- United States

- /

- Biotech

- /

- NasdaqGM:NRIX

Nurix Therapeutics, Inc. (NASDAQ:NRIX) Stock Rockets 30% As Investors Are Less Pessimistic Than Expected

Nurix Therapeutics, Inc. (NASDAQ:NRIX) shareholders have had their patience rewarded with a 30% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 44% in the last twelve months.

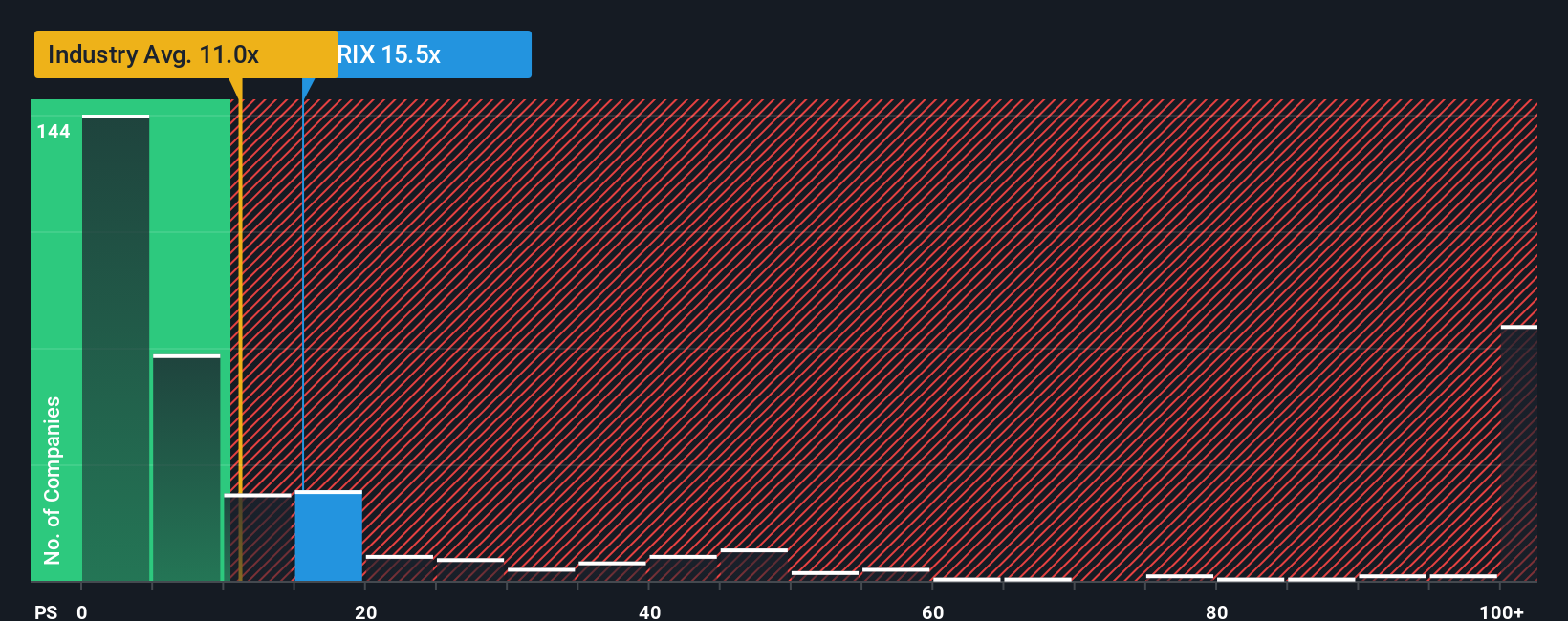

Following the firm bounce in price, Nurix Therapeutics' price-to-sales (or "P/S") ratio of 15.5x might make it look like a sell right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios below 11x and even P/S below 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Nurix Therapeutics

How Nurix Therapeutics Has Been Performing

Nurix Therapeutics could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Nurix Therapeutics will help you uncover what's on the horizon.How Is Nurix Therapeutics' Revenue Growth Trending?

Nurix Therapeutics' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 48% gain to the company's top line. Pleasingly, revenue has also lifted 113% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 9.6% per year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 120% per year, which is noticeably more attractive.

With this information, we find it concerning that Nurix Therapeutics is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Nurix Therapeutics' P/S

The large bounce in Nurix Therapeutics' shares has lifted the company's P/S handsomely. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Nurix Therapeutics, this doesn't appear to be impacting the P/S in the slightest. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Nurix Therapeutics (at least 2 which are a bit concerning), and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Nurix Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:NRIX

Nurix Therapeutics

A clinical stage biopharmaceutical company, focuses on the discovery, development, and commercialization of small molecule and antibody therapies for the treatment of cancer, inflammatory conditions, and other diseases.

Flawless balance sheet with low risk.

Market Insights

Community Narratives