- United States

- /

- Biotech

- /

- NasdaqGS:PRAX

How Investor Scrutiny and Phase 3 Trial Questions at Praxis Precision Medicines (PRAX) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Praxis Precision Medicines recently faced investor scrutiny following a critical short report alleging issues in the Phase 3 ulixacaltamide trial, alongside concerns about insider share sales and a recent public offering.

- Amid this turbulence, upcoming presentations at the December American Epilepsy Society Meeting will highlight substantial progress across the company’s precision epilepsy pipeline, which may influence perceptions of its long-term potential.

- We'll explore how questions surrounding the integrity of recent clinical trial data shape Praxis Precision Medicines’ broader investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Praxis Precision Medicines' Investment Narrative?

For anyone considering Praxis Precision Medicines today, the big picture centers on belief in the potential of its epilepsy and neurology pipeline to deliver meaningful clinical advances and significant value. Despite the recent short report questioning the integrity of Phase 3 ulixacaltamide trial data, and raising new concerns about insider share sales and share dilution, Praxis continues to drive near-term catalysts, notably upcoming pipeline updates at the December American Epilepsy Society Meeting. If these presentations succeed in reaffirming the company’s scientific narrative, investor focus may shift back to milestones involving vormatrigine and relutrigine. Still, increased scrutiny on trial data and corporate governance introduces real uncertainty around investor confidence and the business’s short-term direction. The recent news aligns with existing volatility rather than marking a clear shift in fundamental risk, but it spotlights the importance of successful data presentations as a support for any recovery in sentiment or share price.

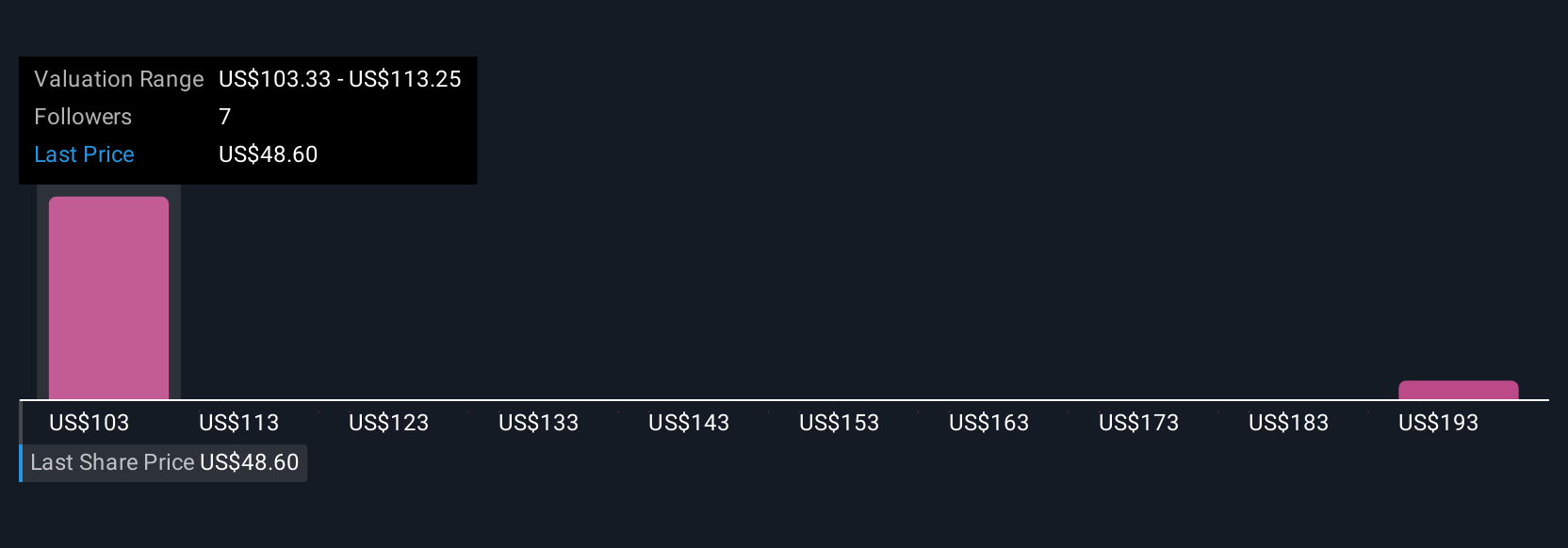

On the other hand, scrutiny over clinical data integrity is something investors need to keep in mind. Praxis Precision Medicines' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Praxis Precision Medicines - why the stock might be a potential multi-bagger!

Build Your Own Praxis Precision Medicines Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Praxis Precision Medicines research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Praxis Precision Medicines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Praxis Precision Medicines' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PRAX

Praxis Precision Medicines

A clinical-stage biopharmaceutical company, engages in the development of therapies for central nervous system (CNS) disorders characterized by neuronal excitation-inhibition imbalance.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026