- United States

- /

- Biotech

- /

- NasdaqCM:VKTX

The Bull Case For Viking Therapeutics (VKTX) Could Change Following Early Completion and Positive Data in Obesity Trial

Reviewed by Sasha Jovanovic

- Viking Therapeutics recently completed enrollment ahead of schedule for its Phase 3 VANQUISH-1 obesity trial evaluating VK2735, and released new Phase 2 data highlighting significant cardiometabolic improvements in obese patients.

- An exploratory analysis revealed that 78% of prediabetic patients receiving VK2735 achieved normal glycemic control, compared to 29% in the placebo group.

- We'll explore how the early trial completion and promising glycemic control data could influence Viking Therapeutics' investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Viking Therapeutics' Investment Narrative?

For investors considering Viking Therapeutics, the investment story often centers on the potential for breakthrough treatments in obesity and metabolic disorders, as well as the company's ability to navigate a sector where clinical results can rapidly reshape prospects. The recent early completion of enrollment for Phase 3 VANQUISH-1 and strong new glycemic control data represent real progress for key near-term catalysts, potentially increasing investor confidence about the pace and likelihood of future approvals. These developments bring clearer visibility to upcoming data readouts, which have had outsized influence on share prices historically. However, cash burn remains high, with rising quarterly net losses and no revenue expected in the short term, making continued capital raises or partnerships a pressing concern. As these catalysts and risks shift, the news event does nudge expectations about major milestones, but doesn’t resolve the core challenges around profitability and commercial execution.

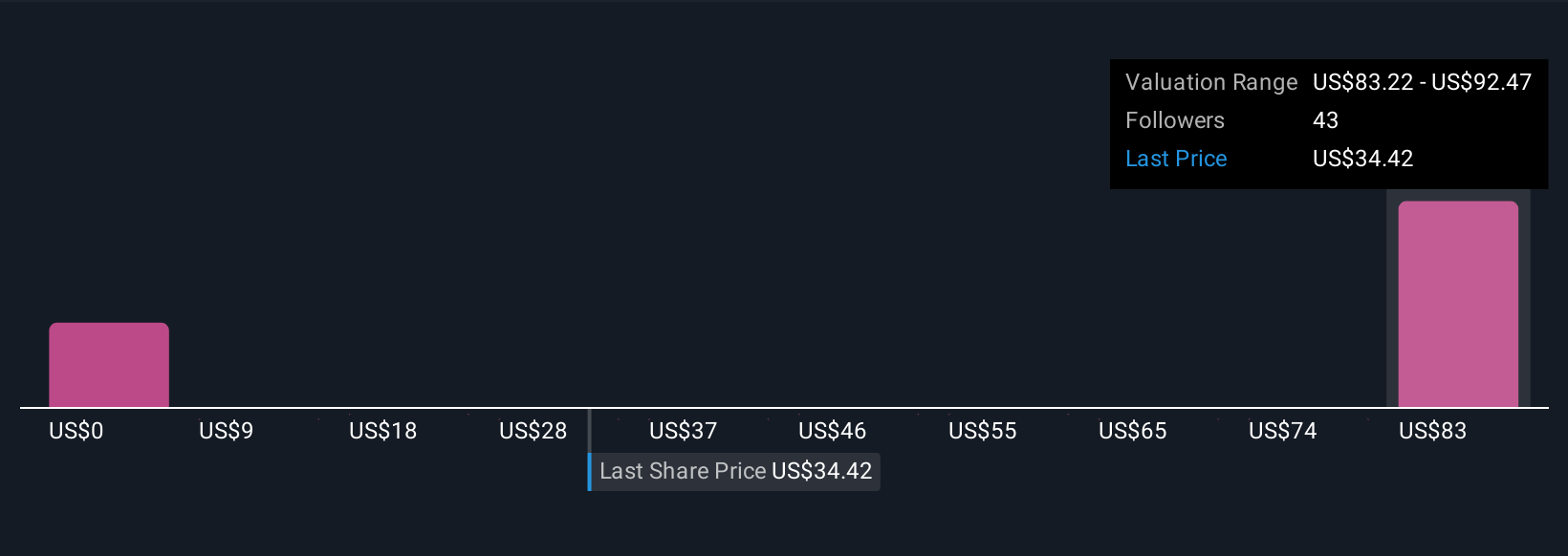

On the flip side, investors should be aware that ongoing losses and no forecasted revenue are still fundamental challenges. The valuation report we've compiled suggests that Viking Therapeutics' current price could be inflated.Exploring Other Perspectives

Explore 24 other fair value estimates on Viking Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Viking Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Viking Therapeutics research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Viking Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Viking Therapeutics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:VKTX

Viking Therapeutics

A clinical-stage biopharmaceutical company, focuses on the development of novel therapies for metabolic and endocrine disorders.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026