- United States

- /

- Biotech

- /

- NasdaqGS:UTHR

How Investors Are Reacting To United Therapeutics (UTHR) Q3 Growth, 2027 Outlook and Insider Selling

Reviewed by Sasha Jovanovic

- In late November 2025, United Therapeutics reported a 7% year-over-year revenue increase in its third-quarter fiscal 2025 results, alongside advancing clinical trials and guidance for up to US$4.00 billion in revenue by 2027, while also seeing heightened institutional demand and bullish investor inflows.

- Around the same time, company officer Martine A. Rothblatt sold 8,000 shares for about US$3.89 million, adding an insider activity lens to an otherwise growth-focused story.

- We’ll now examine how the strong third-quarter revenue growth and institutional interest could influence United Therapeutics’ broader investment narrative.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

United Therapeutics Investment Narrative Recap

To own United Therapeutics, you need to believe its pulmonary therapies and high-risk innovation bets (like xenotransplantation) can offset competitive and pricing pressures. The latest 7% third quarter revenue growth and long term revenue guidance reinforce that core thesis, but do not fundamentally change the near term focus on Tyvaso’s label expansion as the key catalyst, nor the binary risk around upcoming clinical readouts and the heavy spend required to push those programs forward.

The most relevant recent development here is management’s guidance for up to US$4.00 billion of revenue by 2027, coming alongside ongoing progress in key clinical trials such as TETON for Tyvaso in fibrotic lung disease. That outlook ties directly into the stock’s current narrative, where institutional buying appears to be responding to both robust current earnings and the possibility that new indications and platforms could help counter mounting competition in pulmonary arterial hypertension over time.

Yet, despite this growth story, the heavy concentration in pulmonary therapies is a risk investors should be aware of, especially if...

Read the full narrative on United Therapeutics (it's free!)

United Therapeutics' narrative projects $3.7 billion revenue and $1.5 billion earnings by 2028. This requires 6.6% yearly revenue growth and an earnings increase of about $0.3 billion from $1.2 billion today.

Uncover how United Therapeutics' forecasts yield a $518.25 fair value, a 6% upside to its current price.

Exploring Other Perspectives

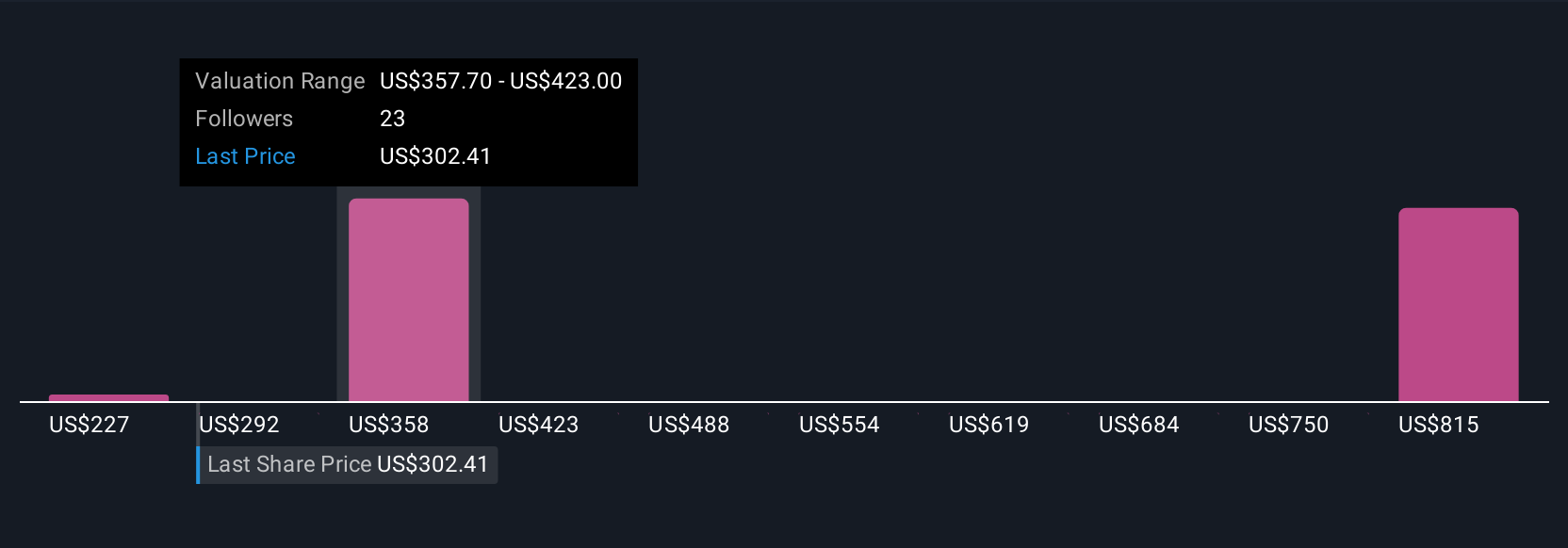

Five Simply Wall St Community fair value estimates range widely from about US$280 to roughly US$1,353 per share, underscoring how far apart individual views can be. You can set those against the company’s recent 7% third quarter revenue growth and ambitious long term revenue guidance, which many see as hinging on upcoming clinical readouts that could significantly influence United Therapeutics’ future earnings path and resilience.

Explore 5 other fair value estimates on United Therapeutics - why the stock might be worth over 2x more than the current price!

Build Your Own United Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your United Therapeutics research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free United Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate United Therapeutics' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:UTHR

United Therapeutics

A biotechnology company, engages in the development and commercialization of products to address the unmet medical needs of patients with chronic and life-threatening diseases in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026