- United States

- /

- Biotech

- /

- NasdaqGS:ONC

BeOne Medicines (ONC) Is Up After ZIIHERA Phase 3 Trial Shows Strong Efficacy for HER2-Positive Cancer

Reviewed by Sasha Jovanovic

- In November 2025, BeOne Medicines Ltd. announced positive top-line results from the Phase 3 HERIZON-GEA-01 trial, showing that ZIIHERA (zanidatamab) in combination with chemotherapy, with or without PD-1 inhibitor TEVIMBRA, led to highly statistically significant improvements in progression-free and overall survival for patients with HER2-positive locally advanced or metastatic gastroesophageal adenocarcinoma.

- The study’s results highlight both clinically meaningful efficacy benefits and a favorable safety profile, potentially strengthening ZIIHERA’s case as a first-line therapy for a broad patient population.

- We'll explore how these encouraging Phase 3 results for ZIIHERA could impact BeOne Medicines' pipeline-focused investment narrative and future growth prospects.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

BeOne Medicines Investment Narrative Recap

To be a shareholder in BeOne Medicines, you need to believe in the company's ability to deliver sustained pipeline growth in cancer therapies, with ZIIHERA’s recent Phase 3 success reinforcing confidence in new product launches. These strong clinical results could accelerate regulatory timelines and support revenue diversification, lessening reliance on BRUKINSA; however, the biggest risk remains the concentration in a few products and the threat of setbacks in other late-stage trials or new market entrants. Investors will need to weigh how each upcoming trial milestone shifts the short-term narrative.

Among recent announcements, BeOne’s new multi-currency loan facility agreement secures up to US$1 billion in additional funding, supporting overall pipeline execution and potential commercial launches tied directly to clinical catalysts like ZIIHERA. Access to flexible capital reinforces near-term operational strength, which is particularly important as pivotal trial readouts continue in multiple programs and regulatory filing activity increases.

In contrast, investors should be aware that increased financial leverage brings obligations that could complicate the company’s position if...

Read the full narrative on BeOne Medicines (it's free!)

BeOne Medicines is projected to achieve $7.6 billion in revenue and $1.3 billion in earnings by 2028. This outlook assumes annual revenue growth of 18.6% and reflects an earnings increase of about $1.48 billion from current earnings of -$177.6 million.

Uncover how BeOne Medicines' forecasts yield a $395.37 fair value, a 19% upside to its current price.

Exploring Other Perspectives

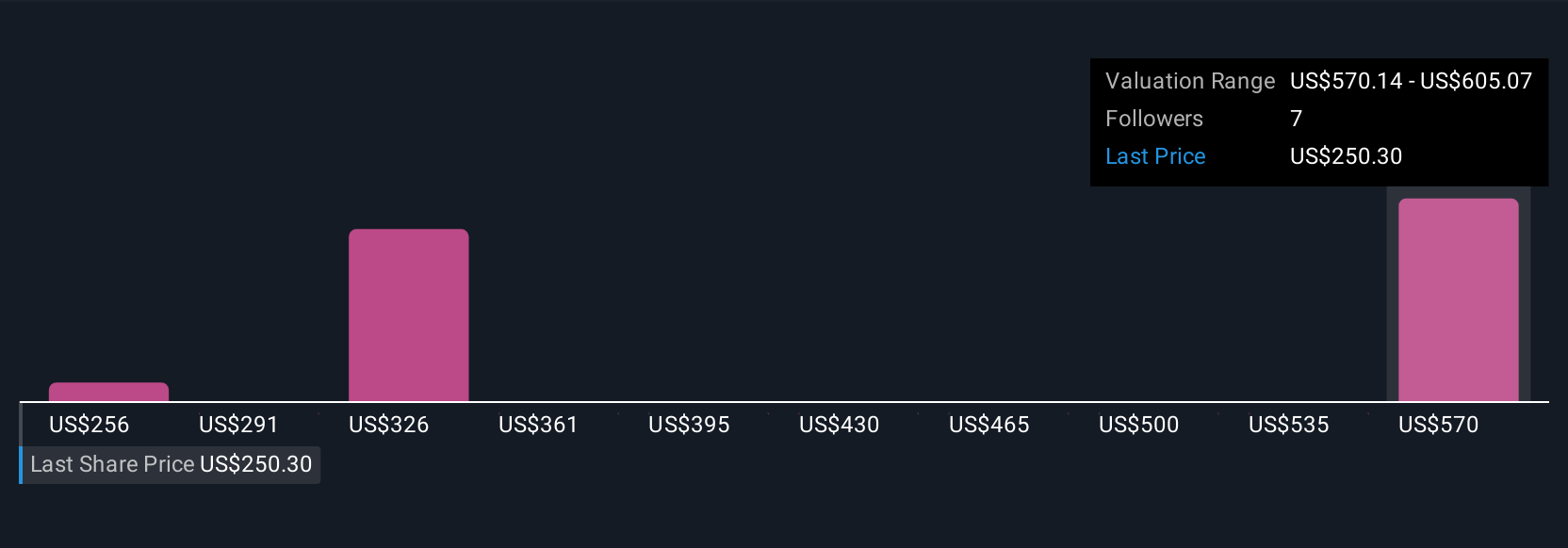

Retail investor fair value estimates for BeOne Medicines range widely, from US$250 to over US$745, with six distinct perspectives from the Simply Wall St Community. While optimism around pipeline catalysts remains high, concentrated product risk and clinical trial uncertainty shape very different views on the company’s potential, consider these varied opinions as you form your own outlook.

Explore 6 other fair value estimates on BeOne Medicines - why the stock might be worth 25% less than the current price!

Build Your Own BeOne Medicines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BeOne Medicines research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BeOne Medicines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BeOne Medicines' overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BeOne Medicines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ONC

BeOne Medicines

An oncology company, engages in discovering and developing various treatments for cancer patients in the United States, China, Europe, and internationally.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026