- United States

- /

- Biotech

- /

- NasdaqCM:OVID

Ovid Therapeutics (OVID) Is Up 6.4% After Positive Phase 1 Results for Drug-Resistant Epilepsy Candidate

Reviewed by Sasha Jovanovic

- Ovid Therapeutics recently announced positive topline results from its Phase 1 study of OV329, a next-generation GABA-aminotransferase inhibitor targeting drug-resistant epilepsies, demonstrating significant GABAergic inhibition and strong safety outcomes in 68 healthy volunteers.

- This clinical milestone signals potential advancement in the treatment of drug-resistant epilepsies and attracted new institutional investors through a substantial private placement.

- We'll explore how OV329’s early GABAergic efficacy and favorable safety profile are shaping Ovid's current investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Ovid Therapeutics' Investment Narrative?

To understand Ovid Therapeutics’ investment case, it helps to focus on both the clinical and financial inflection points facing the company. After years of volatility, the impressive Phase 1 data for OV329 injects renewed confidence into the pipeline and puts the spotlight on Ovid’s momentum in tackling drug-resistant epilepsies. Short term, this milestone is a clear shift in the story: OV329’s safety and efficacy not only attracted fresh institutional capital through the recent private placement, but it may ease concerns around clinical execution risk. However, the stock’s steep valuation relative to sector peers, historical unprofitability, and a recent sharp increase in share price suggest market expectations have risen considerably. Risks around dilution, regulatory hurdles, and the need to maintain positive momentum now hold greater weight in the investment narrative. This news may bolster optimism for OV329, but it also sharpens the focus on execution as Ovid nears more capital-intensive trial stages. Yet, given the cash runway remains tight and profitability is still some way off, sustainability is still a concern.

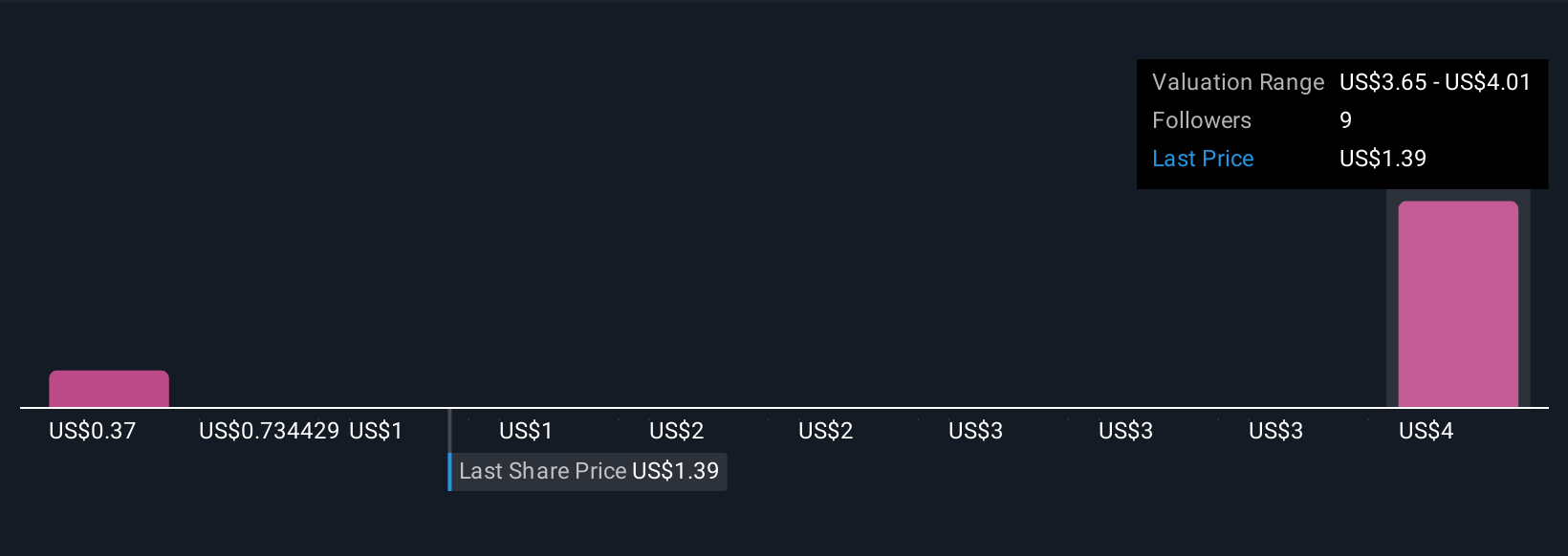

Our expertly prepared valuation report on Ovid Therapeutics implies its share price may be too high.Exploring Other Perspectives

Explore 3 other fair value estimates on Ovid Therapeutics - why the stock might be worth as much as 73% more than the current price!

Build Your Own Ovid Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ovid Therapeutics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Ovid Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ovid Therapeutics' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:OVID

Ovid Therapeutics

A biopharmaceutical company, engages in the development of impactful medicines for patients and families with epilepsies and seizure-related neurological disorders in the United States.

Flawless balance sheet with low risk.

Market Insights

Community Narratives