- United States

- /

- Life Sciences

- /

- NasdaqGS:TXG

Next-Gen Flex Assay Launch Might Change The Case For Investing In 10x Genomics (TXG)

Reviewed by Sasha Jovanovic

- On October 29, 2025, 10x Genomics announced the launch of their next-generation Flex assay, featuring automation-compatible plate-based multiplexing for scalable, cost-efficient single cell analysis.

- The enhanced Flex assay allows researchers to process up to 384 samples and 100 million cells per week, opening new possibilities for high-throughput studies across genomics research and translational applications.

- We'll explore how this plate-based automation innovation could influence 10x Genomics' investment story and positioning in the advanced genomics tools market.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

10x Genomics Investment Narrative Recap

To be a 10x Genomics shareholder, you need to believe in sustained adoption of single-cell and spatial biology across biomedical research, with product innovation like the new Flex assay helping offset current macroeconomic and funding headwinds. While the automation-ready Flex platform could accelerate throughput and broaden demand, the most significant short-term catalyst remains growth in consumables usage, whereas the biggest risk is still pricing pressure and margin compression from increased discounting and budget constraints. This news could help address throughput needs, but pricing and operating leverage remain watchpoints.

The recent launch of Xenium Protein is particularly relevant, as it further extends the company’s portfolio by allowing simultaneous RNA and protein detection, complementing Flex’s scalable single-cell analysis and supporting deeper insights for cancer and immunology research. Like Flex, this new product targets higher-volume, higher-complexity experiments to drive reagent consumption and expand addressable markets, aligning with a catalyst of increased consumables adoption. But amid these advances, it’s important not to overlook the downside if cost-sensitive customers shift to lower-priced consumables at a faster pace than volume growth can compensate...

Read the full narrative on 10x Genomics (it's free!)

10x Genomics' outlook anticipates $688.4 million in revenue and $97.8 million in earnings by 2028. This scenario is built on a yearly revenue growth rate of 2.2% and a $182.4 million increase in earnings from current levels of -$84.6 million.

Uncover how 10x Genomics' forecasts yield a $15.08 fair value, a 13% upside to its current price.

Exploring Other Perspectives

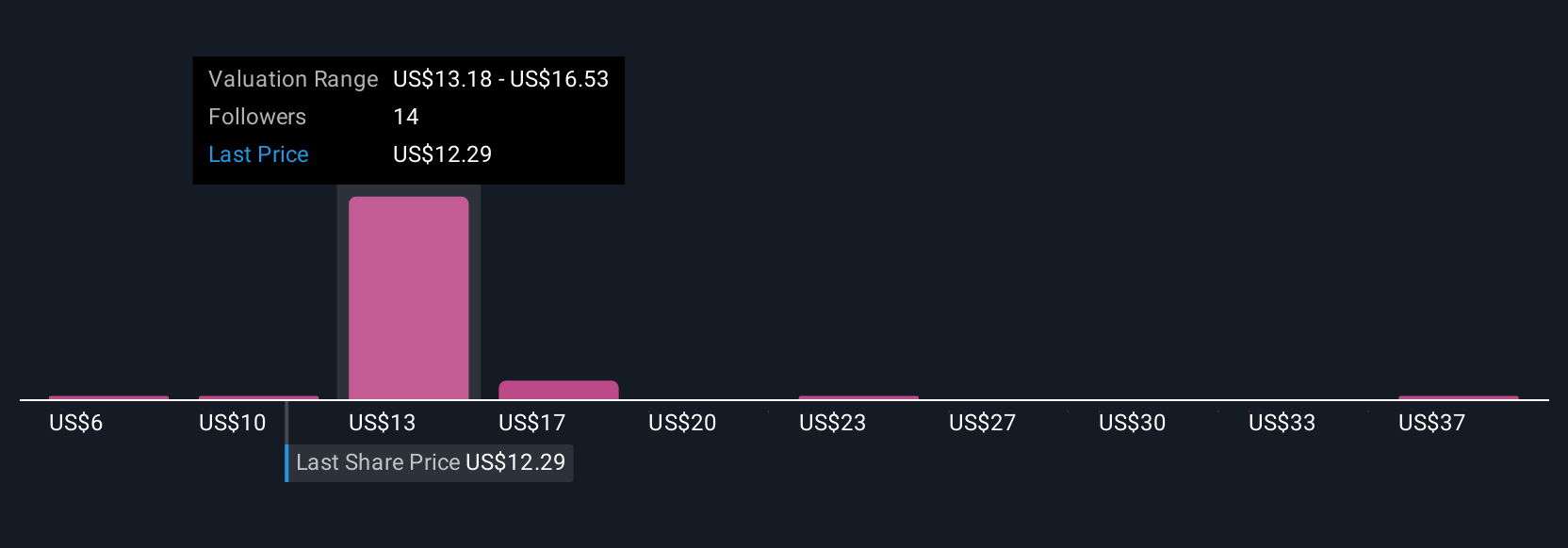

Six community contributors set fair value between US$6.47 and US$23.59 per share for 10x Genomics on Simply Wall St. Yet, as the risk of compressed margins from lower pricing persists, consider how these varied expectations could affect your outlook.

Explore 6 other fair value estimates on 10x Genomics - why the stock might be worth as much as 77% more than the current price!

Build Your Own 10x Genomics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your 10x Genomics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free 10x Genomics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate 10x Genomics' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXG

10x Genomics

A life science technology company, develops and sells instruments, consumables, and software for analyzing biological systems in the Americas, Europe, the Middle East, Africa, China, and the Asia Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives