- United States

- /

- Biotech

- /

- NasdaqGS:SRPT

Does Sarepta Therapeutics' 33% Drop Signal a Possible Market Mispricing?

Reviewed by Bailey Pemberton

- If you have ever found yourself wondering if Sarepta Therapeutics is undervalued or poised for a rebound, you are not alone. Let's dig into whether this moment presents an opportunity or a warning sign.

- The stock has seen sharp moves recently, dropping 33.1% in just the last week and losing nearly 87% of its value over the past year.

- This volatility follows headlines around regulatory delays and shifts in biotech investor sentiment, which have sparked heated debates about the company's prospects. Notably, Sarepta has been in the news for updates on its gene therapy pipeline and the evolving FDA approval process surrounding its primary treatments.

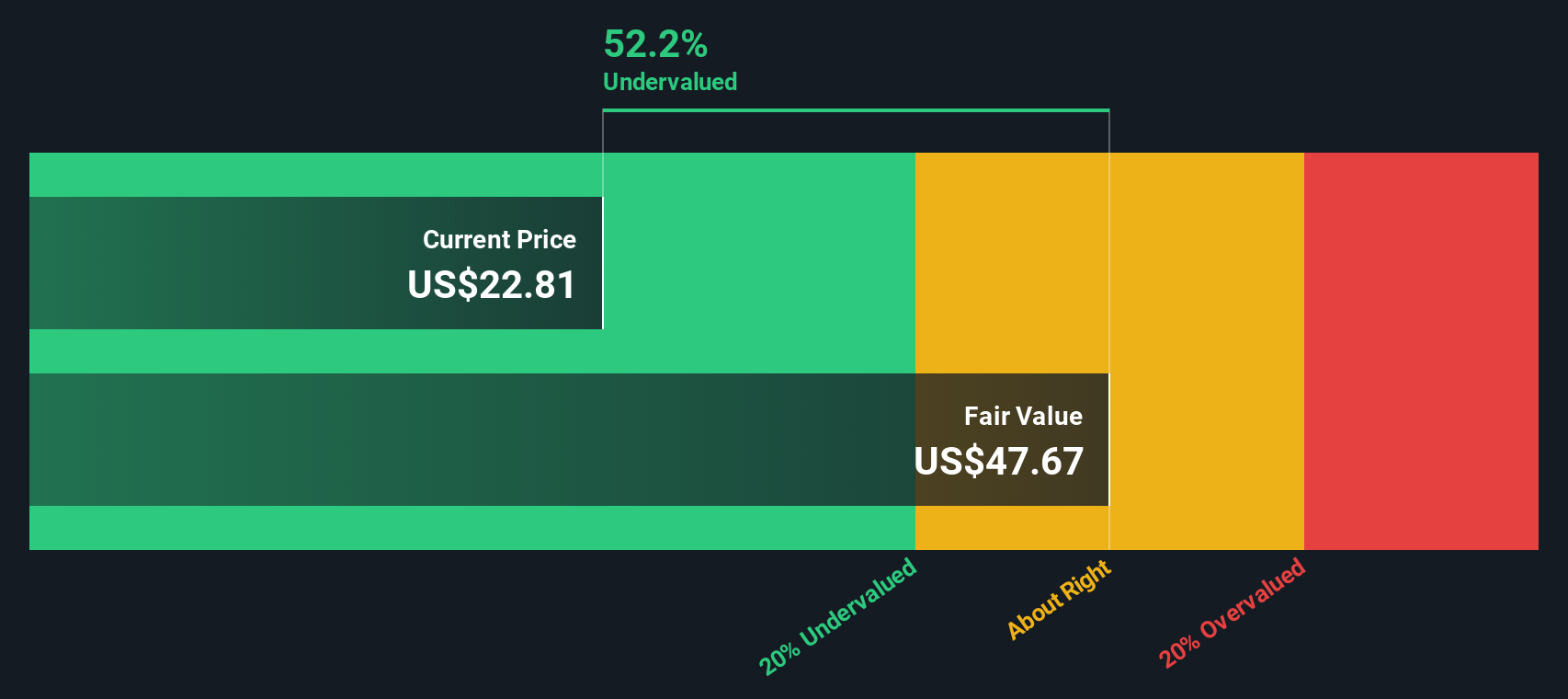

- By our checks, Sarepta scores a 5 out of 6 on undervaluation, meaning it passes almost every standard test with flying colors. We will break down these valuation approaches in detail, but stay tuned, as we will share an even smarter way to get to the bottom of Sarepta's true worth by the end of this article.

Find out why Sarepta Therapeutics's -87.0% return over the last year is lagging behind its peers.

Approach 1: Sarepta Therapeutics Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of Sarepta Therapeutics by projecting future cash flows and discounting them back to today's value. This approach attempts to calculate what the business is really worth, based on the cash it is expected to generate going forward.

Currently, Sarepta Therapeutics is operating with a Free Cash Flow (FCF) of about -$410 million, which means it is burning cash. Analysts project a turnaround, with FCF expected to climb into positive territory by 2026 and reaching a projected $257 million by 2029. Beyond five years, Simply Wall St extrapolates further estimates. Readers should note that these extended projections involve more uncertainty.

All future cash flows are calculated in USD and discounted back to reflect today’s value, resulting in an estimated intrinsic value of $46.55 per share. This value is about 65.2% higher than the current share price, indicating Sarepta Therapeutics may be significantly undervalued according to DCF analysis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sarepta Therapeutics is undervalued by 65.2%. Track this in your watchlist or portfolio, or discover 844 more undervalued stocks based on cash flows.

Approach 2: Sarepta Therapeutics Price vs Sales (P/S)

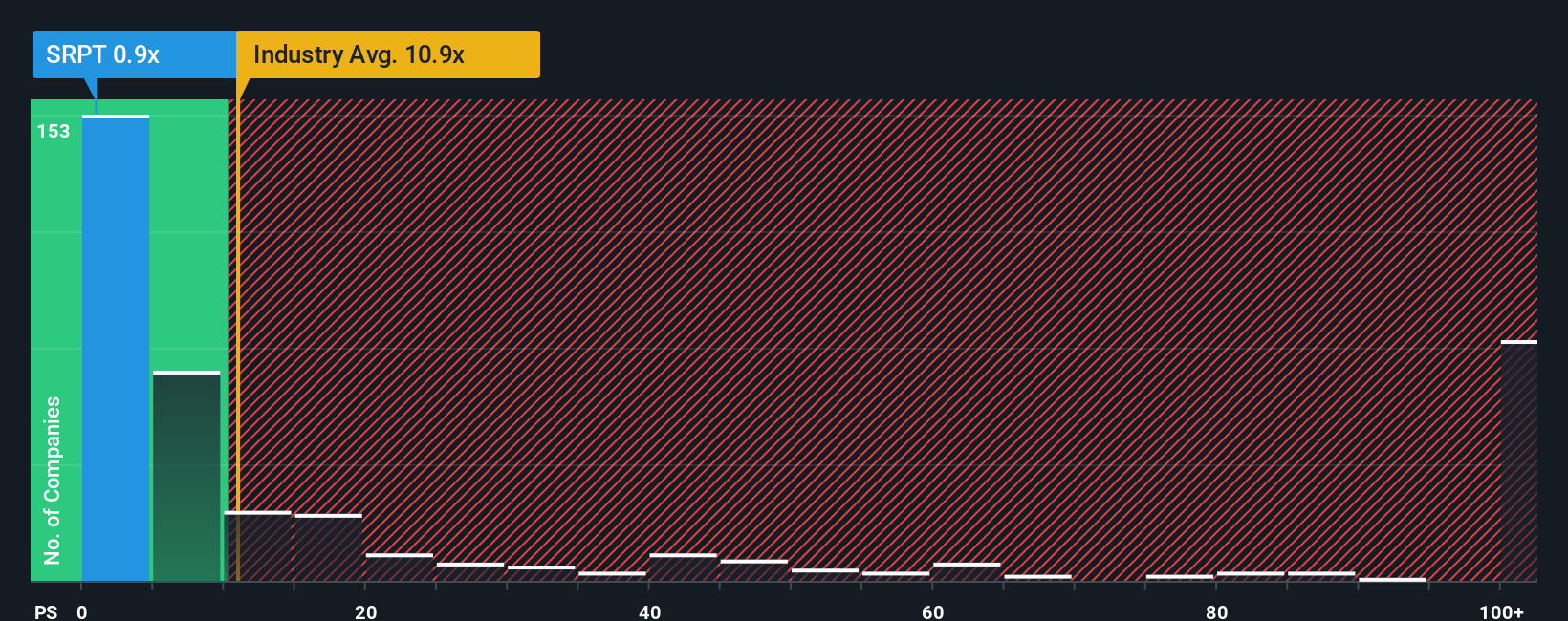

The Price-to-Sales (P/S) ratio is often the go-to multiple for valuing biotech companies like Sarepta Therapeutics, especially when they are not yet profitable. This is because many innovative biotechs reinvest heavily in research and development, making earnings-based multiples such as the Price-to-Earnings less meaningful. The P/S ratio offers a snapshot of how much investors are willing to pay for each dollar of current sales, sidestepping the distortions from negative earnings.

What counts as a "normal" P/S ratio depends on factors such as expected revenue growth, business risk, and market trends. Companies with strong growth prospects or lower risk can justifiably command higher multiples. Conversely, if the outlook dims or risks loom larger, the fair P/S tends to drop.

At the moment, Sarepta Therapeutics trades at a P/S ratio of 0.70x. That is significantly below the biotech industry average of 10.83x and the peer group average of 23.87x. To offer deeper context, Simply Wall St calculates a proprietary Fair Ratio, which blends Sarepta's growth outlook, margins, risk profile, industry standards, and market cap into a customized benchmark. For Sarepta, this Fair Ratio stands at 1.37x.

Relying solely on peer or industry averages can be misleading, since those numbers might not reflect the company’s unique opportunities and risks. Simply Wall St's Fair Ratio is designed to capture just that and help investors avoid the trap of one-size-fits-all benchmarks, allowing a focus on what is truly relevant to Sarepta right now.

Given that Sarepta's current P/S of 0.70x is meaningfully below its Fair Ratio of 1.37x, the stock appears undervalued by this measure.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sarepta Therapeutics Narrative

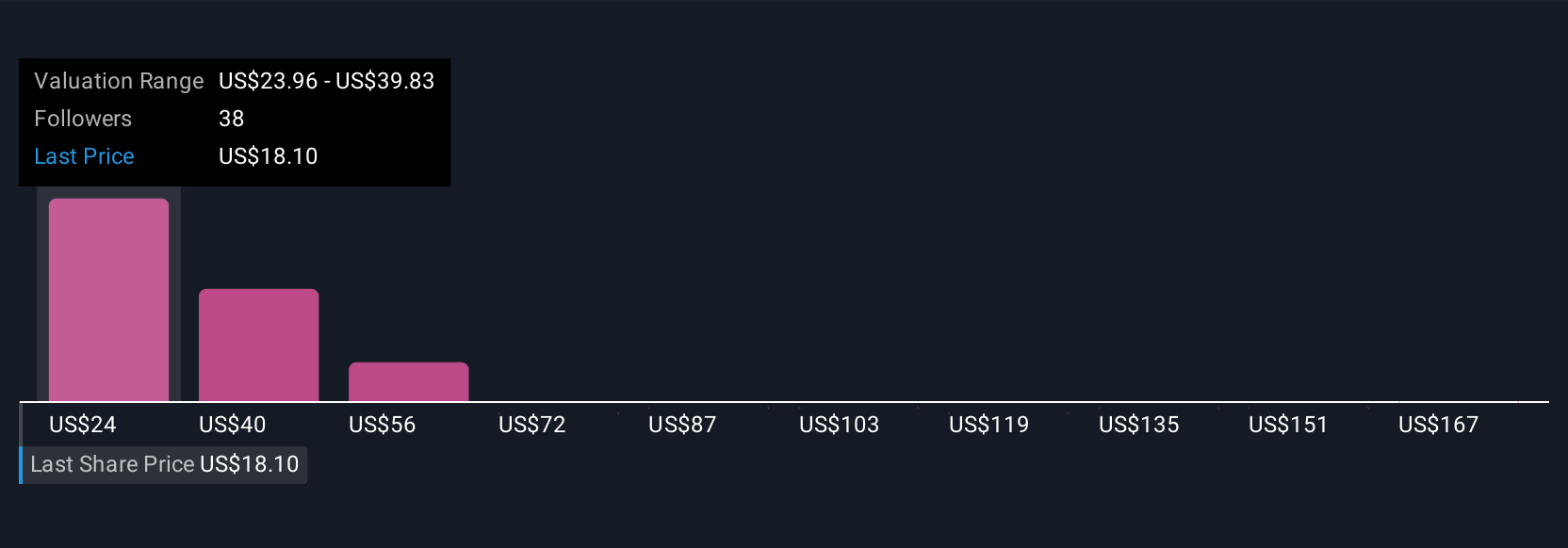

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives bring together numbers and stories, allowing you to express your own perspective about Sarepta Therapeutics by connecting your expectations for its business drivers with future revenue, earnings, margins, and ultimately your estimate of fair value.

Rather than relying solely on formulas or analyst averages, a Narrative lets you frame why you believe Sarepta is undervalued or overvalued, based on operational outlook, new pipeline launches, regulatory events, or evolving market risks. It's a flexible and accessible tool, available on Simply Wall St's Community page, where millions of investors compare their forecasts and fair value estimates transparently and in real time.

The power of Narratives is in their ability to help you decide when to buy or sell, by dynamically updating your fair value view as new information such as company news or earnings becomes available. For example, some investors look at Sarepta and set a bullish Narrative, forecasting blockbuster success for the ELEVIDYS gene therapy and a fair value as high as $80 per share. Others, more cautious about safety events and profit margins, set a far lower fair value closer to $5 per share.

With Narratives, your investment decision is no longer just about the numbers. It’s your story, your assumptions, and your forward-looking judgment, all supported by real-time data and a vibrant community of investors.

Do you think there's more to the story for Sarepta Therapeutics? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRPT

Sarepta Therapeutics

A commercial-stage biopharmaceutical company, focuses on the discovery and development of RNA-targeted therapeutics, gene therapies, and other genetic therapeutic modalities for the treatment of rare diseases.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives