- United States

- /

- Life Sciences

- /

- NasdaqGS:TXG

10x Genomics (TXG): How Fresh Results and New Guidance Are Shaping Its Valuation

Reviewed by Simply Wall St

10x Genomics, Inc. (TXG) drew attention after releasing third quarter results that beat the subdued mood set by previous trends. Revenue and profitability both showed signs of improvement, and guidance for the next quarter points to steadier performance ahead.

See our latest analysis for 10x Genomics.

After underwhelming performance earlier in the year, 10x Genomics has found new momentum lately, as recent product innovation and upbeat quarterly results have helped shift sentiment. The share price jumped more than 26% in the past month and is up 24% over the past three months, signaling renewed investor interest. Still, its total shareholder return over the past year is slightly negative, and long-term holders have faced deep declines since 2021. The bounce is a welcome change but comes in the context of heavier past losses.

If you're interested in what else could be making moves in the life sciences space, now's the perfect time to check out See the full list for free.

With shares rebounding and new guidance suggesting steadier days ahead, the real question is whether 10x Genomics is now trading below its true value or if the latest positivity is already reflected in the stock price. Is this a buying opportunity, or has the market fully priced in the prospects for future growth?

Most Popular Narrative: Fairly Valued

With the most widely followed narrative putting fair value almost in line with the last close, the market appears to be taking a wait-and-see approach after recent momentum. Fresh product launches and a string of new collaborations are forming the backbone of this outlook. This is setting up the potential for a strategic shift in the company's long-term trajectory.

Recent and upcoming product launches, including Flex v2 (targeting higher throughput, lower costs, and AI integration), Visium HD extensions, and Xenium RNA plus protein, are expanding the range of applications and reinforcing 10x's leadership in advanced genomics tools. These launches are expected to drive both top-line growth and sustain premium pricing over time.

What’s driving this narrative? The secret formula is a potent mix of breakthrough new products, long-range growth ambitions, and bold assumptions for future profitability. Want to see the underlying forecasts supporting today’s fair value call? Dive into the narrative to discover what’s fueling analysts’ conviction and what could surprise the market next.

Result: Fair Value of $15.08 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing macroeconomic uncertainty and persistent operating losses could quickly undermine optimism and potentially reverse the recent positive sentiment around 10x Genomics.

Find out about the key risks to this 10x Genomics narrative.

Another View: Is the Market Right?

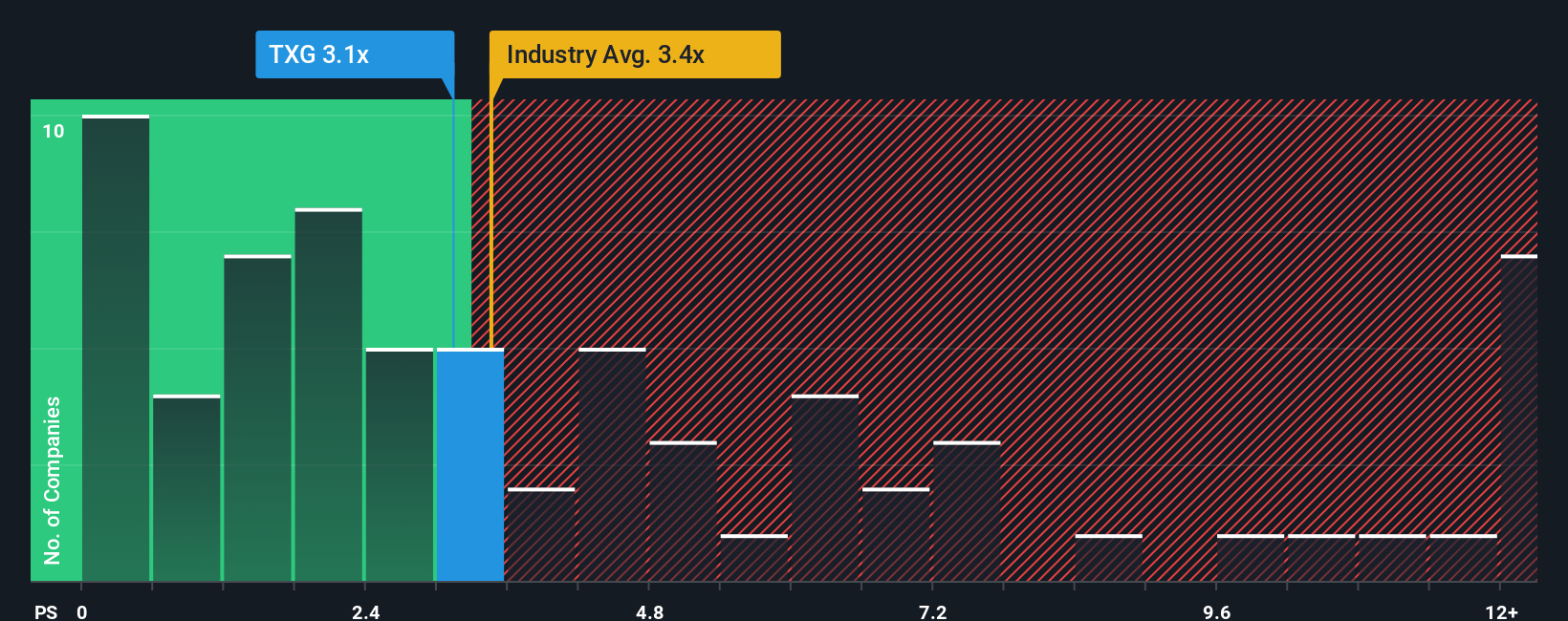

While analysts see 10x Genomics as fairly valued based on future earnings and growth assumptions, a simple comparison to sales tells a similar story. The company’s ratio of price to sales stands at 3x, which is clearly lower than both the industry average of 3.4x and the peer average of 5.1x. It is also below the fair ratio of 3.7x projected by market regression trends. This suggests shares may offer better value than many rivals, but also hints at the market’s lingering caution about near-term risks and the pace of growth.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own 10x Genomics Narrative

For those wanting to dig deeper or challenge these conclusions, you can analyze the numbers yourself and build a custom narrative in just a few minutes. So why not Do it your way

A great starting point for your 10x Genomics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t miss your chance to act on market trends now. Feel confident knowing there are smart, data-driven ways to uncover your next winner. Use the screener to find companies built on strong fundamentals, spot new innovations early, and secure a competitive edge before others catch on.

- Capture the upside of tomorrow’s tech by checking out these 24 AI penny stocks leading the surge in artificial intelligence and automation breakthroughs.

- Unlock steady streams of potential income by reviewing these 16 dividend stocks with yields > 3% offering attractive yields and proven dividend histories above 3%.

- Seize overlooked gems by checking out these 870 undervalued stocks based on cash flows trading below their intrinsic value based on future cash flows and robust financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TXG

10x Genomics

A life science technology company, develops and sells instruments, consumables, and software for analyzing biological systems in the Americas, Europe, the Middle East, Africa, China, and the Asia Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives