- United States

- /

- Biotech

- /

- NasdaqGM:SMMT

Summit Therapeutics (SMMT): Evaluating Valuation After Promising HARMONi-A Phase III Survival Results

Reviewed by Simply Wall St

Summit Therapeutics (SMMT) revealed new data from its HARMONi-A Phase III trial, showing that ivonescimab plus chemotherapy led to improved overall survival in patients with EGFR-mutated non-small cell lung cancer. This milestone highlights the potential impact of ivonescimab for patients and the company’s ongoing development strategy.

See our latest analysis for Summit Therapeutics.

Summit’s breakthrough in the HARMONi-A trial comes after a turbulent year on the market. The company’s 1-year total shareholder return is down 15.1%, reflecting recent challenges and volatility, although its remarkable three-year total return of 1,665% stands out among biotech peers. Momentum has faded lately, but long-term holders remain well ahead, and the survival data could help shift sentiment if progress continues.

If this move in oncology piques your interest, it’s a great time to discover more promising healthcare innovators through our curated list: See the full list for free.

With strong clinical data and the share price still well below analyst targets, the key question is whether Summit is undervalued after recent declines or if the market already anticipates further progress. Could this be a buying opportunity?

Price-to-Book of 70.4x: Is it justified?

Summit Therapeutics trades at a price-to-book ratio of 70.4x, putting its shares at a dramatic premium to both its biotech peers and the wider industry, despite recent share price weakness.

The price-to-book ratio is a key valuation metric for biotech companies that are not yet profitable. It offers insight into how much investors are willing to pay compared to net assets. Typically, investors expect rapid future growth or breakthrough innovation to justify such a high multiple.

However, Summit's price-to-book stands at 70.4x, far exceeding the US Biotechs industry average of 2.4x and the peer average of 5.4x. This significant premium suggests that the market is anticipating very ambitious future success, and the valuation may require a major clinical or commercial win to be justified.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 70.4x (OVERVALUED)

However, ongoing net losses and ambitious valuation remain key risks that could pressure Summit’s outlook if clinical or commercial progress slows or encounters challenges.

Find out about the key risks to this Summit Therapeutics narrative.

Another View: DCF Suggests Deep Undervaluation

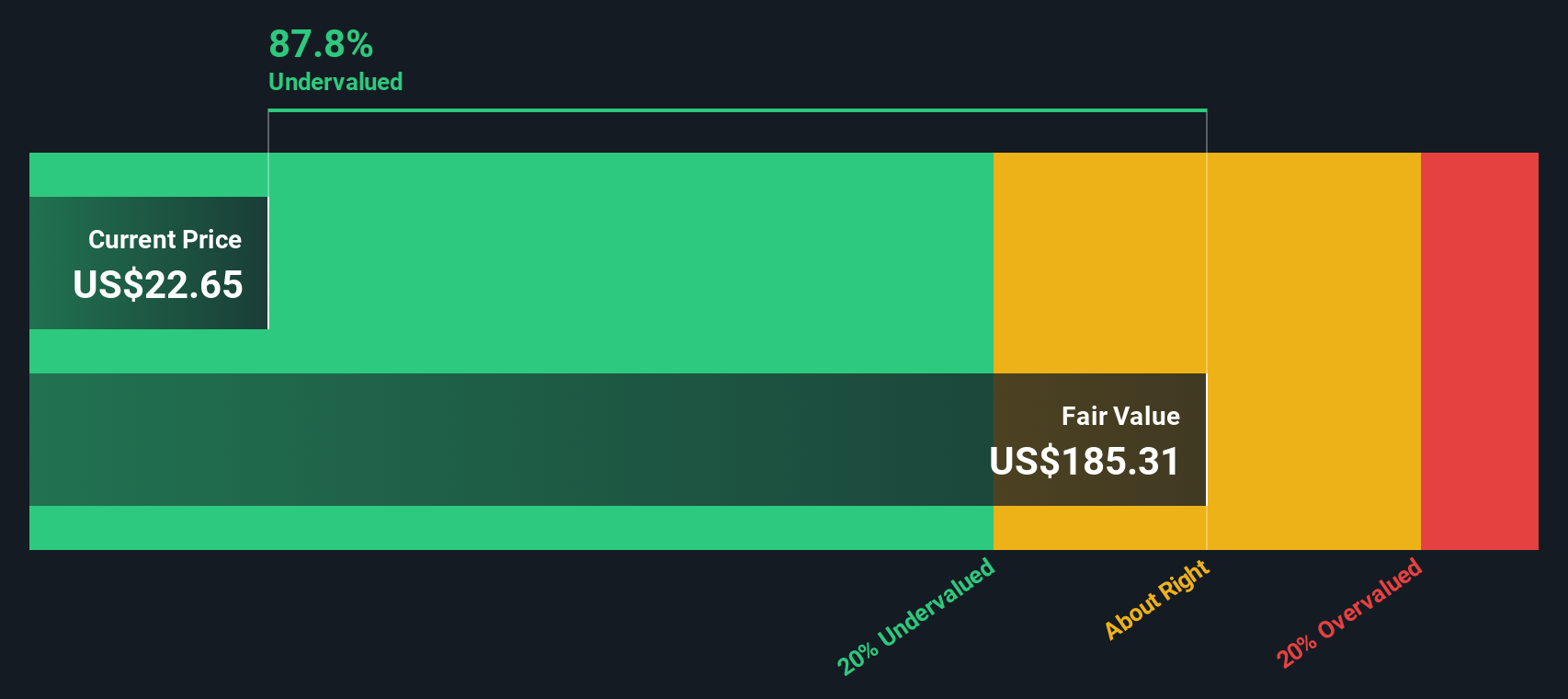

While Summit’s price-to-book ratio points to an expensive stock, our DCF model arrives at a very different conclusion. According to this method, shares trade roughly 90% below their estimated fair value. Is the market overlooking something, or is the risk just too high?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Summit Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Summit Therapeutics Narrative

If you want to dig deeper or draw your own conclusions from the data, crafting your personal take only takes a few minutes. Why not Do it your way?

A great starting point for your Summit Therapeutics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t leave opportunity on the table. Expand your portfolio by checking out handpicked stocks that could complement your strategy and help you stay ahead of the crowd.

- Seize the potential of emerging artificial intelligence by starting with these 25 AI penny stocks built to capitalize on rapid tech evolution.

- Unlock income opportunities by targeting these 16 dividend stocks with yields > 3% that regularly reward shareholders and add stability to your holdings.

- Get ahead of market mispricing by tapping into these 876 undervalued stocks based on cash flows poised for rallies as prices catch up with value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SMMT

Summit Therapeutics

A biopharmaceutical company, focuses on discovery, development, and commercialization of patient, physician, caregiver, and societal friendly medicinal therapies.

Flawless balance sheet with low risk.

Market Insights

Community Narratives