- United States

- /

- Biotech

- /

- NasdaqCM:VKTX

Viking Therapeutics (VKTX) Is Up 11.8% After VK2735 Shows Dual Benefit in Phase 2 Obesity Data Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- At the recent ObesityWeek 2025 conference, Viking Therapeutics presented Phase 2 clinical data showing its VK2735 candidate significantly improved glycemic status and reduced metabolic syndrome in patients after 13 weeks of treatment.

- This development highlights VK2735's potential dual impact on both weight loss and key cardiometabolic risk factors, attracting increased analyst interest in Viking's expanding obesity pipeline.

- We'll explore how VK2735's promising clinical results may influence Viking Therapeutics' investment narrative and future market positioning.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Viking Therapeutics' Investment Narrative?

Viking Therapeutics gives investors a story centered on the promise and uncertainty of cutting-edge science. The ObesityWeek 2025 data has become a significant catalyst, pushing VK2735’s profile further with clear signals on both weight loss and cardiometabolic improvements. This strengthens near-term focus on the progression of VK2735’s Phase 3 trial and may lessen prior concern around the drug’s efficacy, at least for now. Meanwhile, the recently volatile share price and very large losses keep financial risks squarely on the table. With no revenue in sight and growing quarterly net losses, Viking's future relies on successful trial outcomes, ongoing funding, and the potential for partnerships or takeovers. For prospective shareholders, confidence in both scientific advances and management’s ability to sustain operations is key.

Yet, even as clinical results look promising, the need for additional capital remains an important risk to watch.

Exploring Other Perspectives

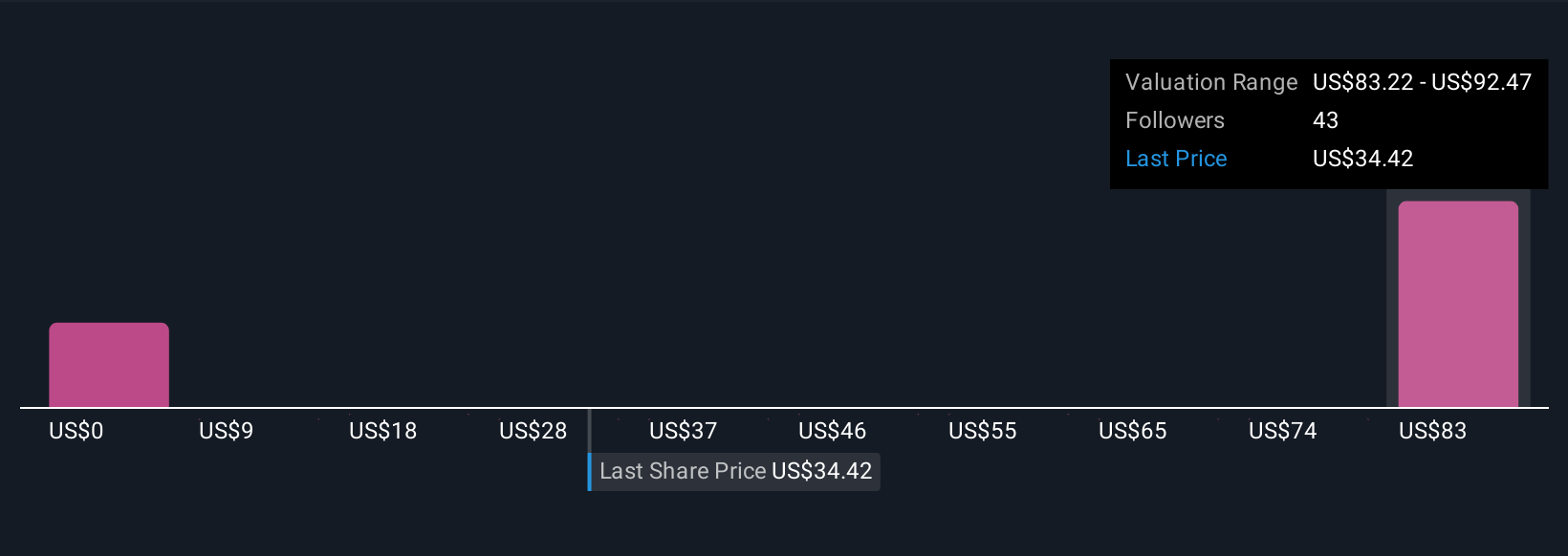

Explore 23 other fair value estimates on Viking Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Viking Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viking Therapeutics research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free Viking Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viking Therapeutics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VKTX

Viking Therapeutics

A clinical-stage biopharmaceutical company, focuses on the development of novel therapies for metabolic and endocrine disorders.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives