- United States

- /

- Pharma

- /

- NasdaqGM:WVE

Wave Life Sciences (WVE): Revisiting Valuation After a 39% YTD Surge and 3-Year Share Price Tripling

Reviewed by Simply Wall St

Wave Life Sciences (WVE) has quietly delivered powerful gains this year, with the stock up roughly 39% year to date and more than tripling over the past 3 years.

See our latest analysis for Wave Life Sciences.

That surge in 1 week share price return of about 165 percent has turned heads, and with a 3 year total shareholder return nearing 287 percent, momentum now looks firmly in Wave’s favor as investors reassess its growth runway and risk profile.

If Wave’s recent jump has you thinking more broadly about healthcare innovation, it could be a good moment to explore other potential opportunities across healthcare stocks.

After such a dramatic rerating and with shares now trading only slightly below analyst targets, investors face a key question: is Wave still flying under the radar, or has the market already priced in its next leg of growth?

Most Popular Narrative: 8.6% Undervalued

With Wave Life Sciences closing at $18.52 against a narrative fair value just above $20, the market is treating aggressive long term growth as increasingly credible.

The expansion and clinical validation of Wave's proprietary RNA editing and siRNA platforms, including the emergence of new wholly-owned pipeline candidates for both rare and prevalent diseases, position the company to benefit from growing market adoption of RNA based and precision therapies, underpinning longer term top line growth and partnership revenue potential.

To see the engine behind that premium price tag and why long term margins and revenue growth would need to shift significantly to support it, explore the full narrative and unpack the assumptions within this valuation roadmap.

Result: Fair Value of $20.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained revenue decline from lumpy partnership payments and widening losses from rising R&D could quickly challenge the bullish growth assumptions that underpin this valuation.

Find out about the key risks to this Wave Life Sciences narrative.

Another View: Rich Multiples Test the Undervaluation Story

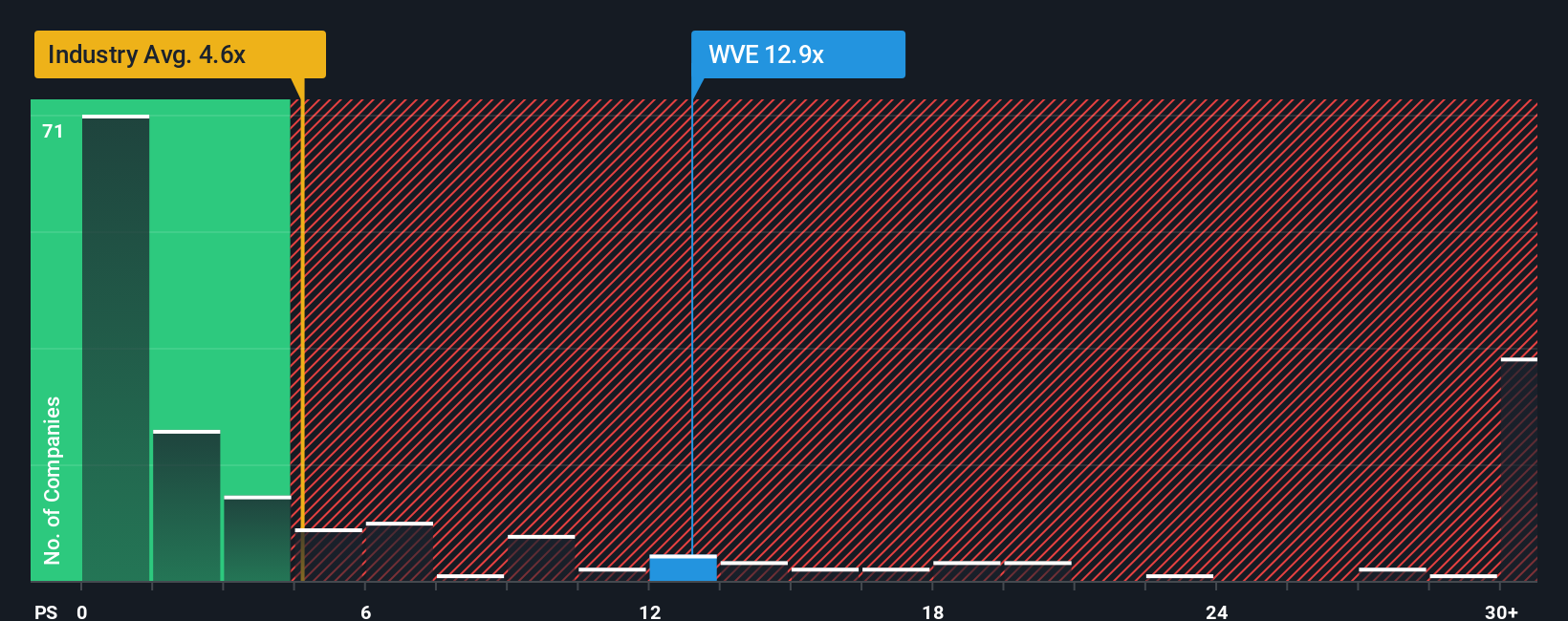

That 8.6 percent undervaluation looks less comfortable when you zoom in on the current price to sales ratio of 28.3 times, versus about 4 times for both the US pharmaceuticals industry and close peers, and a fair ratio of just 3.2 times. This leaves little room for execution missteps.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wave Life Sciences Narrative

If you are not fully aligned with this view or prefer to dig into the fundamentals yourself, you can quickly build a personalized thesis in minutes: Do it your way.

A great starting point for your Wave Life Sciences research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before momentum cools, put your research to work by lining up your next ideas with Simply Wall Street’s powerful screeners tailored to different strategies and opportunities.

- Capture potential high risk, high reward moves by scanning these 3593 penny stocks with strong financials that already show strong financial underpinnings instead of pure speculation.

- Position yourself in the next wave of innovation by targeting these 27 AI penny stocks where artificial intelligence could affect future earnings power.

- Look for potential mispricings by focusing on these 909 undervalued stocks based on cash flows that the market may be overlooking based on underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wave Life Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:WVE

Wave Life Sciences

A clinical-stage biotechnology company, designs, develops, and commercializes ribonucleic acid (RNA) medicines through PRISM, a discovery and drug development platform.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026