- United States

- /

- Biotech

- /

- NasdaqGM:CNTB

October 2025's Promising Penny Stocks To Consider

Reviewed by Simply Wall St

As U.S. stock indexes continue to rise, even amid a government shutdown, investors are keeping a close eye on market dynamics and economic indicators. In this context, penny stocks—despite the somewhat outdated term—remain an intriguing investment area due to their potential for growth and value. This article highlights three penny stocks that stand out for their financial strength and potential long-term success, offering investors the opportunity to explore under-the-radar companies with promising prospects.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.04 | $437.18M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.95 | $705.24M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.18 | $201.8M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.89 | $23.5M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.85 | $636.96M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.9925 | $7.21M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.92 | $88.82M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.74 | $10.96M | ✅ 2 ⚠️ 3 View Analysis > |

| Marine Petroleum Trust (MARP.S) | $4.28 | $8.56M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 364 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Stabilis Solutions (SLNG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Stabilis Solutions, Inc. is an energy transition company that offers comprehensive clean energy services including production, storage, transportation, and fueling solutions with a focus on liquefied natural gas (LNG) for various North American markets, with a market cap of $90.19 million.

Operations: The company generates revenue primarily from its Liquefied Natural Gas (LNG) segment, amounting to $69.57 million.

Market Cap: $90.19M

Stabilis Solutions, Inc., with a market cap of US$90.19 million, focuses on LNG services in North America. Despite a revenue of US$69.57 million primarily from its LNG segment, the company faces challenges with declining earnings forecasted to drop by an average of 61.1% annually over the next three years and recent losses reported for Q2 2025. The company's debt is well covered by operating cash flow, and short-term assets exceed liabilities; however, profit margins have decreased compared to last year. Management changes are evident with an inexperienced team averaging 1.8 years in tenure.

- Click here and access our complete financial health analysis report to understand the dynamics of Stabilis Solutions.

- Explore Stabilis Solutions' analyst forecasts in our growth report.

Connect Biopharma Holdings (CNTB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Connect Biopharma Holdings Limited is a clinical-stage biopharmaceutical company focused on developing therapies for inflammatory diseases in the United States, with a market cap of $83.03 million.

Operations: The company generates revenue of $1.97 million from its biotechnology startups segment.

Market Cap: $83.03M

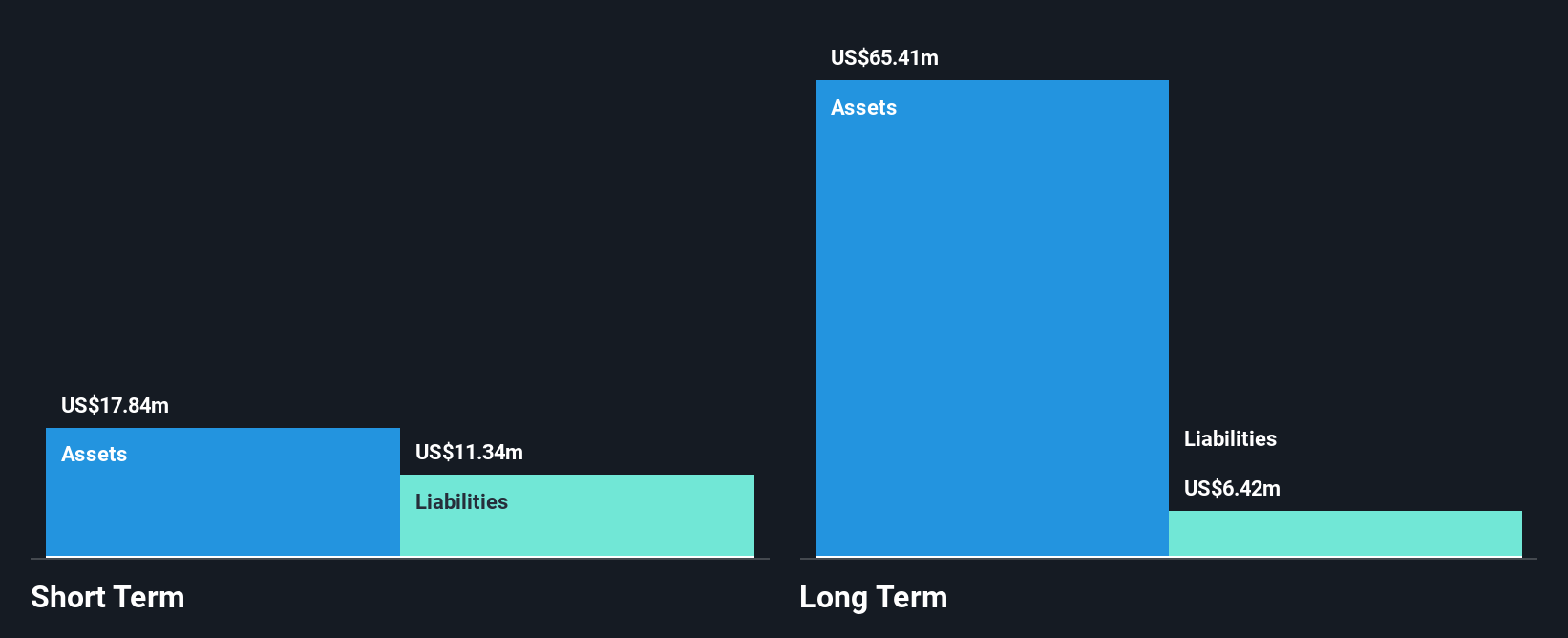

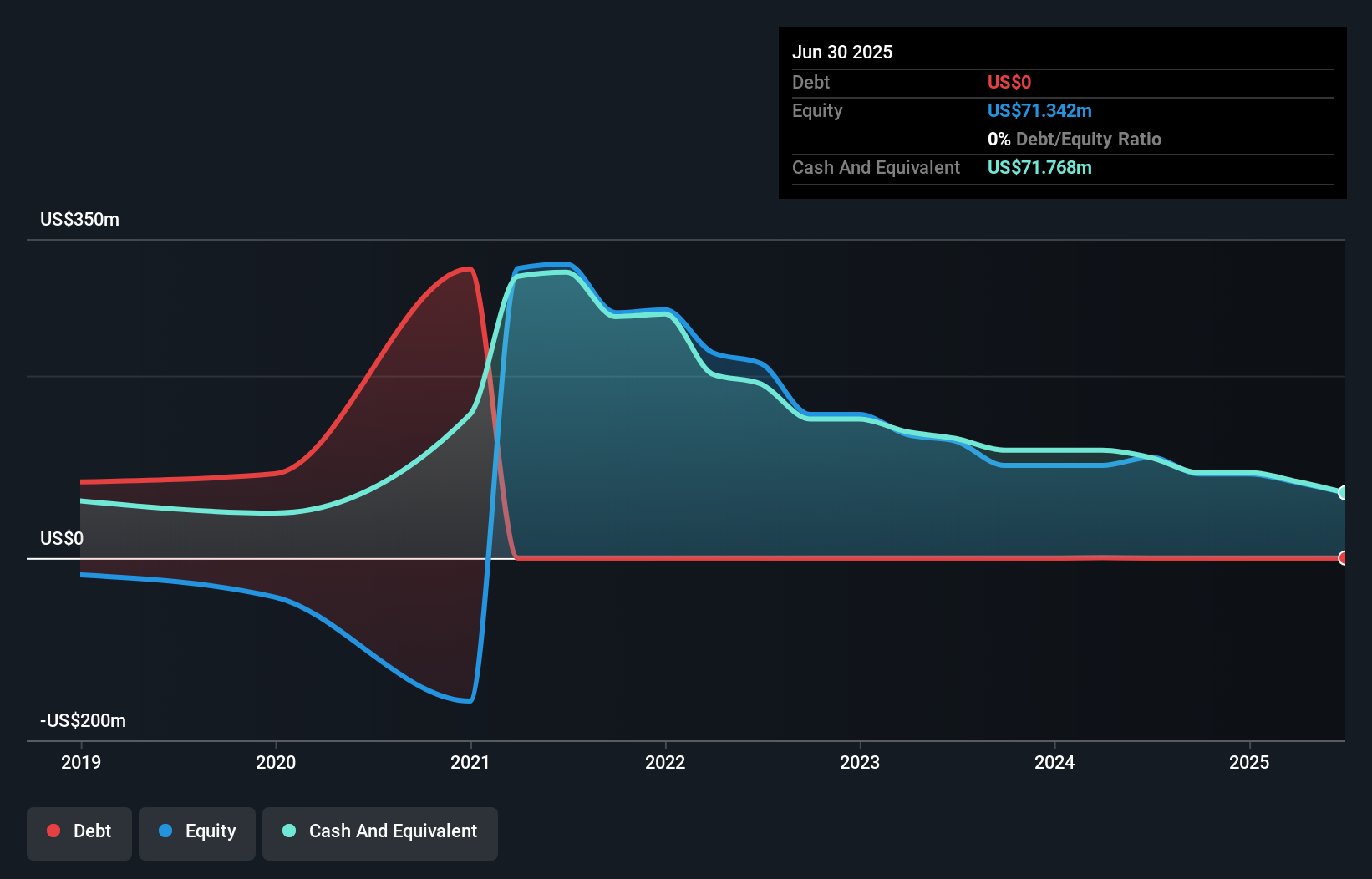

Connect Biopharma Holdings, with a market cap of US$83.03 million, is focused on developing therapies for inflammatory diseases. Despite generating US$1.97 million in revenue, it remains unprofitable and lacks meaningful revenue streams. The company has sufficient cash runway for over a year and no debt burden, which may provide some financial stability amidst its high share price volatility. Recent management changes include the addition of experienced biotech leader Jim Schoeneck to the board, potentially strengthening strategic direction. Analysts expect significant stock price appreciation, although profitability is not anticipated in the near term due to ongoing losses and limited earnings growth visibility.

- Get an in-depth perspective on Connect Biopharma Holdings' performance by reading our balance sheet health report here.

- Understand Connect Biopharma Holdings' earnings outlook by examining our growth report.

Spero Therapeutics (SPRO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Spero Therapeutics, Inc. is a clinical-stage biopharmaceutical company dedicated to developing novel treatments for multi-drug resistant bacterial infections and rare diseases in the United States, with a market cap of $115.36 million.

Operations: The company's revenue is derived entirely from its segment focused on developing treatments for multi-drug resistant bacterial infections, generating $48.58 million.

Market Cap: $115.36M

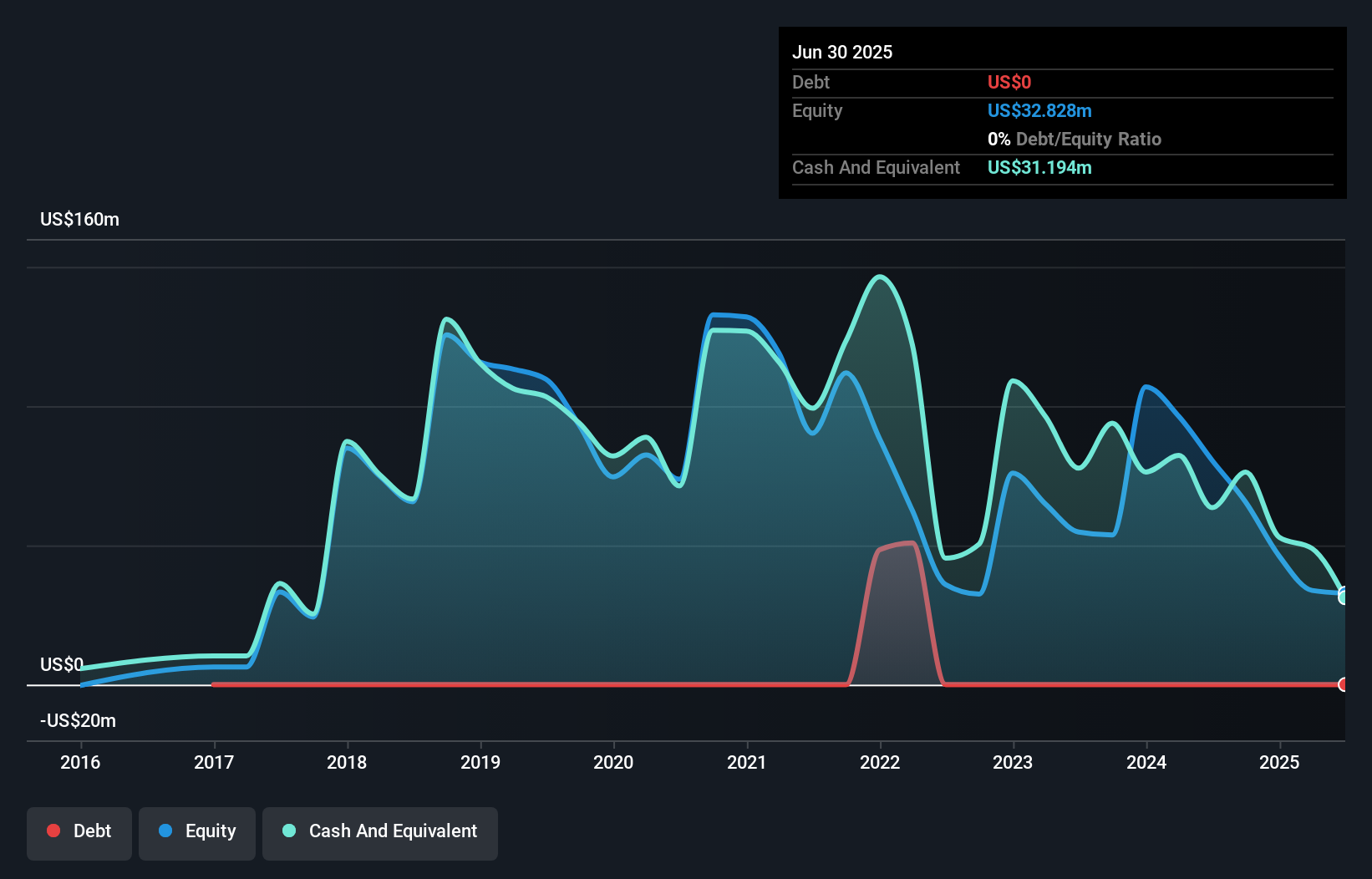

Spero Therapeutics, with a market cap of US$115.36 million, focuses on treatments for multi-drug resistant infections, generating US$48.58 million in revenue. Despite being unprofitable, it has significantly reduced its net loss over the past year and decreased volatility from 36% to 9%. The company’s short-term assets of US$59.4 million exceed both short- and long-term liabilities, indicating financial stability despite having less than a year of cash runway. It remains debt-free but recently filed a shelf registration for US$6.6 million to potentially bolster its financial position amidst ongoing development efforts and management changes.

- Click to explore a detailed breakdown of our findings in Spero Therapeutics' financial health report.

- Assess Spero Therapeutics' future earnings estimates with our detailed growth reports.

Where To Now?

- Jump into our full catalog of 364 US Penny Stocks here.

- Interested In Other Possibilities? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CNTB

Connect Biopharma Holdings

A clinical-stage biopharmaceutical company, engages in the development of therapies for the treatment of inflammatory diseases in the United States.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives