- United States

- /

- Biotech

- /

- NasdaqGS:SRRK

Scholar Rock (SRRK) Valuation Revisited After FDA Warning Letter to Key Manufacturing Partner

Reviewed by Simply Wall St

Scholar Rock Holding (SRRK) is back in the spotlight after its manufacturing partner, Catalent Indiana, received an FDA warning letter. This has raised fresh questions about apitegromab’s launch timing and the stock’s risk reward setup.

See our latest analysis for Scholar Rock Holding.

Despite the manufacturing overhang and a high profile hedge fund exit, investors have mostly treated these as execution risks rather than a broken thesis. Scholar Rock’s roughly 61 percent 1 month share price return and powerful multi year total shareholder return suggest momentum is still skewed to the upside.

If this kind of asymmetric setup interests you, it could be worth scanning other healthcare stocks that pair clinical catalysts with meaningful upside potential.

With shares now sitting just shy of analyst targets after a blistering run, is Scholar Rock still trading at a discount to its long term apitegromab opportunity, or is the market already pricing in that future growth?

Price to Book of 18.8x: Is it justified?

On a price to book basis, Scholar Rock’s 45.20 dollars share price embeds a 18.8x multiple that screens rich versus the broader US biotech space.

The price to book ratio compares a company’s market value to its net assets, a common yardstick for early stage or loss making biotechs with limited revenue. For a business like Scholar Rock that is still unprofitable and pre commercial, a high multiple usually reflects investors assigning significant value to the pipeline and future cash flows rather than today’s balance sheet.

Here, the gap is stark. Scholar Rock trades on 18.8x book value against an industry average of just 2.7x, implying the market is paying a substantial premium for its growth story. Yet relative to a narrower peer set it looks less stretched; the same 18.8x multiple actually sits below a 24x peer average, suggesting that within its high expectation cohort, the valuation is not an outlier.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Book of 18.8x (ABOUT RIGHT)

However, lingering FDA manufacturing concerns and any disappointing apitegromab readout or launch delay could quickly unwind recent gains and reset growth expectations.

Find out about the key risks to this Scholar Rock Holding narrative.

Another View: The SWS DCF Model

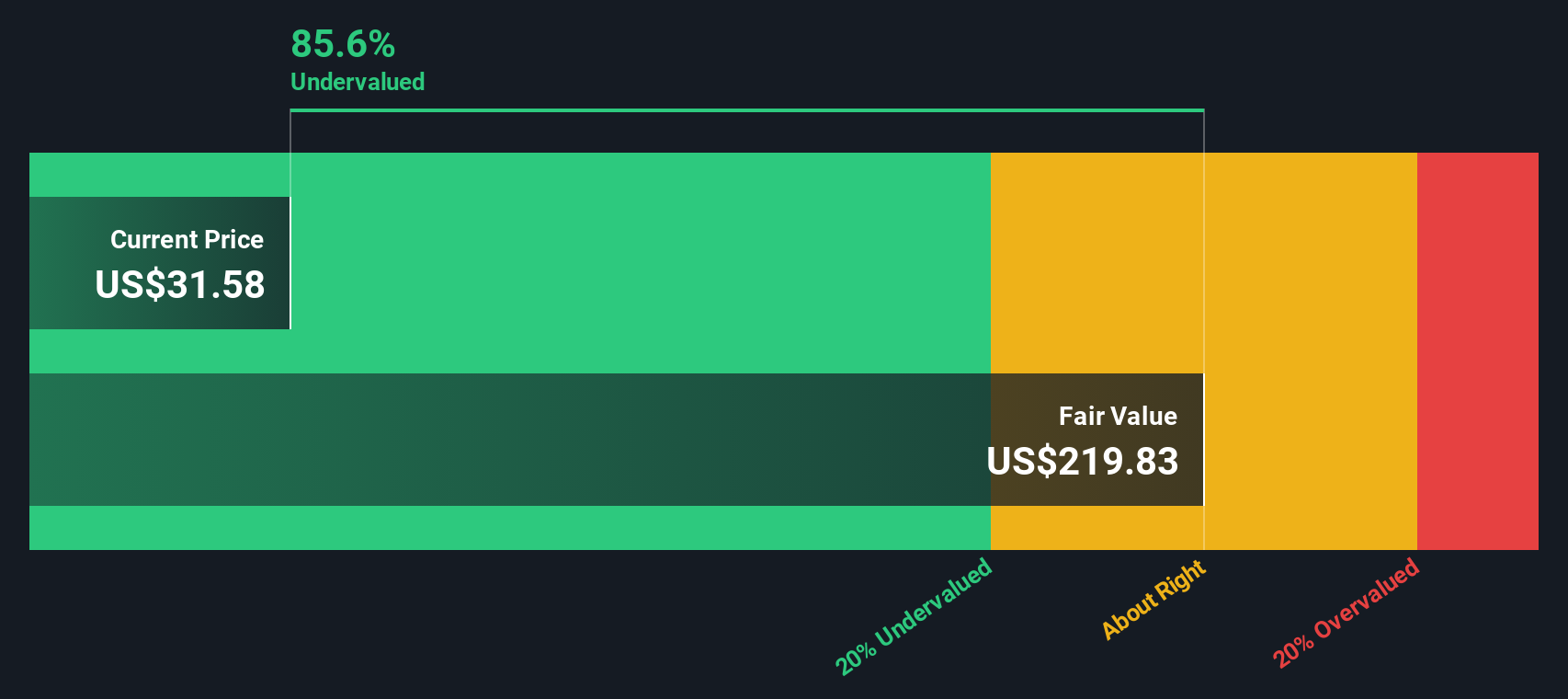

While the 18.8x price to book makes Scholar Rock look expensive on assets, our DCF model paints a very different picture. With an estimated fair value of 198.79 dollars per share, the stock screens as deeply undervalued, potentially reflecting doubt around execution rather than long term cash flows.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Scholar Rock Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Scholar Rock Holding Narrative

If you see the numbers differently or want to dig into the details yourself, you can build a personalised view in just a few minutes: Do it your way.

A great starting point for your Scholar Rock Holding research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at one opportunity when the market is full of mispriced stories. Use the Simply Wall Street Screener now and sharpen your edge.

- Capitalize on potential mispricings by targeting companies trading below intrinsic value through these 908 undervalued stocks based on cash flows, before the rest of the market catches on.

- Position yourself for the next wave of innovation by zeroing in on these 26 AI penny stocks that harness artificial intelligence to reshape entire industries.

- Lock in reliable income potential by focusing on these 15 dividend stocks with yields > 3% that can support long term, compounding returns in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRRK

Scholar Rock Holding

A biopharmaceutical company, focuses on the discovery, development, and delivery of medicines for the treatment of serious diseases in which signaling by protein growth factors plays a fundamental role.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026