- United States

- /

- Pharma

- /

- NasdaqGM:NTHI

Insider Buys Additional US$185k In NeOnc Technologies Holdings Stock

Potential NeOnc Technologies Holdings, Inc. (NASDAQ:NTHI) shareholders may wish to note that the President, Amir Heshmatpour, recently bought US$185k worth of stock, paying US$6.16 for each share. However, it only increased shareholding by a small percentage, and it wasn't a huge purchase by absolute value, either.

NeOnc Technologies Holdings Insider Transactions Over The Last Year

Notably, that recent purchase by Amir Heshmatpour is the biggest insider purchase of NeOnc Technologies Holdings shares that we've seen in the last year. We do like to see buying, but this purchase was made at well below the current price of US$8.53. While it does suggest insiders consider the stock undervalued at lower prices, this transaction doesn't tell us much about what they think of current prices.

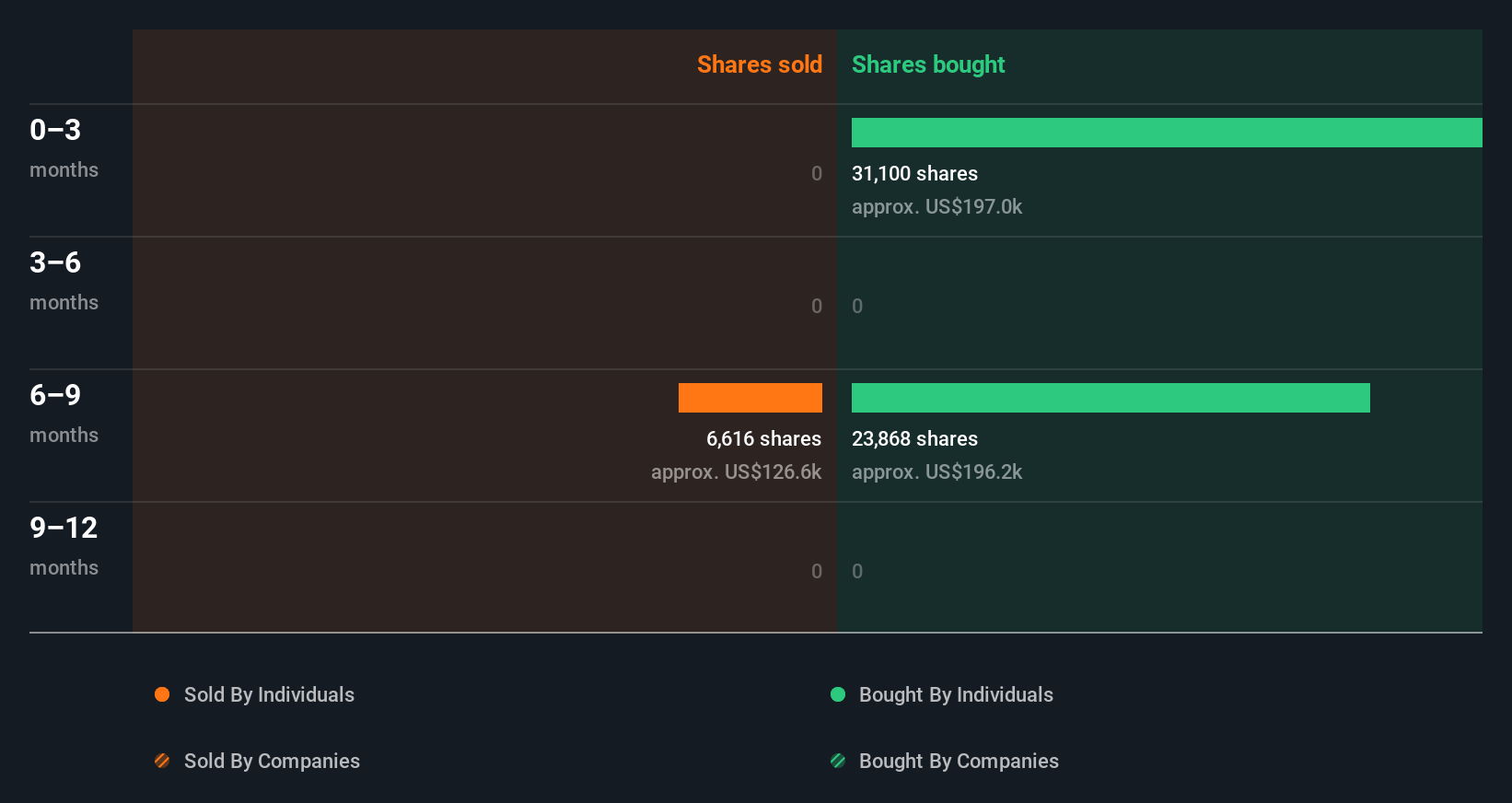

In the last twelve months insiders purchased 54.97k shares for US$400k. But they sold 6.62k shares for US$164k. In total, NeOnc Technologies Holdings insiders bought more than they sold over the last year. Their average price was about US$7.28. It is certainly positive to see that insiders have invested their own money in the company. But we must note that the investments were made at well below today's share price. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

View our latest analysis for NeOnc Technologies Holdings

There are always plenty of stocks that insiders are buying. If investing in lesser known companies is your style, you could take a look at this free list of companies. (Hint: insiders have been buying them).

Insider Ownership Of NeOnc Technologies Holdings

Many investors like to check how much of a company is owned by insiders. We usually like to see fairly high levels of insider ownership. NeOnc Technologies Holdings insiders own 61% of the company, currently worth about US$101m based on the recent share price. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Does This Data Suggest About NeOnc Technologies Holdings Insiders?

The recent insider purchases are heartening. And the longer term insider transactions also give us confidence. However, we note that the company didn't make a profit over the last twelve months, which makes us cautious. Along with the high insider ownership, this analysis suggests that insiders are quite bullish about NeOnc Technologies Holdings. One for the watchlist, at least! So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. Case in point: We've spotted 5 warning signs for NeOnc Technologies Holdings you should be aware of.

Of course NeOnc Technologies Holdings may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're here to simplify it.

Discover if NeOnc Technologies Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:NTHI

NeOnc Technologies Holdings

A clinical-stage biopharmaceutical company, focuses on developing treatments for intracranial malignancies.

Moderate risk with weak fundamentals.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026