- United States

- /

- Pharma

- /

- NasdaqGS:TLRY

Tilray (TLRY) Is Down 9.6% After Reverse Split And Beverage Pivot - What's Changed

Reviewed by Sasha Jovanovic

- In early December 2025, Tilray Brands implemented a 1-for-10 reverse stock split of its common shares, shrinking the float to roughly 116 million and helping the company remain compliant with Nasdaq’s minimum bid-price rules while trimming some administrative costs.

- At the same time, Tilray is pushing harder into beverages and hemp-derived THC drinks with a curated 2025 holiday lineup, underscoring its effort to diversify beyond core cannabis amid shifting regulations and consumer tastes.

- We’ll now explore how the reverse split and share-count consolidation could reshape Tilray’s investment narrative and future capital-raising options.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Tilray Brands Investment Narrative Recap

To own Tilray today, you need to believe its mix of cannabis, beverages and hemp-derived THC can eventually support a sustainable, less dilutive business, despite ongoing losses and weak U.S. legalization progress. The reverse split and smaller float help preserve Nasdaq listing and may slightly ease future capital raises, but they do not change the core near term catalyst around regulatory movement or the biggest current risk of prolonged unprofitability and cash burn.

The new 2025 holiday drink lineup, spanning craft beer, premium spirits and hemp-derived THC beverages like Happy Flower and Fizzy Jane’s, is the clearest recent example of Tilray leaning into diversification. This push into beverages and THC drinks ties directly into one of the main potential growth drivers investors are watching: whether non cannabis segments can offset Canadian price pressure and soft craft beer demand enough to improve margins over time.

Yet behind the reverse split and festive drink launches, investors should be aware of the ongoing risk that persistent operating losses and cash outflows could...

Read the full narrative on Tilray Brands (it's free!)

Tilray Brands’ narrative projects $940.4 million revenue and $193.4 million earnings by 2028.

Uncover how Tilray Brands' forecasts yield a $16.17 fair value, a 120% upside to its current price.

Exploring Other Perspectives

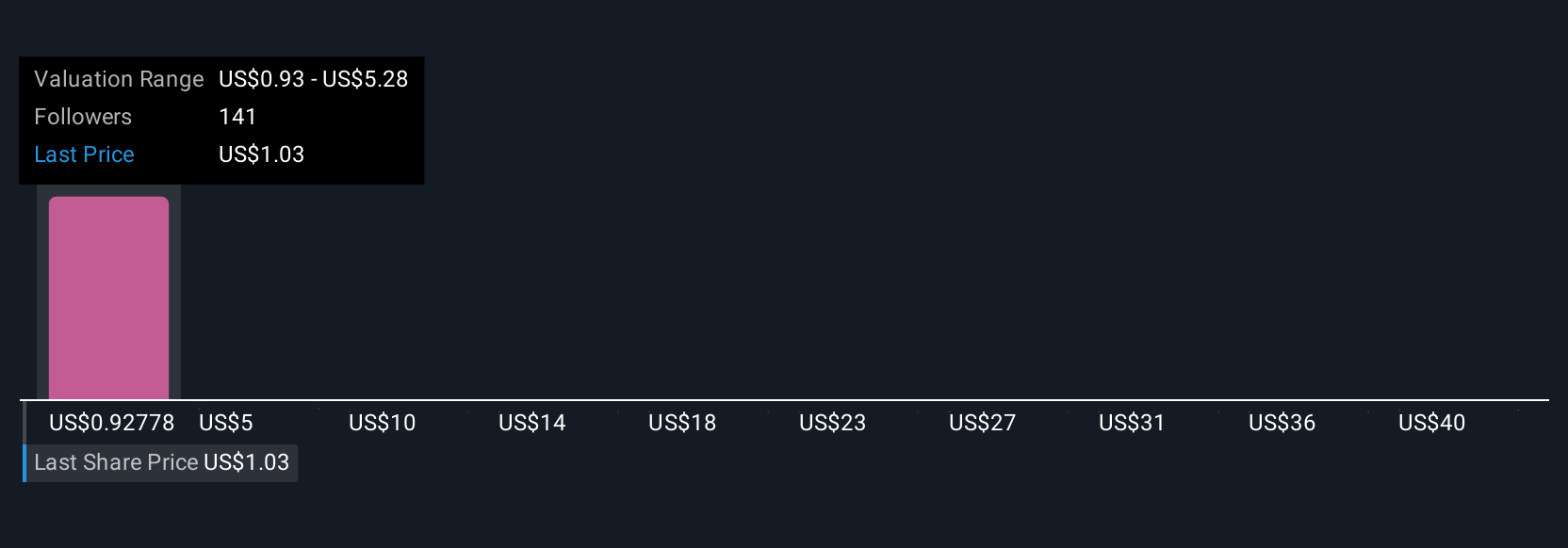

Nineteen members of the Simply Wall St Community currently value Tilray between US$1.47 and US$16.17 per share, highlighting very different return expectations. You should weigh those views against the ongoing risk that years of net losses and negative free cash flow could constrain Tilray’s ability to fund growth or avoid further dilution, with clear implications for future shareholder outcomes.

Explore 19 other fair value estimates on Tilray Brands - why the stock might be worth over 2x more than the current price!

Build Your Own Tilray Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tilray Brands research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Tilray Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tilray Brands' overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tilray Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TLRY

Tilray Brands

A lifestyle consumer products company, engages in the research, cultivation, processing, and distribution of medical cannabis products in Canada, the United States, Europe, the Middle East, Africa, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026