- United States

- /

- Biotech

- /

- NasdaqGS:UTHR

United Therapeutics (UTHR) Margins Outpace Market as Growth Rate Deceleration Challenges Bullish Narratives

Reviewed by Simply Wall St

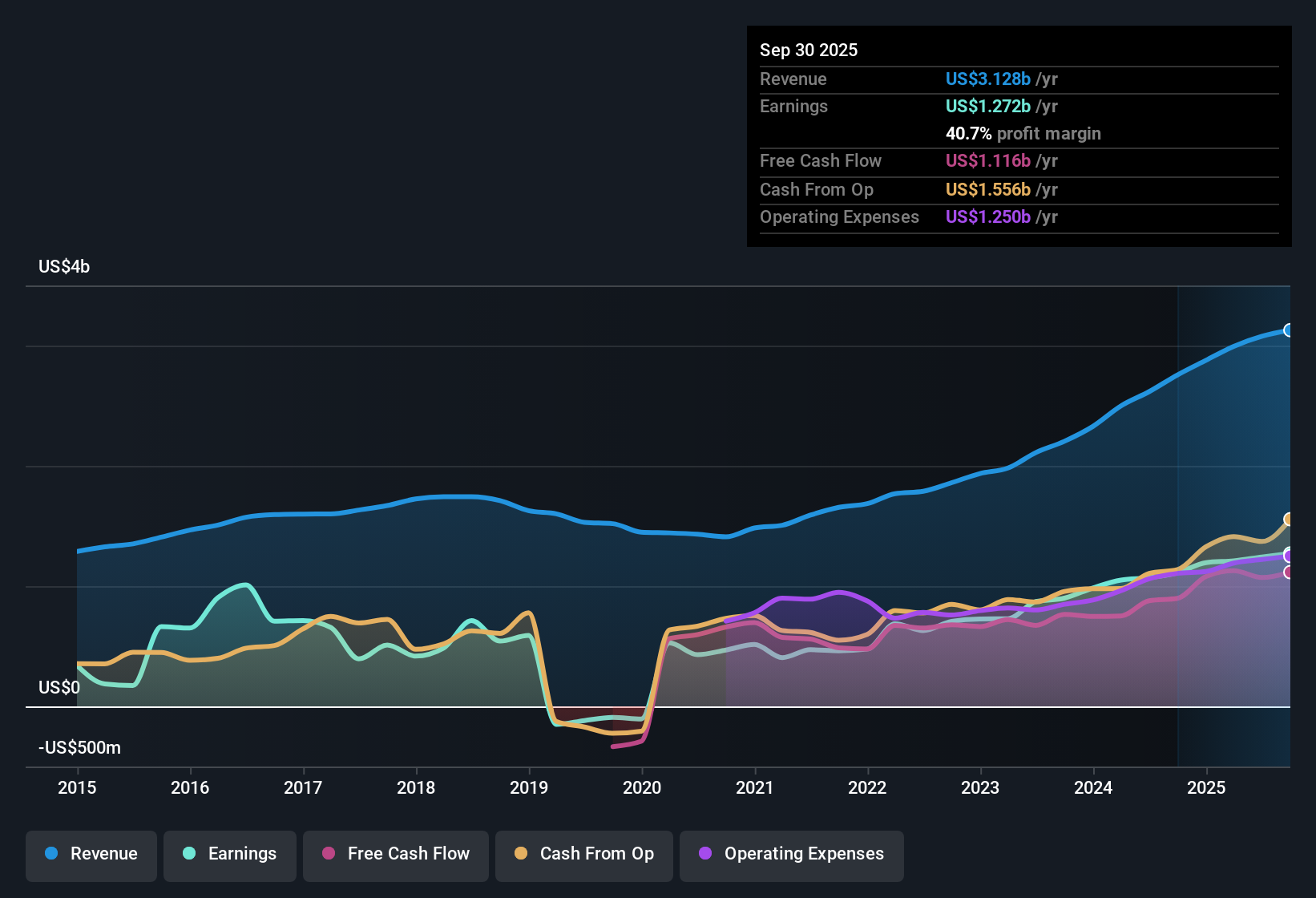

United Therapeutics (UTHR) reported net profit margins of 40.7%, edging up from last year’s 40.3%. Over the past five years, earnings rose at a robust 22.8% annual rate, but most recent profit growth slowed to 14.5%. With analysts forecasting 10% annual earnings growth and revenue set to expand 9.4% per year, both metrics are tracking a bit below the wider US market outlook. Strong profitability, solid margins, and a Price-To-Earnings ratio of 16.1x, which is under both industry and peer averages, underscore the company’s value angle. Recent filings highlight no major risks or significant insider selling.

See our full analysis for United Therapeutics.Now, let’s see how these numbers stack up against the widely held market narratives. Some expectations might be reinforced, and others could be called into question.

See what the community is saying about United Therapeutics

Cash Flow Strength Drives Stability

- United Therapeutics generated nearly $1.5 billion in operating cash flow this year, underpinning its financial stability and capacity to invest in R&D.

- According to the analysts' consensus view, this strong cash flow is a core reason the company can fund its innovation efforts and absorb competitive pressure. The newly authorized $1 billion in share buybacks could reinforce earnings per share growth.

- Recurring revenue streams from established therapies, combined with this robust cash position, give it resilience to handle high R&D costs.

- The buybacks highlight management’s confidence in value even as projected revenue growth (9.4% per year) slightly trails the broader market pace.

Innovation and Pipeline Catalysts

- Upcoming readouts from the TETON Phase III clinical trials for Tyvaso in idiopathic pulmonary fibrosis could unlock a new multi-billion-dollar indication for United Therapeutics.

- Analysts' consensus narrative emphasizes that progress across next-gen drug delivery, organ manufacturing, and R&D pipeline milestones, such as TETON and other studies, could expand future revenue streams and sustain growth. However, high costs and binary trial risks remain significant concerns.

- Analysts estimate the profit margin to remain strong at 40.4% over the next three years if these innovations succeed.

- Any failure in trials or difficulty commercializing new products could materially harm growth expectations.

Valuation Discount Versus Sector

- United Therapeutics trades at a Price-To-Earnings ratio of 16.1x, a discount both to its biotech sector peers (20.2x) and the broader US Biotechs industry (17.4x). Its current share price of $453.53 is far below the DCF fair value of $1,318.49.

- From the analysts' consensus view, this valuation gap reflects both the company’s solid underlying profitability and investor wariness about slower projected growth rates. However, it offers a margin of safety if key R&D programs deliver on their potential.

- The 11.6% gap between current share price and the analyst target of $510.77 further suggests upside if the market resets its growth expectations.

- Sector-wide pricing pressures and uncertainty around new launches mean United Therapeutics' low multiple may persist until new catalysts materialize.

Curious whether analysts see the value gap closing as new clinical milestones approach? 📊 Read the full United Therapeutics Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for United Therapeutics on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at these figures from a different angle? Take a moment to craft your take and share your unique perspective. It only takes a few minutes. Do it your way

A great starting point for your United Therapeutics research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite United Therapeutics’ strong margins, its slowing profit growth and projected earnings lag behind broader market expectations. This raises questions about future momentum.

If you’re seeking companies with a proven record of consistent growth and steadier expansion, check out stable growth stocks screener (2095 results) for compelling alternatives performing through cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UTHR

United Therapeutics

A biotechnology company, engages in the development and commercialization of products to address the unmet medical needs of patients with chronic and life-threatening diseases in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives