- United States

- /

- Biotech

- /

- NasdaqGS:ZBIO

Is Zenas BioPharma’s (ZBIO) Royalty Deal Quietly Rewriting Its Late-Stage Risk Profile?

Reviewed by Sasha Jovanovic

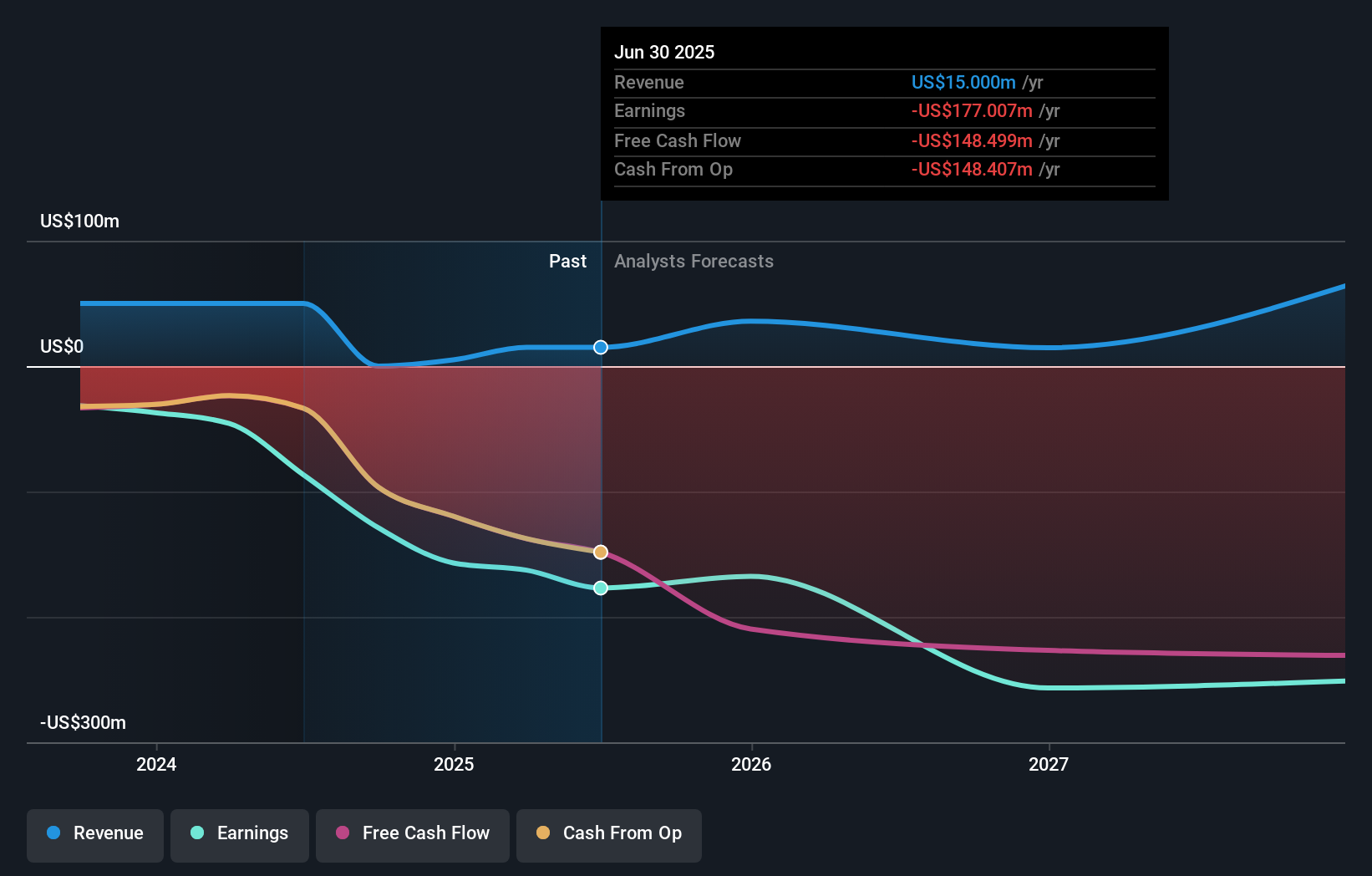

- Earlier this year, Zenas BioPharma announced an agreement with Royalty Pharma for up to US$300,000,000 in non-dilutive financing to support Phase 3 trials and potential commercialization of its lead autoimmune therapy, Obexelimab, targeted for a possible 2027 launch.

- This structure allows Zenas to access substantial capital without issuing new shares, which can be especially important for clinical-stage companies managing late-stage trial costs.

- Next, we’ll examine how this sizeable non-dilutive funding commitment from Royalty Pharma shapes Zenas BioPharma’s investment narrative and risk profile.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Zenas BioPharma's Investment Narrative?

To own Zenas, you have to believe that Obexelimab can successfully clear late‑stage trials, secure approval and become a meaningful autoimmune franchise before the company runs short of cash. The Royalty Pharma deal, alongside the recent private placement, materially shifts the near‑term picture by extending runway through at least early 2027 and reducing pressure for additional near‑term dilution, which had been a key overhang for a business still posting large quarterly losses. That lets investors focus more squarely on clinical and regulatory catalysts such as the ongoing Phase 3 program and follow‑on indications, rather than purely financing risk. At the same time, the royalty structure means any future Obexelimab revenue will be shared, and the stock’s sharp move higher over the past year keeps execution risk firmly in the spotlight.

However, one key clinical and funding risk could still catch new shareholders off guard. Upon reviewing our latest valuation report, Zenas BioPharma's share price might be too optimistic.Exploring Other Perspectives

Explore another fair value estimate on Zenas BioPharma - why the stock might be worth just $45.00!

Build Your Own Zenas BioPharma Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zenas BioPharma research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Zenas BioPharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zenas BioPharma's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zenas BioPharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZBIO

Zenas BioPharma

A clinical-stage biopharmaceutical company, engages in the development and commercialization of transformative immunology-based therapies.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026