- United States

- /

- Pharma

- /

- NasdaqGM:OCS

What Oculis Holding (OCS)'s Q3 Losses and Shelf Registration Reveal About Its Funding Strategy

Reviewed by Sasha Jovanovic

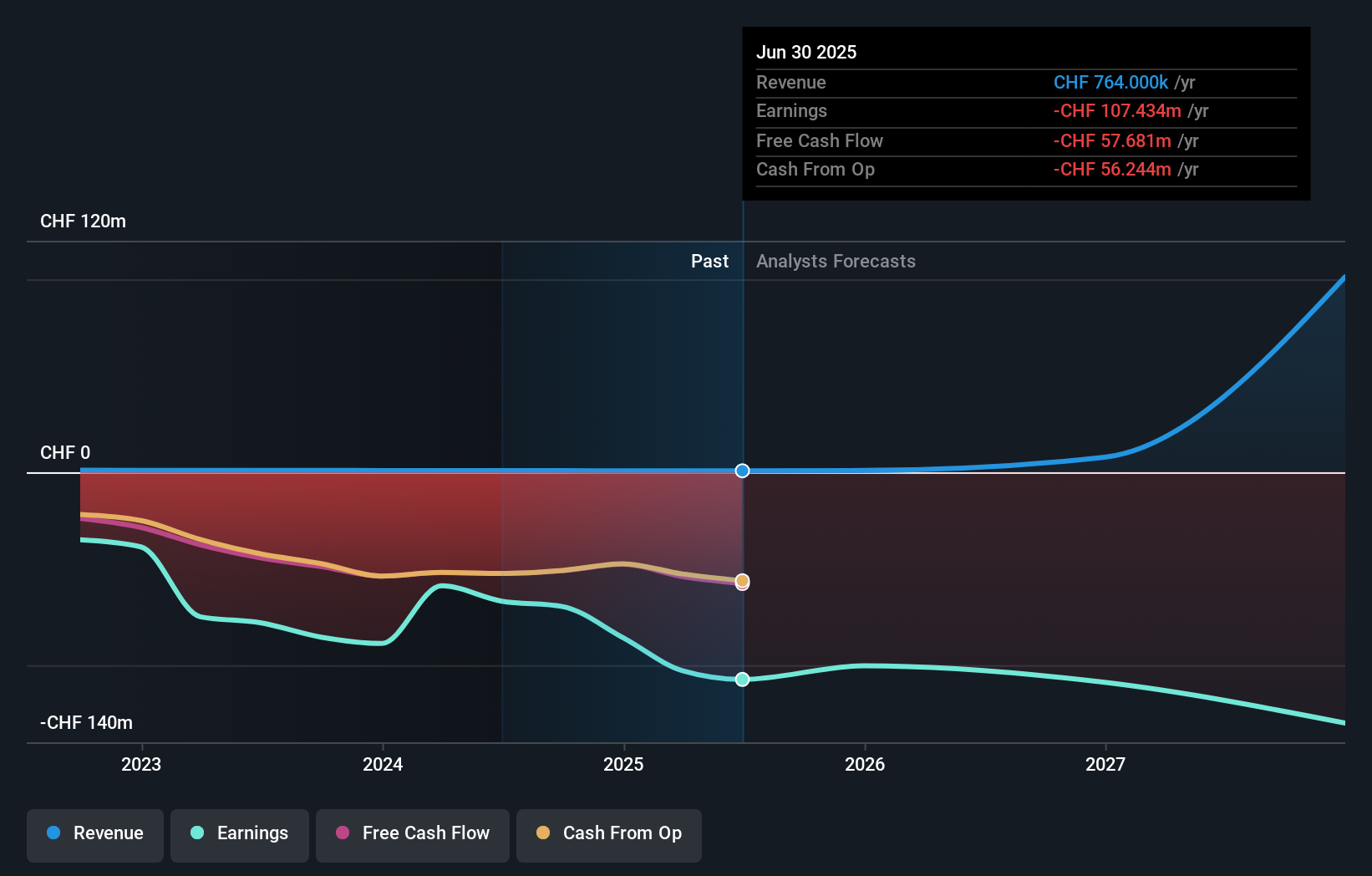

- Oculis Holding AG recently reported its third quarter 2025 earnings, showing revenue of CHF 243,000 and a net loss of CHF 16.86 million, while also filing a shelf registration to potentially issue 494,259 new ordinary shares.

- This combination of narrowing quarterly losses and moves to secure additional capital highlights the company's efforts to manage its financial position amid ongoing development needs.

- We will explore how the shelf registration filing informs Oculis Holding's investment narrative, particularly regarding its funding strategy and operational outlook.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

What Is Oculis Holding's Investment Narrative?

When I look at Oculis Holding today, what stands out is the long-term belief investors must have in the power of its pipeline and the future of ophthalmic innovation. The recent Q3 earnings tell a story of incremental progress, with quarterly losses narrowing year-over-year, but a substantial net loss remains. The added wrinkle is the newly filed shelf registration to potentially issue nearly half a million new shares, positioning Oculis for more flexible capital raising while underscoring the ongoing cash needs of clinical development. For those watching short-term catalysts, the shelf filing and ongoing equity offerings introduce heightened uncertainty around dilution and funding runway, though the modest scale of this latest shelf filing may not reshape the near-term picture on its own. However, the core risk, Oculis’s ability to convert its science pipeline into meaningful revenue before additional funding becomes challenging, remains front and center for most shareholders. On the other hand, funding dilution risk is something every current investor should watch closely.

Our comprehensive valuation report raises the possibility that Oculis Holding is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore another fair value estimate on Oculis Holding - why the stock might be worth just $42.30!

Build Your Own Oculis Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oculis Holding research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Oculis Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oculis Holding's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:OCS

Oculis Holding

A clinical-stage biopharmaceutical company, develops drug candidates to treat ophthalmic diseases in Switzerland, Iceland, and internationally.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives