- United States

- /

- Biotech

- /

- NasdaqGM:VERA

Will Vera Therapeutics (VERA) Strengthen Its Commercial Edge With Board Appointment of James R. Meyers?

Reviewed by Sasha Jovanovic

- Vera Therapeutics recently announced the appointment of seasoned biopharmaceutical leader James R. Meyers to its Board of Directors as the company advances commercial readiness for its lead drug candidate atacicept in immunoglobulin A nephropathy (IgAN).

- This move signals a focus on strengthening commercial capabilities as Vera prepares for potential regulatory approval and market entry of a first-in-class therapy.

- We'll explore how leadership additions such as James R. Meyers' appointment influence Vera Therapeutics’ investment narrative amid its pivotal commercialization phase.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

What Is Vera Therapeutics' Investment Narrative?

Being a shareholder in Vera Therapeutics means buying into the company’s ability to transform a strong clinical pipeline, anchored by its lead candidate atacicept, into meaningful revenue growth, despite not yet generating sales or posting profits. The recent addition of James R. Meyers, with his deep commercialization expertise, could be influential as Vera moves closer to a possible FDA approval and market launch, positioning the company to address key commercial execution risks that analysts had previously highlighted. While this board appointment signals a renewed emphasis on operational readiness and could strengthen the company’s chances in the high-stakes months ahead, the most important short-term catalyst remains the FDA’s regulatory decision on atacicept, which continues to be accompanied by substantial clinical, competition, and financing risks. In sum, while the Meyers appointment bolsters commercial prospects, the material drivers remain regulatory outcomes and execution in a competitive, capital-intensive biotech environment. However, the possibility of new competition reaching the IgAN market sooner is a risk not to overlook.

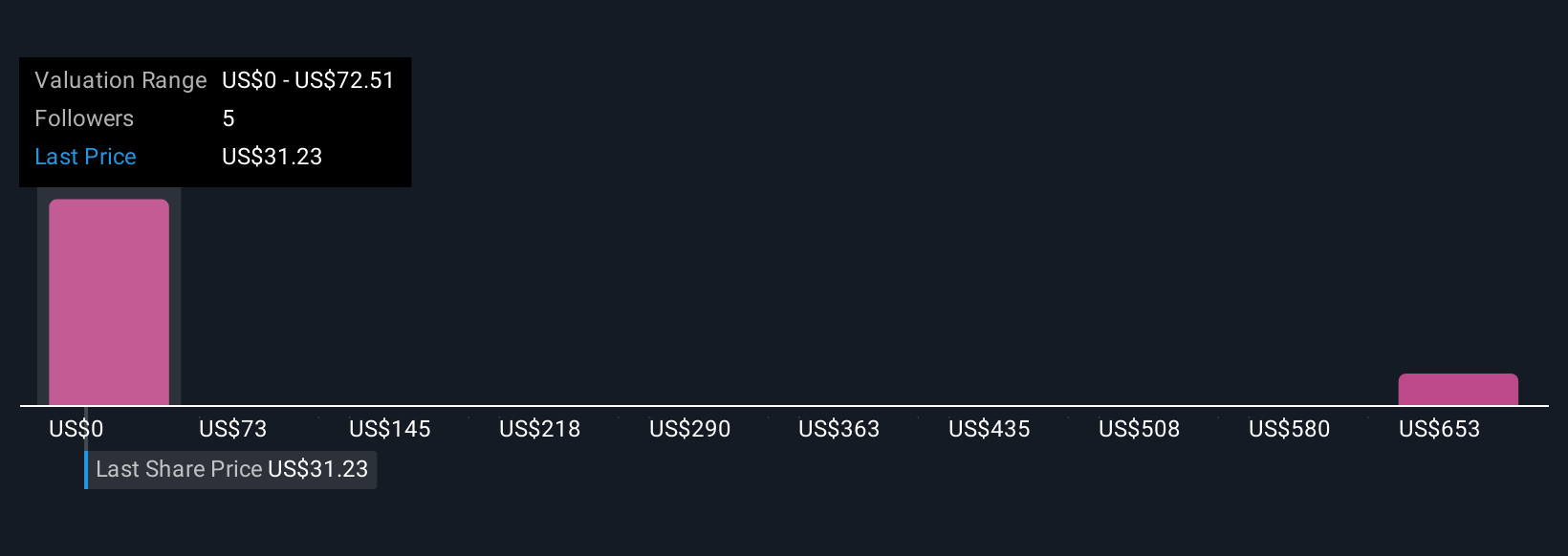

Vera Therapeutics' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 5 other fair value estimates on Vera Therapeutics - why the stock might be a potential multi-bagger!

Build Your Own Vera Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vera Therapeutics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Vera Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vera Therapeutics' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VERA

Vera Therapeutics

A clinical stage biotechnology company, focuses on the development and commercialization of transformative treatments for patients with serious immunological diseases.

Excellent balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026