- United States

- /

- Pharma

- /

- NasdaqGM:OCUL

Ocular Therapeutix (OCUL): Is the Recent Share Price Momentum Backed by Its Valuation?

Reviewed by Simply Wall St

Ocular Therapeutix (OCUL) has quietly put up an interesting run lately, with the stock gaining around 44% year to date and roughly 16% over the past month, drawing fresh attention.

See our latest analysis for Ocular Therapeutix.

That move sits against a choppy backdrop, with the latest share price at $12.58 and a strong year to date share price return, but a more mixed multi year total shareholder return profile. This suggests sentiment has improved even as risk remains firmly on the table.

If Ocular’s recent strength has caught your eye, it might be a good moment to explore other potential opportunities across healthcare stocks that are showing interesting momentum and fundamentals.

With the share price still trading at a steep discount to analyst targets despite strong revenue growth, investors face a key question: is Ocular Therapeutix undervalued today, or is the market already pricing in its future pipeline success?

Most Popular Narrative Narrative: 45.1% Undervalued

With the most widely followed narrative placing fair value near $22.92 against a last close of $12.58, the upside case hinges on aggressive growth execution.

The anticipated approval of AXPAXLI, potentially the first wet AMD product with a superiority label and longer dosing intervals (every 6 to 12 months), may allow Ocular Therapeutix to capture significant market share in a rapidly growing population of elderly patients with retinal disease, unlocking large revenue growth opportunities as the global prevalence of ophthalmic disorders increases.

Curious how this potential market share grab, steep revenue ramp, and a rich future earnings multiple all fit together? Want to see the full blueprint behind that upside case?

Result: Fair Value of $22.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in pivotal AXPAXLI trials or weaker than expected wet AMD data could quickly challenge the upside case built into today’s valuation.

Find out about the key risks to this Ocular Therapeutix narrative.

Another Angle on Valuation

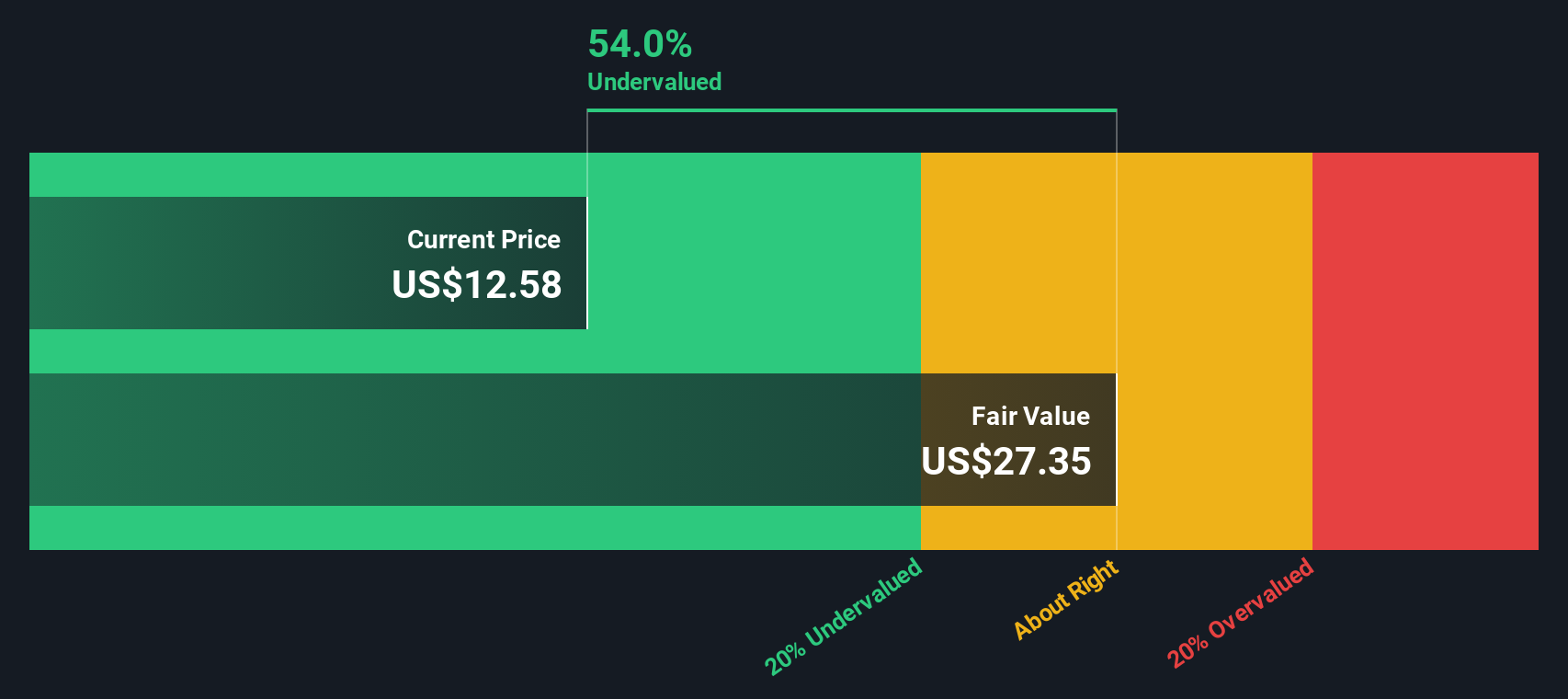

Our DCF model paints a very different picture, suggesting fair value closer to $27.35 versus today’s $12.58, implying OCUL is deeply undervalued despite its rich revenue multiple. If cash flows eventually follow the pipeline story, could sentiment be lagging too far behind?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ocular Therapeutix Narrative

If you see the story differently or want to run your own numbers, you can quickly build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Ocular Therapeutix research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next move with fresh opportunities uncovered by powerful screeners on Simply Wall St, so you never miss what matters.

- Uncover potential mispricings with these 906 undervalued stocks based on cash flows that may be trading well below what their cash flows suggest.

- Ride the next wave of innovation by targeting these 26 AI penny stocks positioned at the forefront of intelligent automation.

- Strengthen your income stream with these 15 dividend stocks with yields > 3% offering yields that could lift your portfolio’s regular cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:OCUL

Ocular Therapeutix

A biopharmaceutical company, engages in the development and commercialization of therapies for retinal diseases and other eye conditions using its bioresorbable hydrogel-based formulation technology in the United States.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026