- United States

- /

- Biotech

- /

- NasdaqGM:ORKA

How Investors May Respond To Oruka Therapeutics (ORKA) Positive Phase 1 Data and Expanded Funding Efforts

Reviewed by Sasha Jovanovic

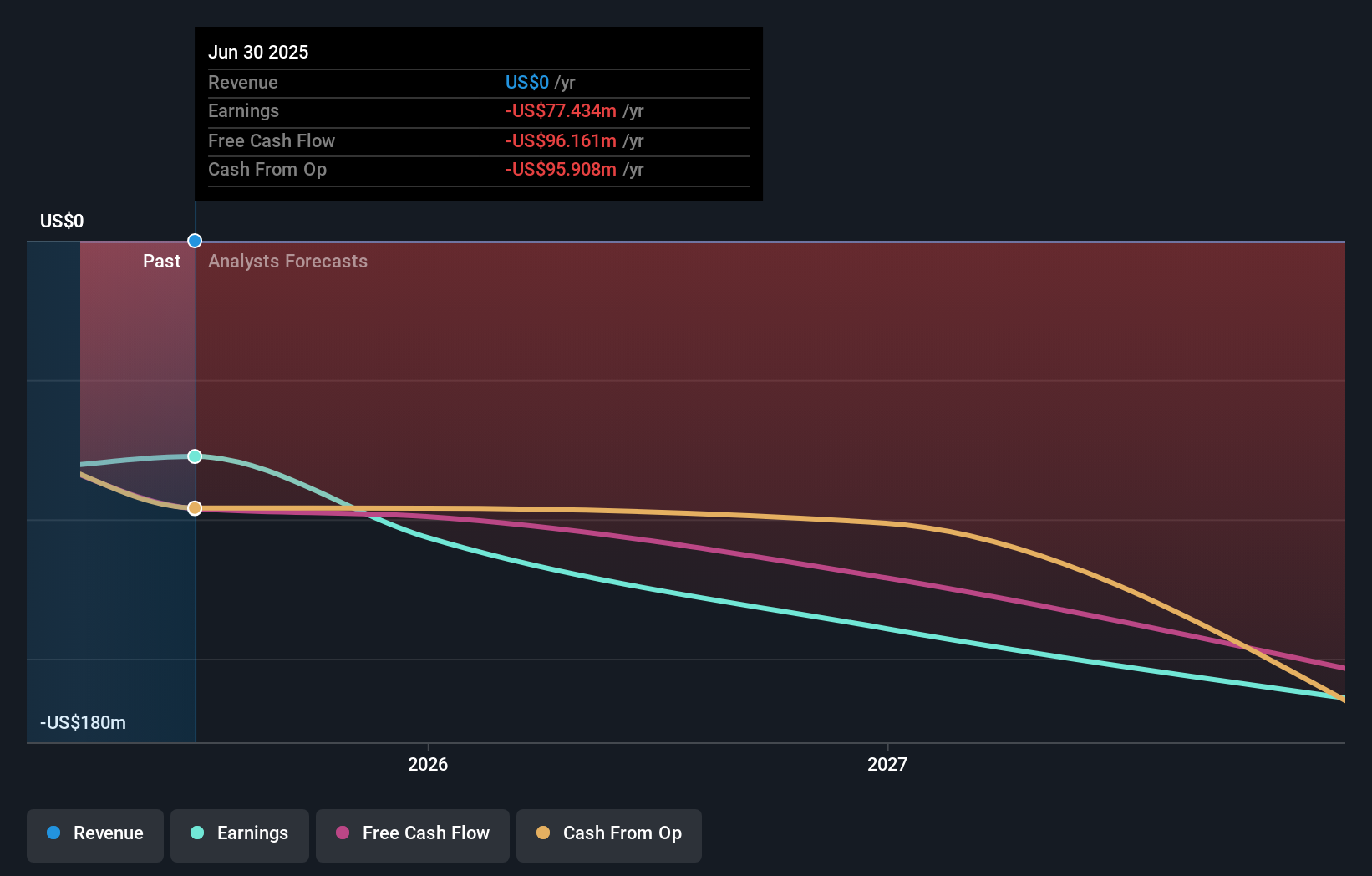

- Oruka Therapeutics recently reported third quarter 2025 results, noting a net loss of US$30.28 million and closed a substantial shelf registration of approximately US$756 million for common stock.

- Positive interim Phase 1 results for ORKA-001 in psoriasis, together with US$180 million in PIPE financing, have strengthened Oruka's ability to advance multiple clinical trials and extend its cash runway past key milestones.

- We'll explore how encouraging Phase 1 efficacy data for ORKA-001 underpins a shifting investment narrative for Oruka Therapeutics.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Oruka Therapeutics' Investment Narrative?

For those looking at Oruka Therapeutics, the investment story hinges on belief in the company’s targeted therapies for autoimmune and inflammatory diseases. The positive interim Phase 1 results for ORKA-001 have set a new tone for the short-term, with efficacy signals and an extended dosing window potentially giving Oruka an edge if these results hold up in Phase 2 trials. Coupled with the recent US$180 million PIPE financing and the US$756 million shelf registration, there’s fresh confidence that Oruka’s cash position is strong enough to see it through upcoming clinical milestones. However, the business is still running at a loss with no revenue and a young management team, so any setback in clinical progress or further dilution could quickly re-focus attention on risk rather than opportunity. The news flow gives investors new reasons for optimism, but it also sharpens the spotlight on execution in the next year.

But, if management’s short tenure raises questions, investors should weigh the implications for continuity and focus. In light of our recent valuation report, it seems possible that Oruka Therapeutics is trading beyond its estimated value.Exploring Other Perspectives

Explore 2 other fair value estimates on Oruka Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Oruka Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oruka Therapeutics research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free Oruka Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oruka Therapeutics' overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ORKA

Oruka Therapeutics

A clinical-stage biopharmaceutical company, focuses on developing novel monoclonal antibody therapeutics for psoriasis (PsO), and other inflammatory and immunology (I&I) indications.

Flawless balance sheet with moderate risk.

Market Insights

Community Narratives