- United States

- /

- Biotech

- /

- NasdaqGS:ROIV

Roivant Sciences (ROIV): Evaluating Valuation After Earnings, Pipeline Wins, and Legal Milestone

Reviewed by Simply Wall St

Roivant Sciences (ROIV) shares traded actively following its recent earnings announcement. The report showed a reduced net loss compared to last year amid lower sales. Investors also took note of positive Phase 3 clinical results and legal developments.

See our latest analysis for Roivant Sciences.

Roivant Sciences’ mix of narrowing losses and pipeline wins appears to have shifted sentiment, as shown by a 31.5% share price return over the past month and an impressive 81.5% return over the last 90 days. With the stock now up 78.4% in total shareholder return over the past year and a massive 307.7% return over the past three years, momentum is clearly building as investors respond to promising clinical milestones and improving fundamentals.

If biotech breakthroughs and strong price momentum are on your radar, it could be a smart move to see what else is happening with innovators in the field by checking out See the full list for free.

With the stock on a remarkable winning streak and several catalysts in the pipeline, is Roivant Sciences still undervalued at current levels, or has the market already priced in all of its anticipated growth?

Most Popular Narrative: 2% Overvalued

Roivant Sciences’ last close at $21.32 is just above the most popular narrative’s fair value estimate of $20.86. This close gap between price and consensus valuation means the narrative's assumptions are under the microscope, especially with the company in a high-growth phase fueled by clinical and commercial milestones.

Bullish analysts point to strong Phase 3 results for brepocitinib in dermatomyositis. This outcome is viewed as a significant validation of Roivant’s clinical and regulatory execution.

Curious why analysts think Roivant’s future is priced so high? The answer lies in bold projections about key growth drivers, aggressive margin targets, and a profit outlook typically reserved for industry giants. The real intrigue is that the numbers used to justify this fair value will surprise even seasoned investors.

Result: Fair Value of $20.86 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty surrounding ongoing legal proceedings and potential delays in key clinical trial milestones could still shift the outlook for Roivant Sciences in the future.

Find out about the key risks to this Roivant Sciences narrative.

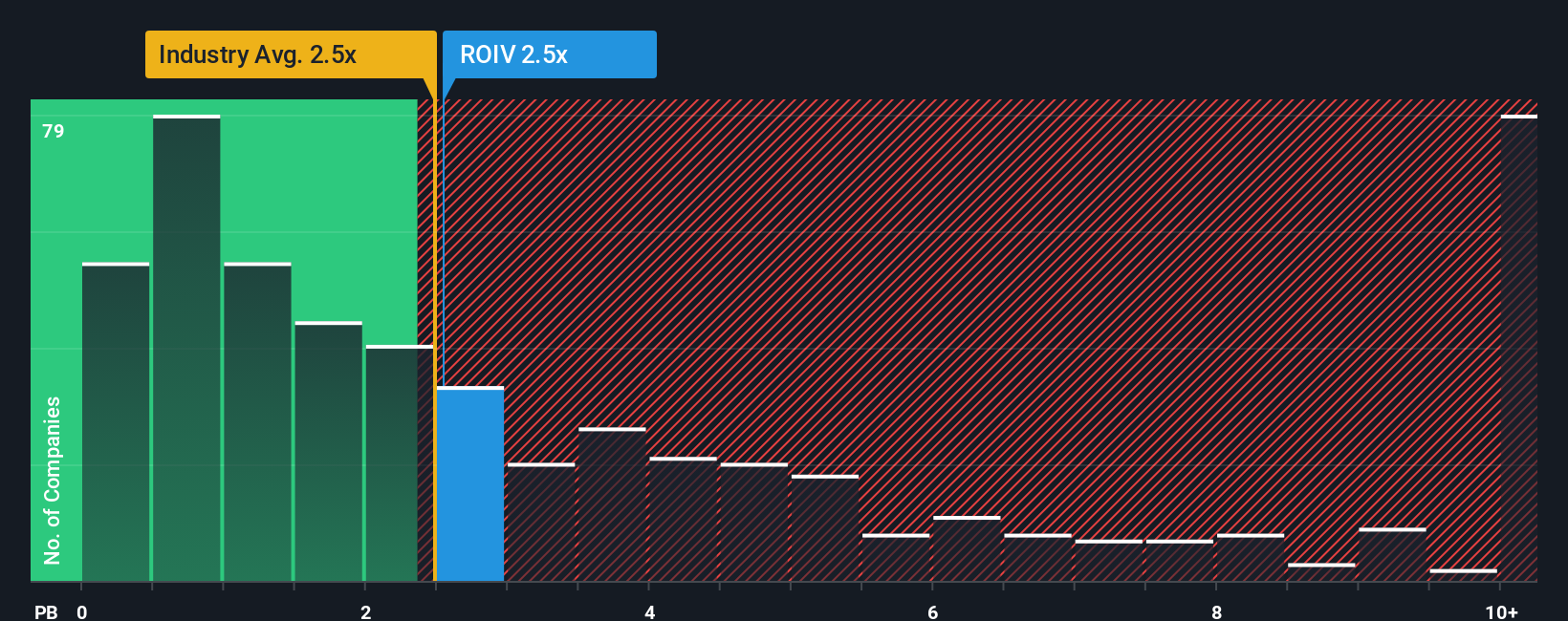

Another View: Looking at Price-to-Book Comparisons

While consensus valuation sees Roivant Sciences as slightly overvalued, a look at its price-to-book ratio tells a more nuanced story. Roivant trades at 3.4x book value, much lower than the peer average of 8.6x, but higher than the US Biotechs industry average of 2.6x. This places the company in an interesting position, offering some value compared to peers, but less so compared to the broader sector. Does this gap signal untapped opportunity or potential valuation risk if the industry average becomes the market’s focus?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Roivant Sciences Narrative

Feel that a different story is taking shape or want to dig deeper into Roivant’s data on your own? You can craft your own perspective in just a few minutes. Do it your way

A great starting point for your Roivant Sciences research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Open the door to fresh investment themes and potential market movers chosen for their unique growth drivers and financial strength.

- Uncover high-yield potential with these 14 dividend stocks with yields > 3% offering reliable dividend payouts and stable returns for income-focused investors.

- Position yourself at the forefront of AI innovation by checking out these 25 AI penny stocks powering advancements in intelligence, automation, and future tech.

- Get ahead of the crowd by tracking these 865 undervalued stocks based on cash flows that are currently flying under the market’s radar and could offer attractive upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ROIV

Roivant Sciences

A clinical-stage biopharmaceutical company, focuses on the discovery, development, and commercialization of medicines and technologies.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives