- United States

- /

- Biotech

- /

- NasdaqGS:SRPT

Did FDA Green Light for ELEVIDYS and Pipeline Progress Just Shift Sarepta Therapeutics' (SRPT) Narrative?

Reviewed by Sasha Jovanovic

- In late November 2025, Sarepta Therapeutics announced two major developments: FDA approval to begin dosing non-ambulant Duchenne muscular dystrophy patients with ELEVIDYS in a new ENDEAVOR study cohort, and progress in the Phase 1/2 multiple ascending dose clinical trial for SRP-1003, its investigational siRNA therapy for type 1 myotonic dystrophy.

- These advancements underscore Sarepta's commitment to expanding its pipeline and addressing rare neuromuscular diseases with innovative genetic therapies.

- We'll explore how the FDA's decision to advance ELEVIDYS into a new patient group may influence Sarepta's future investment outlook.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Sarepta Therapeutics Investment Narrative Recap

For investors considering Sarepta Therapeutics, the core thesis centers on the company's ability to bring innovative genetic therapies to patients with rare neuromuscular conditions, while effectively handling regulatory and safety hurdles. The FDA's move to broaden ELEVIDYS' use in non-ambulant Duchenne patients highlights potential expansion, but also brings heightened scrutiny to safety, so though this progress could influence patient access, its impact on the immediate key catalyst, restoring confidence following recent safety concerns, remains modest. Of the latest announcements, the November update allowing dosing of non-ambulant DMD patients in the ENDEAVOR study stands out, reflecting regulatory willingness to expand ELEVIDYS' reach. This development may support long-term growth drivers by demonstrating Sarepta's ongoing collaboration with agencies and continued patient enrollment, which are both crucial factors tied to the company's major revenue catalysts. Yet, investors should also be aware that in contrast to positive regulatory steps, there remain key concerns around...

Read the full narrative on Sarepta Therapeutics (it's free!)

Sarepta Therapeutics' outlook anticipates $1.4 billion in revenue and $171.6 million in earnings by 2028. This scenario assumes a 17.0% annual decline in revenue and an earnings increase of $229.6 million from the current earnings of -$58.0 million.

Uncover how Sarepta Therapeutics' forecasts yield a $19.91 fair value, in line with its current price.

Exploring Other Perspectives

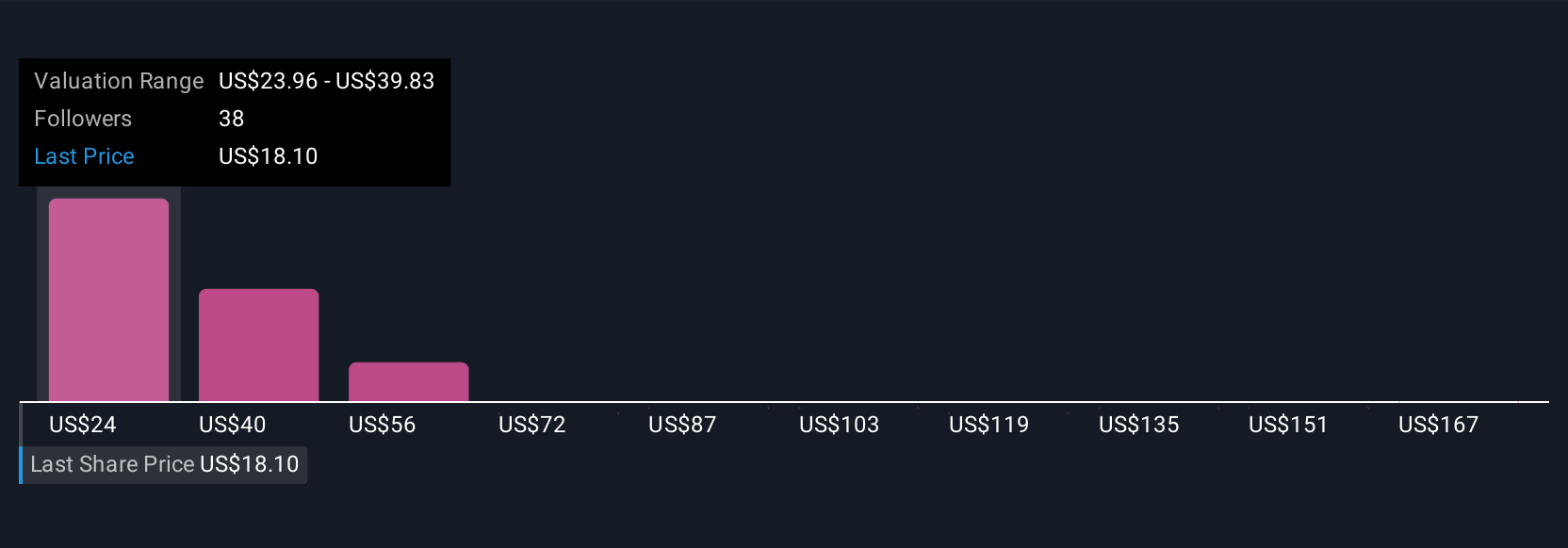

Ten members of the Simply Wall St Community estimate Sarepta's fair value between US$19.91 and US$168.51, reflecting strongly varied outlooks. With safety updates and evolving regulatory focus, individual expectations for Sarepta's future performance can differ sharply, so it's worth comparing several perspectives before making up your mind.

Explore 10 other fair value estimates on Sarepta Therapeutics - why the stock might be worth over 8x more than the current price!

Build Your Own Sarepta Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sarepta Therapeutics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sarepta Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sarepta Therapeutics' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRPT

Sarepta Therapeutics

A commercial-stage biopharmaceutical company, focuses on the discovery and development of RNA-targeted therapeutics, gene therapies, and other genetic therapeutic modalities for the treatment of rare diseases.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026