- United States

- /

- Pharma

- /

- NasdaqGM:RETA

Investors ignore increasing losses at Reata Pharmaceuticals (NASDAQ:RETA) as stock jumps 16% this past week

When we invest, we're generally looking for stocks that outperform the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. For example, the Reata Pharmaceuticals, Inc. (NASDAQ:RETA) share price is up 90% in the last 5 years, clearly besting the market return of around 53% (ignoring dividends).

Since it's been a strong week for Reata Pharmaceuticals shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for Reata Pharmaceuticals

Because Reata Pharmaceuticals made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Reata Pharmaceuticals saw its revenue shrink by 44% per year. Despite the lack of revenue growth, the stock has returned a respectable 14%, compound, over that time. It's probably worth checking other factors such as the profitability, to try to understand the share price action. It may not be reflecting the revenue.

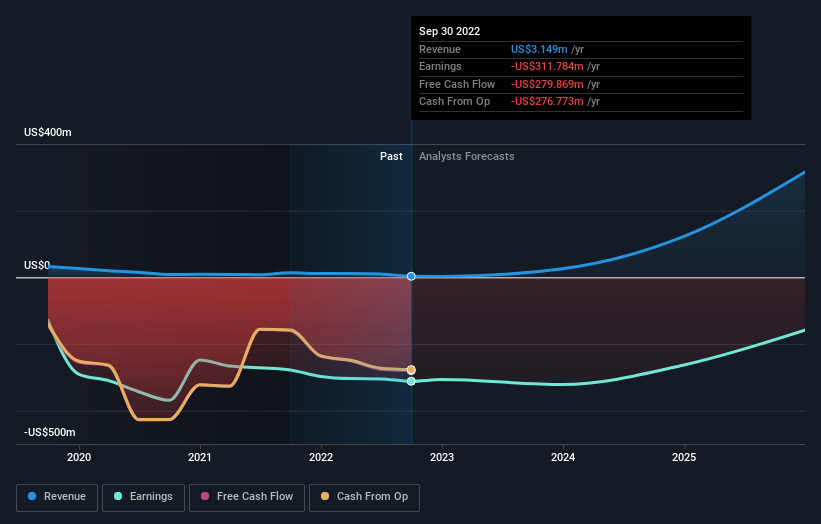

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Reata Pharmaceuticals stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that Reata Pharmaceuticals has rewarded shareholders with a total shareholder return of 81% in the last twelve months. That gain is better than the annual TSR over five years, which is 14%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Reata Pharmaceuticals better, we need to consider many other factors. For example, we've discovered 2 warning signs for Reata Pharmaceuticals that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:RETA

Reata Pharmaceuticals

Reata Pharmaceuticals, Inc., a clinical-stage biopharmaceutical company, identifies, develops, and commercializes novel therapeutics for patients with serious or life-threatening diseases.

High growth potential with excellent balance sheet.