA

Zevra Therapeutics

A commercial-stage company, focuses on addressing unmet needs for the treatment of rare diseases in the United States.

Very undervalued with exceptional growth potential.

Similar Companies

Market Insights

Community Narratives