- United States

- /

- Biotech

- /

- NasdaqGM:VCYT

Why Veracyte (VCYT) Is Up 18.0% After Raising 2025 Outlook and Highlighting Afirma Progress

Reviewed by Sasha Jovanovic

- Veracyte reported strong third quarter 2025 results, raising full-year revenue guidance to US$506–510 million and highlighting gains in Decipher and Afirma testing as well as positive net income growth.

- Recent research publications suggest Veracyte’s Afirma GRID platform could transform pre-surgical thyroid cancer risk assessment, showcasing ongoing clinical innovation and depth of its genomic data capabilities.

- With the upgraded revenue outlook underscoring operational momentum, we'll examine how these developments influence Veracyte's investment narrative and future growth assumptions.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Veracyte Investment Narrative Recap

To be a Veracyte shareholder right now, you have to believe in the sustained expansion of genomic diagnostics and the company’s ability to keep driving adoption of its flagship Decipher and Afirma tests, even as competition and reimbursement dynamics shift. The recent strong earnings and revenue guidance upgrade should benefit confidence in the near-term demand outlook, reinforcing the primary growth catalyst, but does not materially reduce the critical risk of heavy product concentration given ongoing industry pressures.

One of the most relevant recent developments is the publication of new studies validating the Afirma GRID research tool’s utility in refining thyroid nodule evaluation, which supports the company's clinical evidence base and potential for future test adoption. This underscores how pipeline innovation continues to strengthen the central thesis around topline growth, highlighting a positive backdrop for the core business as new products advance commercialization milestones.

Yet, in contrast to strong revenue momentum, investors need to be aware of the risks tied to Veracyte’s high reliance on Decipher and Afirma, particularly if reimbursement or competitive shifts affect volumes...

Read the full narrative on Veracyte (it's free!)

Veracyte's outlook anticipates $629.2 million in revenue and $121.9 million in earnings by 2028. This projection relies on a 9.5% annual revenue growth rate and a $95.6 million increase in earnings from the current $26.3 million.

Uncover how Veracyte's forecasts yield a $41.10 fair value, in line with its current price.

Exploring Other Perspectives

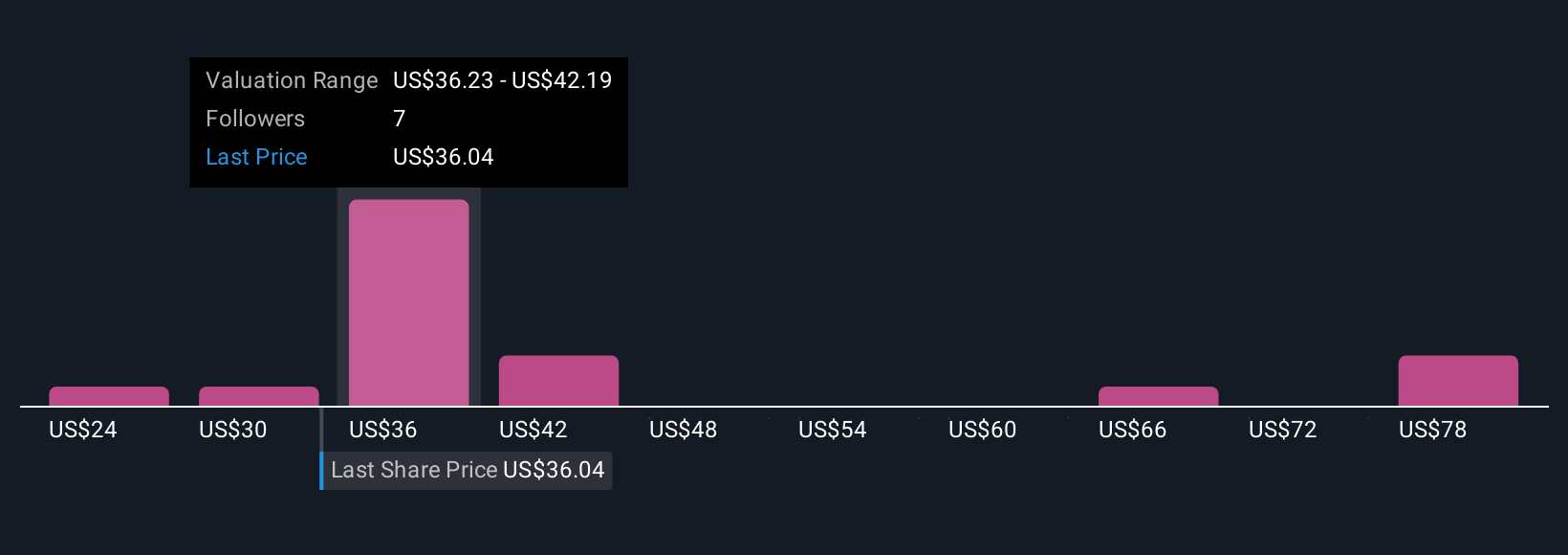

Six Simply Wall St Community fair value estimates for Veracyte span a wide range, from US$24.31 to US$68.68 per share. With ongoing advances in key testing platforms, market participants may hold very different expectations, consider several viewpoints before deciding what fits your outlook.

Explore 6 other fair value estimates on Veracyte - why the stock might be worth as much as 65% more than the current price!

Build Your Own Veracyte Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Veracyte research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Veracyte research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Veracyte's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:VCYT

Veracyte

Operates as a diagnostics company in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives