- United States

- /

- Biotech

- /

- NasdaqGS:REGN

Regeneron (REGN) Is Up 5.8% After Positive Phase 2 and 3 Data Across Key Clinical Programs

Reviewed by Sasha Jovanovic

- In early November 2025, Regeneron Pharmaceuticals announced positive Phase 2 trial results for two investigational factor XI antibodies in preventing blood clots during knee surgery, alongside the presentation of favorable Phase 3 data for Dupixent in allergic fungal rhinosinusitis through its collaboration with Sanofi.

- These results highlight Regeneron's continued progress in late-stage clinical programs, with multiple new therapeutic indications potentially expanding its addressable patient population and supporting its ongoing pipeline momentum.

- We'll examine how Regeneron's strong clinical pipeline progress, especially positive Dupixent data, impacts its investment narrative and future outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Regeneron Pharmaceuticals Investment Narrative Recap

Regeneron shareholders need to believe the company can offset ongoing pricing and competitive threats to EYLEA with new flagship drugs and successful product launches. While recent positive clinical data on factor XI antibodies and Dupixent expands the pipeline, it does not yet materially alter the short-term outlook: resolving manufacturing delays and securing regulatory approvals for EYLEA HD remain the biggest near-term catalyst, while loss of EYLEA market share remains the primary risk.

Among recent updates, the announced strategic amendment with JW Therapeutics stands out as most relevant. It highlights Regeneron’s pursuit of revenue diversification, which may help address concerns about heavy reliance on a few core products, especially as pipeline assets like Dupixent see new potential indications.

In contrast, investors should be aware that continued branded market share declines for EYLEA in the face of biosimilar competition could…

Read the full narrative on Regeneron Pharmaceuticals (it's free!)

Regeneron Pharmaceuticals' outlook anticipates $16.6 billion in revenue and $5.0 billion in earnings by 2028. This reflects a 5.4% annual revenue growth rate and an increase of $0.5 billion in earnings from the current $4.5 billion level.

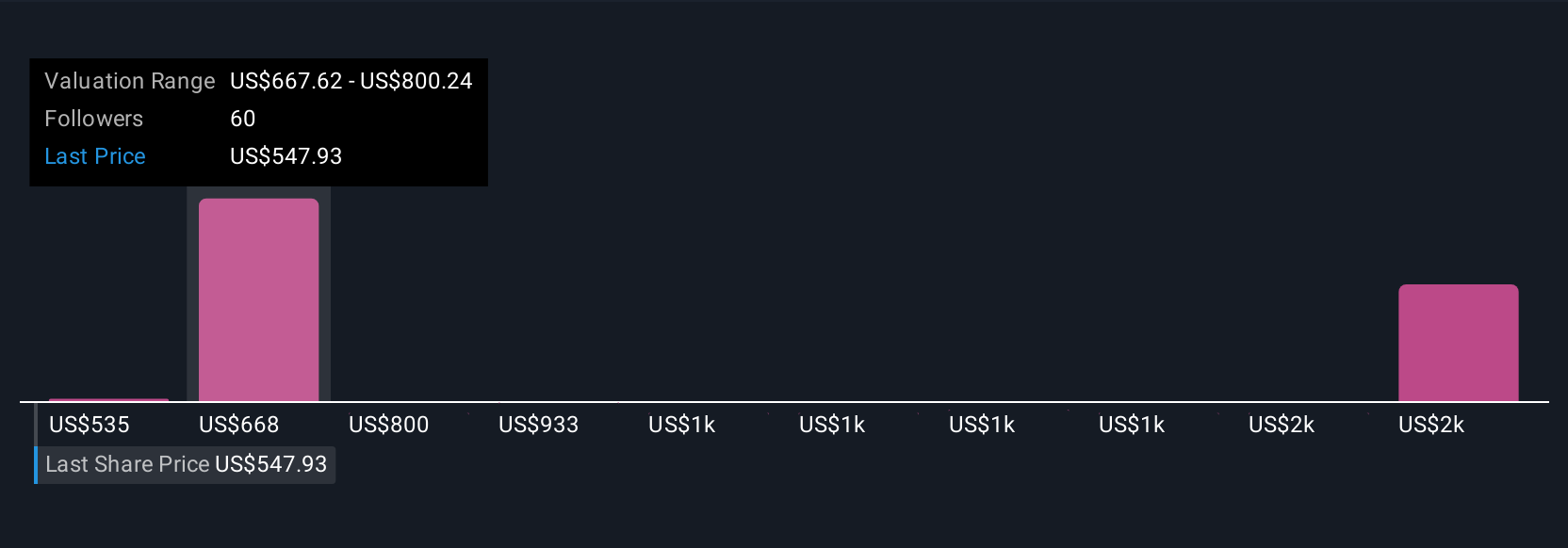

Uncover how Regeneron Pharmaceuticals' forecasts yield a $753.17 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Compared to consensus, the most optimistic analysts point to a future where Regeneron’s emergence in hematology and oncology and strong Dupixent adoption could support annual revenues of US$17.8 billion and earnings of US$6.2 billion by 2028. If you believe the newest pipeline wins could reshape future sales as those bullish expectations suggest, it’s worth exploring how recent trial results might change your view.

Explore 10 other fair value estimates on Regeneron Pharmaceuticals - why the stock might be worth 20% less than the current price!

Build Your Own Regeneron Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Regeneron Pharmaceuticals research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Regeneron Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Regeneron Pharmaceuticals' overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REGN

Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives