- United States

- /

- Life Sciences

- /

- NasdaqGS:TECH

Bio-Techne (TECH): Reassessing Valuation After Strong Earnings and New Product Launches

Reviewed by Simply Wall St

Bio-Techne (TECH) just released its first-quarter earnings, reporting a jump in net income and earnings per share, even as sales dipped slightly year over year. Alongside earnings, several recent company updates stand out.

See our latest analysis for Bio-Techne.

Despite Bio-Techne's surge in innovation, from AI-driven biomarker advances unveiled at recent conferences to steady progress on share buybacks and dividends, the stock has yet to spark a reversal in momentum. The 1-year total shareholder return sits at -22.4%, and the year-to-date share price return is also in the red. This reflects persistent market caution following a multi-year decline even amid brighter earnings and product breakthroughs.

If you're eyeing potential in health sciences, it's worth exploring other innovators with growth stories in the space. See the full list here: See the full list for free.

With Bio-Techne trading at a notable discount to analyst targets but facing a challenging track record, investors must consider whether the market is overlooking long-term potential or if future growth has already been fully accounted for in the stock price.

Most Popular Narrative: 15.3% Undervalued

With the fair value cited at $67.83 and the last closing price at $57.46, the prevailing narrative points to a disconnect between market pessimism and positive earnings expectations. This sets up a compelling debate about whether Bio-Techne's latest innovations and profitability trends have truly been factored into the stock price.

Strategic portfolio shifts and ongoing innovation are enhancing product margins and positioning the company for improved profitability and core business growth. Growing demand for advanced therapies and diagnostics, coupled with international expansion, underpins sustained revenue momentum and deepening market presence.

Want to know what’s fueling this valuation leap? It all comes down to bold growth assumptions, such as bigger earnings, wider margins, and an ambitious profit multiple in the years ahead. Curious which key forecasts drive the gap between today’s price and fair value? Dive in to unlock the figures behind this optimistic outlook.

Result: Fair Value of $67.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing biotech funding drops and regulatory uncertainty could quickly shift sentiment. This may put Bio-Techne’s recovery and valuation case to the test.

Find out about the key risks to this Bio-Techne narrative.

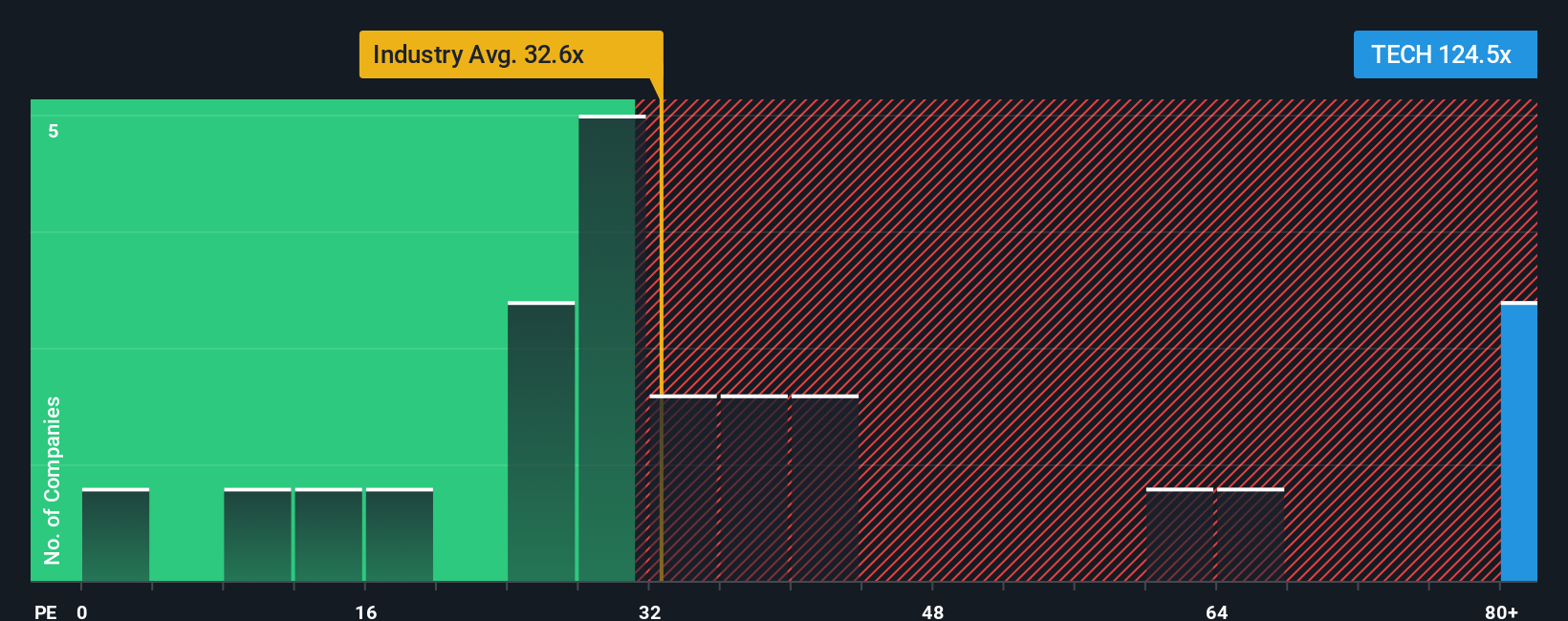

Another View: Pricing by Market Ratios

Looking from a different lens, market ratios suggest Bio-Techne is richly priced. Its price-to-earnings ratio stands far above the industry average, its peers, and the fair ratio. This raises the question: does the market expect more than the fundamentals can deliver, or is there hidden upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bio-Techne Narrative

If you see things differently or want to dive into the details yourself, shaping your own view takes just a few minutes. Do it your way

A great starting point for your Bio-Techne research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Expand your portfolio with confidence and seize opportunities others might overlook. These stock ideas could put you ahead of the curve, so act before the crowd catches on.

- Uncover high-yield possibilities by checking out these 16 dividend stocks with yields > 3% for stocks that offer generous dividends and consistent income potential.

- Seize early growth stories by evaluating these 3572 penny stocks with strong financials with strong financial foundations before they become mainstream market favorites.

- Tap into the future of medicine and data with these 32 healthcare AI stocks, where revolutionary innovations are transforming the healthcare sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bio-Techne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TECH

Bio-Techne

Develops, manufactures, and sells life science reagents, instruments, and services for the research, diagnostics, and bioprocessing markets worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives