- United States

- /

- Biotech

- /

- NasdaqGS:SANA

Will Sana Biotechnology’s (SANA) Sharper Focus on Diabetes and CAR T Unlock Its Next Chapter?

Reviewed by Sasha Jovanovic

- Sana Biotechnology recently reported third quarter results, highlighting a reduced net loss of US$42.15 million and a strategic shift to focus on its type 1 diabetes program SC451 and next-generation in vivo CAR T product SG293.

- Newly published clinical findings for UP421, a hypoimmune-modified pancreatic islet cell therapy, showed safety and immune evasion in a type 1 diabetes patient without immunosuppression, spotlighting Sana’s innovative cell therapy platforms.

- We’ll now explore how Sana’s decision to concentrate resources on SC451 and SG293 influences the company’s investment narrative moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Sana Biotechnology's Investment Narrative?

Sana Biotechnology’s decision to narrow its focus to SC451 for type 1 diabetes and SG293 as its next-generation in vivo CAR T platform brings new clarity to the investment thesis. For many investors, the big picture here is about whether Sana can translate its innovative cell therapy science into clinical and, ultimately, commercial success, despite having no revenue and ongoing losses. The recent positive data on UP421 and new IND timelines injected fresh momentum and may strengthen investor confidence, but the move also heightens dependency on just two programs. This makes upcoming clinical and regulatory developments more meaningful as short-term catalysts, potentially raising the stakes of any setback. Meanwhile, unresolved legal action and the company’s cash runway remain key risks, especially in light of cost cuts and portfolio rationalization announced alongside earnings. Despite an improved net loss, recent share price volatility and lack of revenue suggest news flow and clinical progress will be closely watched for the foreseeable future.

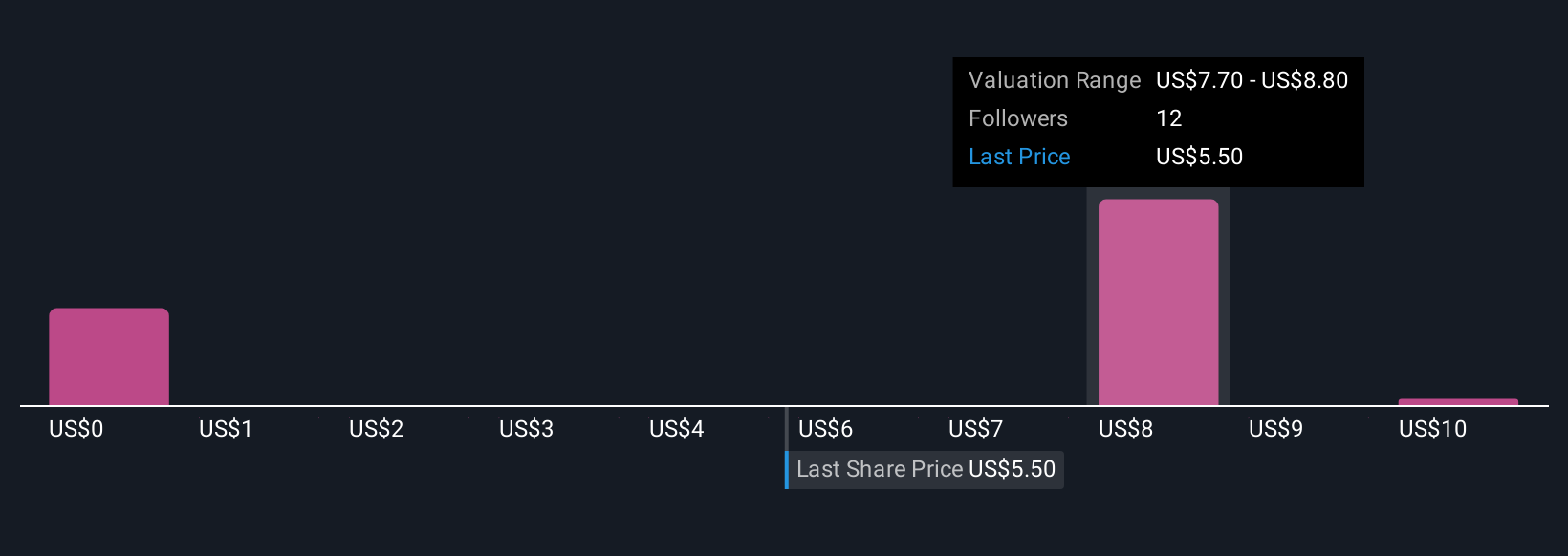

But with this intensified focus, legal challenges could become even more consequential for shareholders. Our valuation report here indicates Sana Biotechnology may be overvalued.Exploring Other Perspectives

Explore 8 other fair value estimates on Sana Biotechnology - why the stock might be worth less than half the current price!

Build Your Own Sana Biotechnology Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sana Biotechnology research is our analysis highlighting 1 key reward and 6 important warning signs that could impact your investment decision.

- Our free Sana Biotechnology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sana Biotechnology's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SANA

Sana Biotechnology

A biotechnology company, focuses on utilizing engineered cells as medicines in the United States.

Medium-low risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives