- United States

- /

- Biotech

- /

- NasdaqGS:VRTX

How FDA Recognition of Kidney Disease Therapies at Vertex (VRTX) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Vertex Pharmaceuticals recently announced progress across its kidney disease programs, including FDA Breakthrough Therapy Designation for povetacicept in IgA Nephropathy and enrollment completion in a major Phase 2/3 trial for inaxaplin in APOL1-mediated kidney disease.

- This marks a significant milestone, signaling Vertex’s expanding innovation beyond cystic fibrosis and its ability to advance first-in-class therapies for serious unmet medical needs.

- We’ll explore how the recent regulatory recognition of povetacicept for IgA Nephropathy impacts Vertex’s investment narrative and growth outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Vertex Pharmaceuticals Investment Narrative Recap

To be a Vertex Pharmaceuticals shareholder, you generally need to believe the company can move beyond its reliance on cystic fibrosis therapies and successfully bring new, first-in-class treatments, such as those for kidney disease, to market. The FDA's Breakthrough Therapy Designation for povetacicept in IgA Nephropathy reflects credible progress in pipeline diversification, but it does not fundamentally alter the short-term catalyst, which remains the commercial rollout and uptake of recently launched products. The main risk stays Vertex’s dependence on its established cystic fibrosis franchise and the challenges of developing new revenue streams.

Among recent announcements, the FDA's Breakthrough Therapy Designation for povetacicept stands out, as it may accelerate the timeline for new kidney disease treatments. This regulatory recognition aligns directly with efforts to diversify the pipeline and address long-term risk from cystic fibrosis competition and patent expiries. However, it remains to be seen how these advances will translate into revenue and earnings growth relative to consensus expectations.

By contrast, it’s important for investors to consider the potential for increased pricing pressure on new gene and cell therapies as regulatory and reimbursement scrutiny rises...

Read the full narrative on Vertex Pharmaceuticals (it's free!)

Vertex Pharmaceuticals’ outlook anticipates $14.9 billion in revenue and $5.6 billion in earnings by 2028. This reflects a 9.4% annual revenue growth rate and a $2 billion increase in earnings from the current level of $3.6 billion.

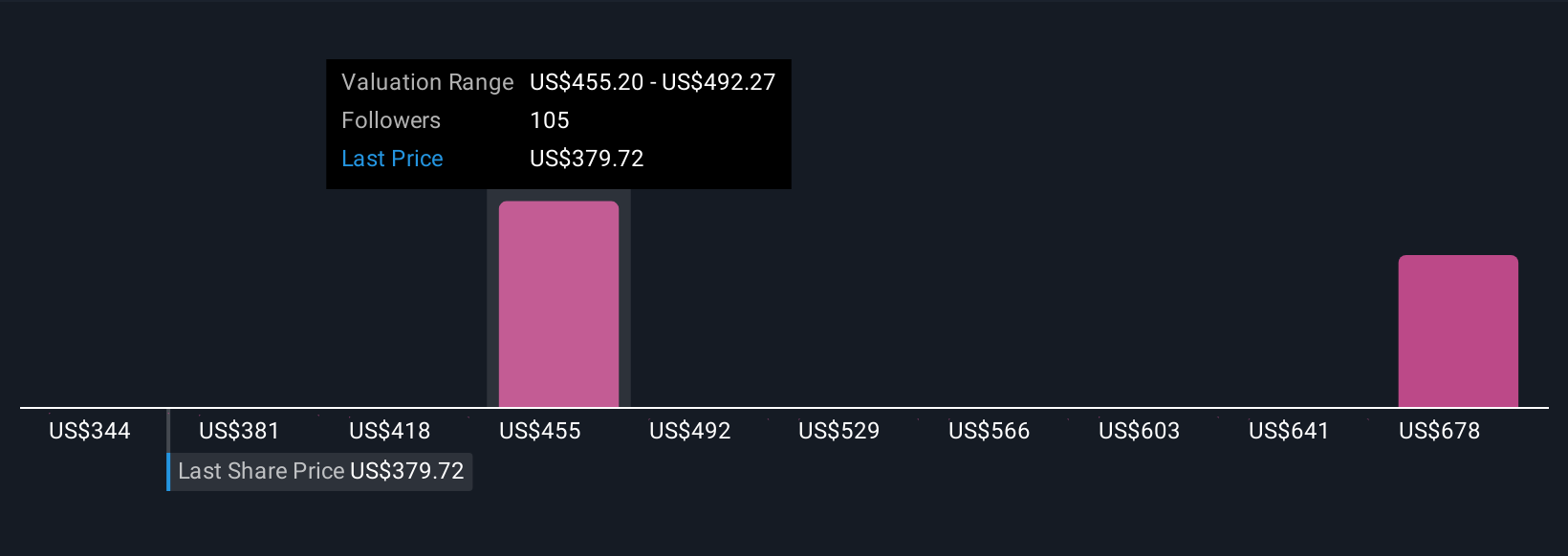

Uncover how Vertex Pharmaceuticals' forecasts yield a $479.83 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Compared to consensus forecasts, some of the most optimistic analysts were expecting Vertex's annual revenues to reach US$16.9 billion with earnings of US$7.8 billion by 2028, assuming accelerated adoption of new gene and cell therapies. If you see Vertex’s latest innovation or regulatory win as confirming these strong pipeline expectations, you’re already ahead of the curve, but keep in mind that expert opinions range widely and the next phase of results or payer negotiations could shift outlooks quickly.

Explore 8 other fair value estimates on Vertex Pharmaceuticals - why the stock might be worth as much as 73% more than the current price!

Build Your Own Vertex Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vertex Pharmaceuticals research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Vertex Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vertex Pharmaceuticals' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRTX

Vertex Pharmaceuticals

A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives