- United States

- /

- Life Sciences

- /

- NasdaqGS:TXG

10x Genomics (TXG) Is Down 5.5% After Morgan Stanley Downgrade Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Earlier this month, Morgan Stanley shifted its view on 10x Genomics by downgrading the stock’s rating while maintaining coverage with a more conservative stance.

- This change, set against generally supportive opinions from other analysts, highlights growing differences over how to value 10x Genomics amid current conditions.

- We’ll now explore how Morgan Stanley’s more cautious rating, alongside a still-supportive analyst consensus, may influence 10x Genomics’ investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

10x Genomics Investment Narrative Recap

To own 10x Genomics, you need to believe its single cell and spatial platforms can translate into durable, recurring consumables revenue despite muted funding and ongoing losses. Morgan Stanley’s downgrade to Equal Weight with a slightly higher US$20 target mostly reflects valuation caution, and does not materially change the near term focus on accelerating adoption of newer, lower cost consumables or the key risk from a still challenging research spending backdrop.

The recent Asia Pacific Spatial Translational Research Alliance (ASTRA) pan cancer spatial atlas, built on 10x’s Xenium platform, is particularly relevant here, as it showcases how large, multi country projects can deepen platform entrenchment and data complexity. For investors watching catalysts, initiatives like ASTRA sit alongside product rollouts such as Flex v2 and Xenium upgrades as practical tests of whether installed base and consumables usage can grow fast enough to offset pricing pressure and capital spending headwinds.

But against that opportunity, the pressure on research budgets and capital equipment purchases is something investors should be aware of, because...

Read the full narrative on 10x Genomics (it's free!)

10x Genomics' narrative projects $688.4 million revenue and $97.8 million earnings by 2028. This requires 2.2% yearly revenue growth and a $182.4 million earnings increase from $-84.6 million today.

Uncover how 10x Genomics' forecasts yield a $16.36 fair value, a 8% downside to its current price.

Exploring Other Perspectives

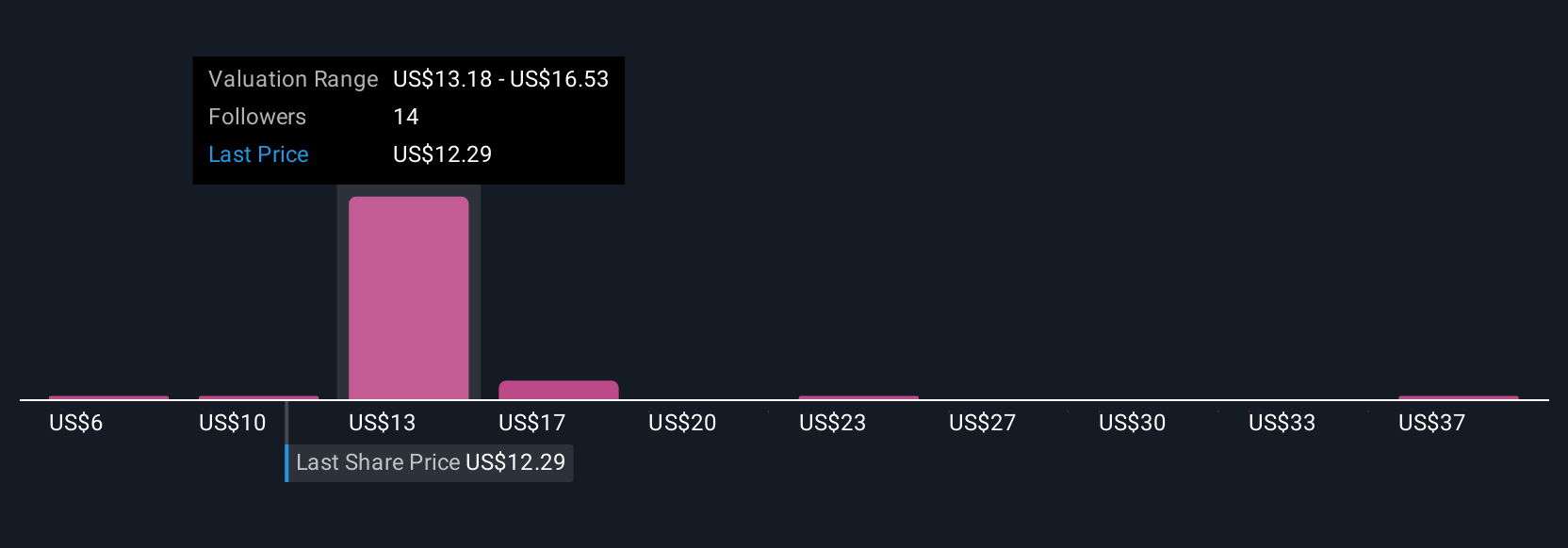

Six Simply Wall St Community fair value estimates for 10x Genomics span roughly US$6.47 to US$23.59, underlining how far apart individual views can be. When you set those against concerns about softer research funding and pricing pressure, it becomes even more important to compare several perspectives before deciding how 10x’s tools and consumables model might perform over time.

Explore 6 other fair value estimates on 10x Genomics - why the stock might be worth as much as 33% more than the current price!

Build Your Own 10x Genomics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your 10x Genomics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free 10x Genomics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate 10x Genomics' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXG

10x Genomics

A life science technology company, develops and sells instruments, consumables, and software for analyzing biological systems in the Americas, Europe, the Middle East, Africa, China, and the Asia Pacific.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026