- United States

- /

- Telecom Services and Carriers

- /

- NasdaqGS:LILA

3 Growth Companies With High Insider Ownership Expecting 109% Earnings Growth

Reviewed by Simply Wall St

In the current U.S. market landscape, major stock indices like the Dow Jones, S&P 500, and Nasdaq have shown modest gains as investors assess banking sector health and geopolitical developments. Amid this backdrop of cautious optimism, growth companies with high insider ownership can be particularly appealing due to their potential for strong alignment between management interests and shareholder value creation.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 92.9% |

| Prairie Operating (PROP) | 31.3% | 75.9% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.2% | 52.6% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.1% | 30.3% |

| Celsius Holdings (CELH) | 10.8% | 32.1% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.7% |

| Astera Labs (ALAB) | 12.1% | 36.6% |

| Accelerant Holdings (ARX) | 24.9% | 66.5% |

We're going to check out a few of the best picks from our screener tool.

Organogenesis Holdings (ORGO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Organogenesis Holdings Inc. is a regenerative medicine company that develops, manufactures, and commercializes products for advanced wound care and surgical and sports medicine markets in the United States, with a market cap of $516.31 million.

Operations: The company's revenue primarily comes from its regenerative medicine segment, totaling $429.53 million.

Insider Ownership: 36.6%

Earnings Growth Forecast: 109.0% p.a.

Organogenesis Holdings is poised for growth with forecasts of profitability within three years and earnings expected to grow 109% annually. Despite a recent setback in Phase 3 trials for its ReNu product, the company maintains a favorable safety profile and seeks FDA review, bolstered by RMAT designation. Financially, it faces challenges with declining revenue but offers good relative value against peers. Insider ownership remains significant, though recent insider trading data is unavailable.

- Delve into the full analysis future growth report here for a deeper understanding of Organogenesis Holdings.

- Our valuation report unveils the possibility Organogenesis Holdings' shares may be trading at a discount.

Liberty Latin America (LILA)

Simply Wall St Growth Rating: ★★★★☆☆

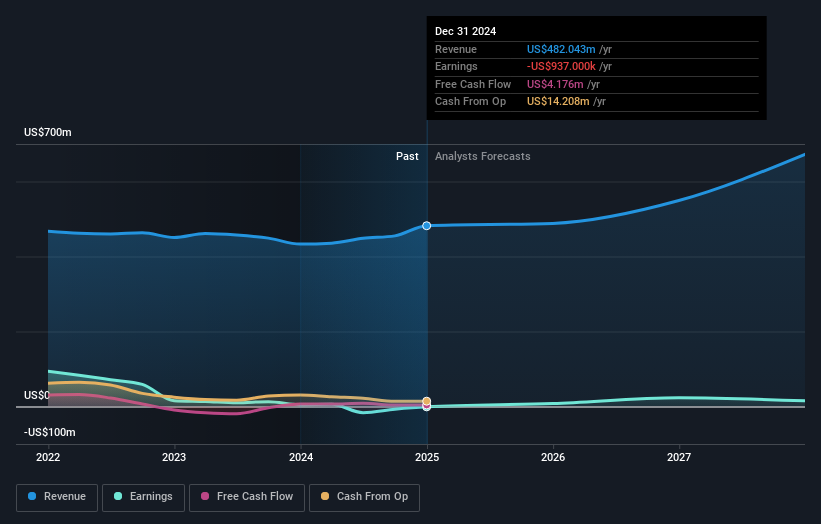

Overview: Liberty Latin America Ltd. offers fixed, mobile, and subsea telecommunications services across various regions including Puerto Rico, Panama, and the Caribbean, with a market cap of approximately $1.61 billion.

Operations: The company's revenue segments include $751.10 million from C&W Panama, $444.90 million from Liberty Networks, $1.46 billion from Liberty Caribbean, $623.10 million from Liberty Costa Rica, and $1.22 billion from Liberty Puerto Rico, along with $16.30 million from Corporate activities.

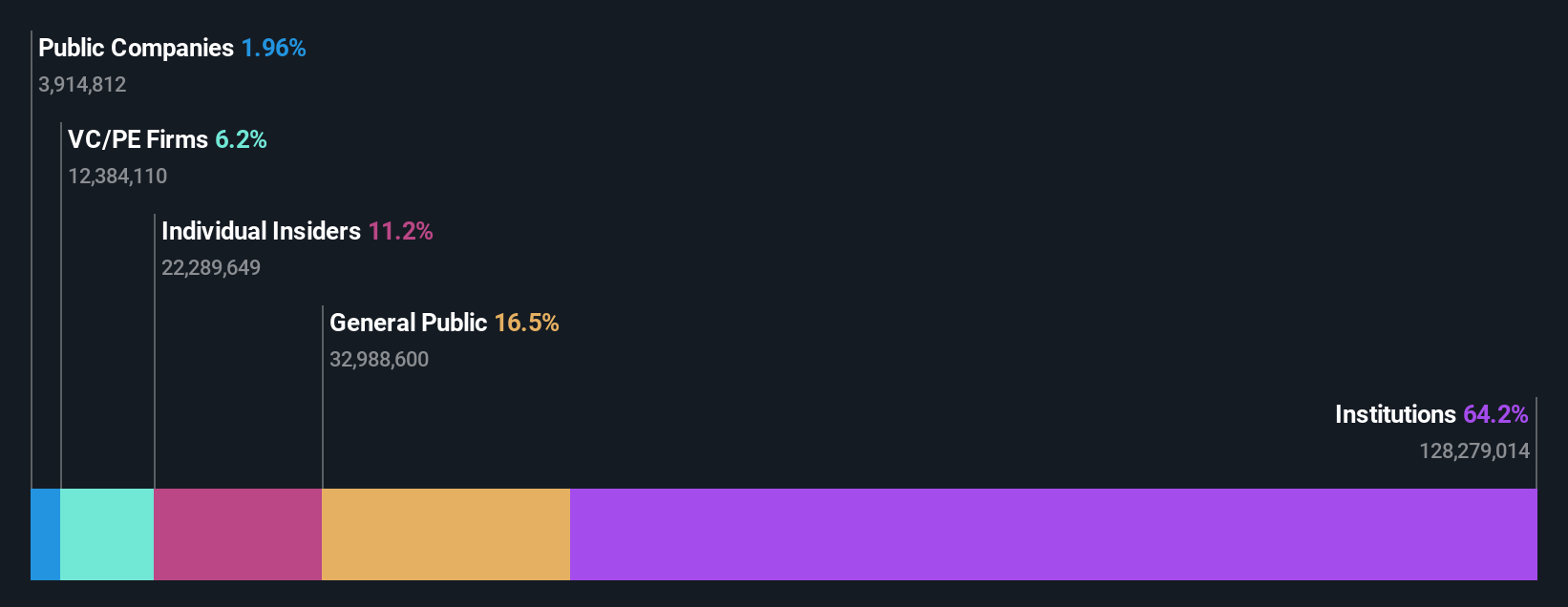

Insider Ownership: 11.2%

Earnings Growth Forecast: 107.9% p.a.

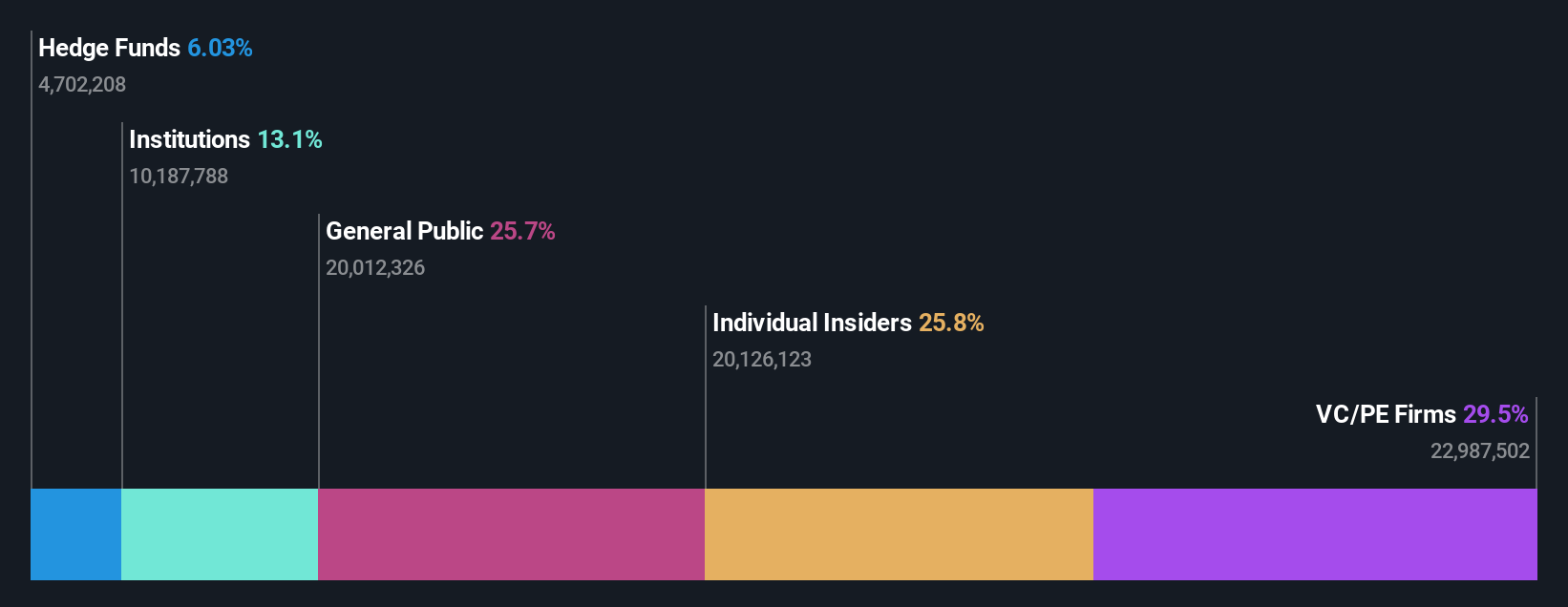

Liberty Latin America is positioned for future growth with forecasts indicating profitability within three years and earnings expected to grow significantly. Despite recent financial losses, the company trades at a substantial discount to its estimated fair value and offers good relative value compared to peers. The strategic launch of the MAYA-1.2 subsea cable system enhances regional digital infrastructure, supporting long-term growth prospects in connectivity across the Caribbean and Central America. Insider trading data is currently unavailable.

- Click here and access our complete growth analysis report to understand the dynamics of Liberty Latin America.

- Insights from our recent valuation report point to the potential undervaluation of Liberty Latin America shares in the market.

Hinge Health (HNGE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hinge Health, Inc. is dedicated to scaling and automating healthcare services delivery, with a market cap of approximately $3.95 billion.

Operations: The company's revenue is generated entirely from its healthcare software segment, which amounts to $480.79 million.

Insider Ownership: 18.9%

Earnings Growth Forecast: 98% p.a.

Hinge Health is trading significantly below its estimated fair value, with analysts expecting a 25.6% stock price increase. Revenue grew 40.9% last year and is forecasted to grow at 15.8% annually, outpacing the US market. The company anticipates profitability within three years, aligning with above-average market growth projections. Recently added to the S&P TMI Index, Hinge Health provided revenue guidance for Q3 and full-year 2025, indicating robust year-over-year growth around 41%.

- Click to explore a detailed breakdown of our findings in Hinge Health's earnings growth report.

- The valuation report we've compiled suggests that Hinge Health's current price could be quite moderate.

Key Takeaways

- Unlock more gems! Our Fast Growing US Companies With High Insider Ownership screener has unearthed 199 more companies for you to explore.Click here to unveil our expertly curated list of 202 Fast Growing US Companies With High Insider Ownership.

- Looking For Alternative Opportunities? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LILA

Liberty Latin America

Provides fixed, mobile, and subsea telecommunications services in Puerto Rico, Panama, Costa Rica, Jamaica, Latin America and the Caribbean, the Bahamas, Trinidad and Tobago, Barbados, Curacao, Chile, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives